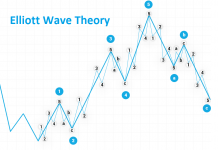

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

Our analyses are prepared based on Ducascopy’s SWFX Sentiment Index, available here.

EUR/USD

The pair, having rejected a resistance level with a Pin Bar, easily broke through a subsequent support zone riding strongly on wave 3. At present the pair reached a support zone and the inner line drawn on the peaks of the last upward-moving consolidation. As waves i and v are equal, a rebound may be expected in these regions and an attempt to form wave 4. The space that got created between the breached support and the support currently being tested is ideal for that purpose. However, one should bear in mind the strength of wave 3 and numerous extensions that may appeal along the way. Once the regions being tested are breached, the price should move further ahead towards the 1.1600 level.

On the weekly Ichimoku chart, we can see that the pair is slowly reaching the support in the form of Senkou Span A line of the upwards-moving cloud. If that line is rejected, it may result in the formation of wave 4. Once a down impulse is completed, we should see moves up as part of wave 2B that may test the Kijun line from the bottom and form the right shoulder of a hypothetical H&S formation. Currently we can see that small players are counting on the defence of the support – they have been using the whole falling move to open long positions. This setup does not justify joining the trend and we can’t do anything but observe.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

GBP/USD

The pair has started wave 5. The last consolidation right above the support that took the form of an expanding triangle, was wave 4. Now the way to the 1.3300 level is open, where another demand zone is located. The pair is currently breaking out of the Pin Bar and a possible correction and a retest of its lower limit may be used to look for trend-following positions.

On the Ichimoku chart we can see that the pair has ideally respected the Tenkan line while the correction developed. Those areas could be used to take a short position. On the H4 chart it was exactly there that the pair bounced off the downward-moving cloud, providing entry signals. At that time sentiment was neutral and confirmed those signals.

JPY/USD

The pair, after the support level was rejected on Friday, today has tried for the second time to break out of it. If it succeeds, it will open the way towards the 111.800 level. The pair should currently be in wave 3, therefore the said level should be reached easily.

The weekly Ichimoku chart is showing that the pair is faced with a resistance in the form of the Senkou Span B line of the downward-moving cloud. A correction may develop in these regions, as was the case recently when the Kijun line was tested. This correction could be used to look for a long position provided that sentiment changes, as currently the moves up are being used to open short positions.

Translation: Mirosław Wilk