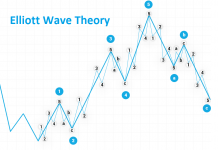

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

Our analyses are prepared based on Ducascopy’s SWFX Sentiment Index, available here.

EUR/USD

As there is not much happening on lower TFs, let’s have a look at the weekly chart. It shows that the pair is defending vehemently the support zone located around the 1.1580 area. Three Pin Bars formed, which imply that there is willingness of a reaction to the last declines. Until the said zone is breached, I am more inclined to expect an attempt to attack the 1.1750 level and then possibly 1.1930. Such a move would allow the development of the right shoulder of a hypothetical H&S formation and would be the second wave of a resultant impulse down. Looking at the daily chart, it is still unclear whether the last decline is wave 5 ending an impulse or wave 1 of e.g. a triangle. This conundrum should be resolved once resistance at 1.1730 has been tested.

No major changes have occurred on the Ichimoku chart, either. The pair came up to the Kijun D1 line. Once it gets breached permanently, a path towards Senkou Span A and Tenkan W1 should be open. The Chikou line approached maximally the price line, which implies a sideway move. Only after we see a decisive break out of the consolidation, will we be able to look for a position. Therefore, I am staying on the side lines for now.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

GBP/USD

We are analysing H4 TF for the GBP/USD pair. We can see that the scenario outlined yesterday has played out – the pair, having rejected the support zone, started forming wave c of a simple correction. Until a breakout of the last peak, this is our basic scenario. At present, the pair has reached an inner line that has been consistently respected for a longer time. If this is really a correction of the last wave down, we have a good spot for its completion. This scenario will be tentatively confirmed once support on wave b is breached.

No major changes have occurred on the Ichimoku chart, either. The pair is sitting underneath the lines and is now attempting to pierce through and get above Tenkan D1. From the bottom, the price is supported by a flat extended Kijun W1 line, and from the top it is limited by Senkou Span A W1. Here I will be sitting on my hands until one of them is breached as well. Once Tenkan D1 is broken, it may imply an attempted attack on Kijun D1 and that spot will determine whether we are dealing with a major reaction, or another wave down is ahead.

USD/JPY

The pair has reached a major resistance zone – being the line drawn on peaks and on the last one as well. We can say tentatively that those lines have been rejected and since yesterday we have been witnessing declines. The pair got to a support area marked on the weekly chart. Once breached, further declines should follow towards the 109.740 level, where another support zone is located. The last ascending sequence, as I mentioned yesterday, looks like an ending element – therefore a fall towards 109.000 is possible. Now all we can do is wait for a decisive move confirming one of the above scenarios.

On the Ichimoku chart, the pair is still locked between the extended flat Kijun W1 line (marked green), Kijun D1 and Senkou Span A D1. Currently the pair has reached the Tenkan D1 line and we will most likely see an attempt at defending it. Sentiment for this pair is pointing to longs and if there was no resistance area sitting nearby, I would probably look for a position to enter. However, I am going to refrain until the last peak is cleared.

Tłumaczenie: Mirosław Wilk