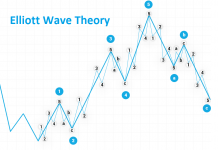

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

Our analyses are prepared based on Ducascopy’s SWFX Sentiment Index, available here.

EUR/USD

The pair remains stuck between two levels. The inner line is gradually losing its significance, though the pair keeps respecting it. The base scenario for me is still the one in which the last wave down X is the first and I assume it will continue. I treat the current gains as wave c of a simple correction and once it has been completed, I expect declines. This scenario will be valid until the pair breaches the resistance zone that is located around the 1.1730 level.

On the Ichimolu chart, the pair keeps respecting the monthly Senkou Span A line that keeps preventing continuation of declines towards the Kijun line. This line is sitting around 200 pips below the SSA and I am looking for occasions to trade that move. For the time being, as can be seen on the daily chart, the pair is hovering between the Tenkan and Kijun lines. If the price breaches Kijun, which should be the case based on the scenario involving a simple correction, a break out of the peak and a quick retreat under Kijun, will create an opportunity to trade declines. Sentiment remains neutral; therefore, it will be possible to look for positions. This scenario will become invalid once the Kijun D1 line is breached decisively and permanently.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

GBP/USD

The pair is testing alternately the inner SR line. From the bottom, the pair is affected by a support zone, located around the 1.3100 area, and from the top it is impacted very robustly by the inner line drawn on the peaks of the last correction up. As I wrote yesterday, the entire declining structure should play out as part of an extended wave 5 and is slowly turning into a descending wedge. The structure is already comprised of 5 sub-waves; however, the last 3 can be treated as wave c. Based on that assumption, any gains from the bottom should be treated as wave d, and following its completion we should see declines as part of the ending wave. If the pair breaches the nearest peak, this scenario becomes invalid and we will need to consider the whole structure as completed.

On the Ichimoku chart, the pair remains under the Senkou Span A W1 and only once it is exceeded, a stronger reaction to declines will be possible. On the daily chart, the pair is sitting under Tenkan, but it is quite likely that the line will be breached, and the pair will head towards Tenkan. This scenario would fit the one that involves the formation of wave d and will allow us, if the line is rejected, to look for positions to trade shorts as part of wave e.

USD/JPY

The pair reached a crucial spot with a resistance zone located near the area of the last peak and the zone marked between the lines drawn on the peaks. If they are breached, the path to the 113.500 level is open. The last sequence of waves is more like an ending structure than an impulse. Therefore, it makes more sense to wait for a break out above the peak and to look for positions to trade continuation of the moves up only after a retest.

There are no major changes on the Ichimoku chart. The pair stopped on the extension of the weekly Kijun line. Only once it has been breached, can we consider continuation of the moves up. There isn’t too much space as the next obstacle for the pair will be the Weekly Senkou Span A and the extended Kijun MN line. All we can do is observe. Sentiment has been dynamically becoming negative for some time. On the one hand, this prevents us from opening long positions, but on the other hand such an accumulation of shorts with a possible break through the first obstacle may accelerate any moves up and consequently let us look for a long position once the breached zone has been retested.

Tłumaczenie: Mirosław Wilk