Is a pip the smallest denomination is currency trading?

Well, yes it is or at least it was, since now we have fractional pips that are 1/10 of a pip.

The increase in trading volume and more importantly liquidity has narrowed spread by an incredible amount.

“Back in the Day” trading GBP/USD in a bank the “normal spread was five pips!. Now, five pips to a trader with a $25 account is an insult.

Technology has enabled retail traders to flourish!

What is pip?

There is a lot of jargon to the calculation of a pip. A pip always meant (until the advent of fractional pips) the smallest denomination when trading a currency. It calculates spread and also P&L. For calculating P&L you need to be trading in a fixed lot size. That way your P&L can be, say, seventy pips. If you are trading Eur 100k lots a pip is worth $ 10 so seventy pips is $700.

That is also useful to know when setting orders. Pips are bigger in some currencies than others.

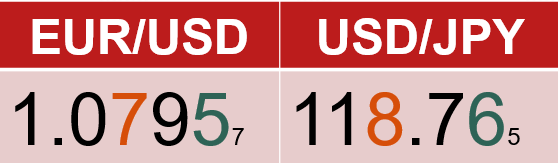

In the example above you can see quoting of two currency pairs. First one is EURUSD. In this case second decimal place is 7 and this is a point. Percentage in point – pip – is fourth decimal place (5). The small number in the end is fractional pip which is 7.

A little different situation is on pairs with Japanese yen. As you can see on the example above, there are only three decimal numbers. Point is the last number before comma (8) and pip is second decimal (6). Fractional pip is of course in the end and it is equal to 5.

Watch out for misunderstanding

On the MetaTrader4 platform you can see a little different point definition that we showed above. When you try to modify order you can see this screen:

The point on MT4 is of course a fractional pip. If we want to modify our stop loss or take profit they need to be moved by 10 pips (100 point on MT4) from current ASK/BID price.

You should also notice that also in case of indices we should treat points different than on currency pairs.

Subscribe to Elliott Waves International to get report for 2017!

Pips value

Every change of currency pair price is connected with profit or loss for our position. The size of profits or losses will depend on size of our position. The bigger position, the higher pip is worth.

Worth of pip is always showed in quoted currency, so if you want to calculate worth of pip for EURUSD, it will be showed in US dollars.

How can we calculate pip worth for standard unit (1 lot) for EURUSD?

1 lot = 100,000 units of base currency

1 pip for EURUSD = 0.0001

100,000 * 0.0001 = 10 USD

Different situation will be with USDJPY where pip is 0.01 and its worth is showed in JPY:

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)