When looking at a chart we try to disseminate levels at which the price has a tendency to change direction, to react somehow. Spotting these places is a major benefit in planning investments.

The changes in direction occur because price movements are creating cycles on the chart. If the market rejects a level once, there is high probability that this situation will happen again in the future or at least we will see some kind of reaction in this area.

What’s the difference between support and resistance?

Looking at a chart we are trying to find important levels above and below current price.

All levels above price are called resistances and all levels below are called supports. Investors and analysts often use the abbreviation S/R. The reason is that any move higher will be resisted by the level we find and any move lower will find support at the appropriate level.

If the price breaks a resistance level during an upmove that resistance becomes support and the same is true when a support is broken, that becomes resistance.

The market is not so exact that these levels are not exact to a single pip. They set a guide to what to expect.

A few methods are used to set S/R points. Some use candle wicks on highs and lows, others just use a line chart.

How you create support/resistance lines in your own trading is unimportant. However the understanding that the levels are never exact and can lead to a false break is vital in order to not be forever on the “wrong side of the market”.

How to set supports and resistances properly

As you probably already know, investors using MT4 have the ability to speculate using different time frames: M1, M5, M15, M30, H1, H4, D1, W1, MN. The higher the time frame, the more reliable the level.

We cannot, however, be tied up about that. If someone trades on M5 or M15 charts he will not set supports and resistances for weekly or monthly charts and vice versa, if you trade on daily chart you do not care about S/R on lower time frames.

Another thing worth noticing is the number of tests and reactions of the price at the level we note as support or resistance. The more times it was tested in the past the stronger the support or resistance is.

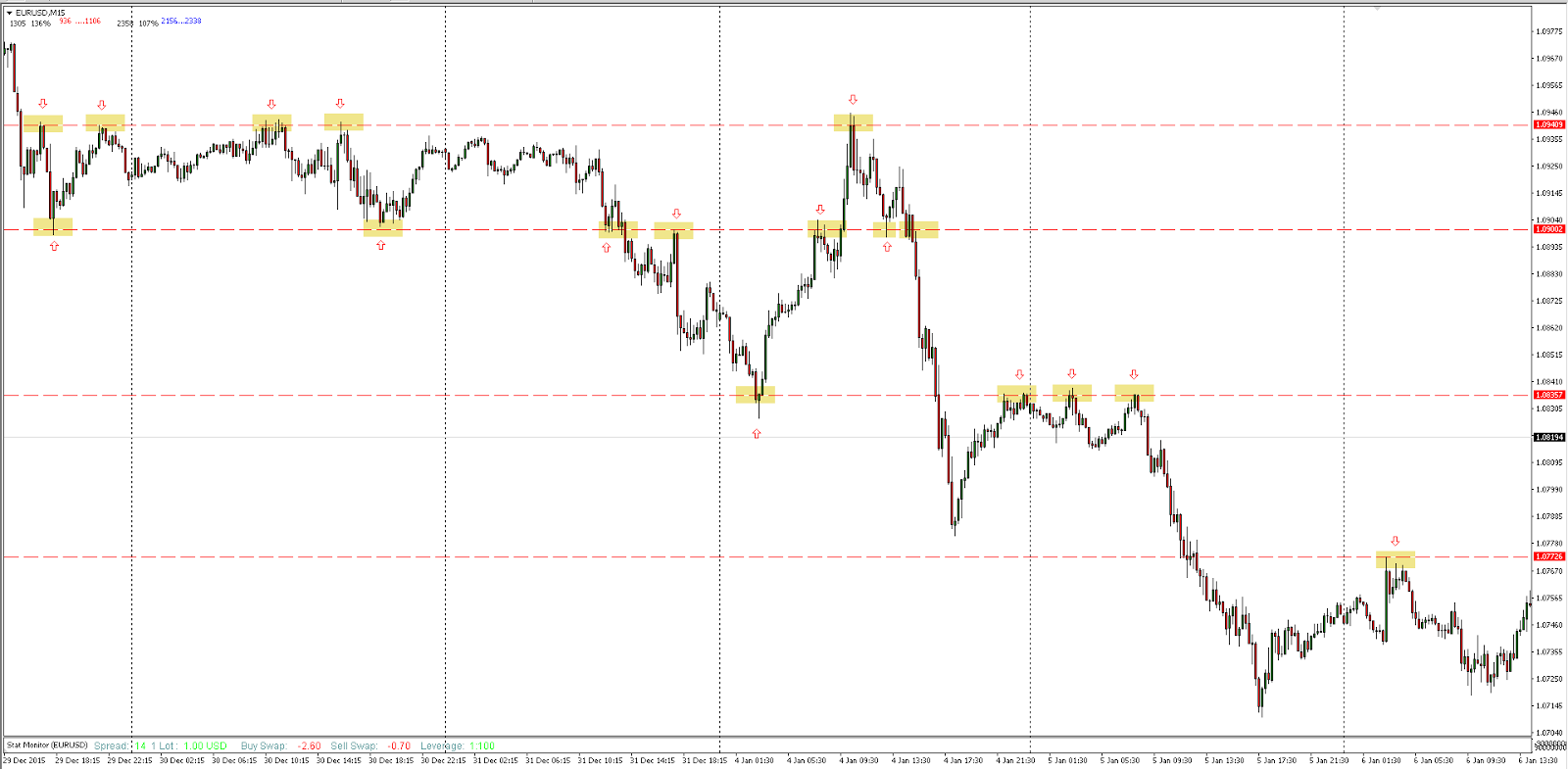

The chart below shows how often the market respected certain levels:

This also shows how supports become resistance and vice versa.

Even s the time-frame moves forward, it can be seen that these levels continue to be in effect.

You can also notice that distances between supports and resistances are often similar. The most significant are those levels which were tested both from above and bottom.

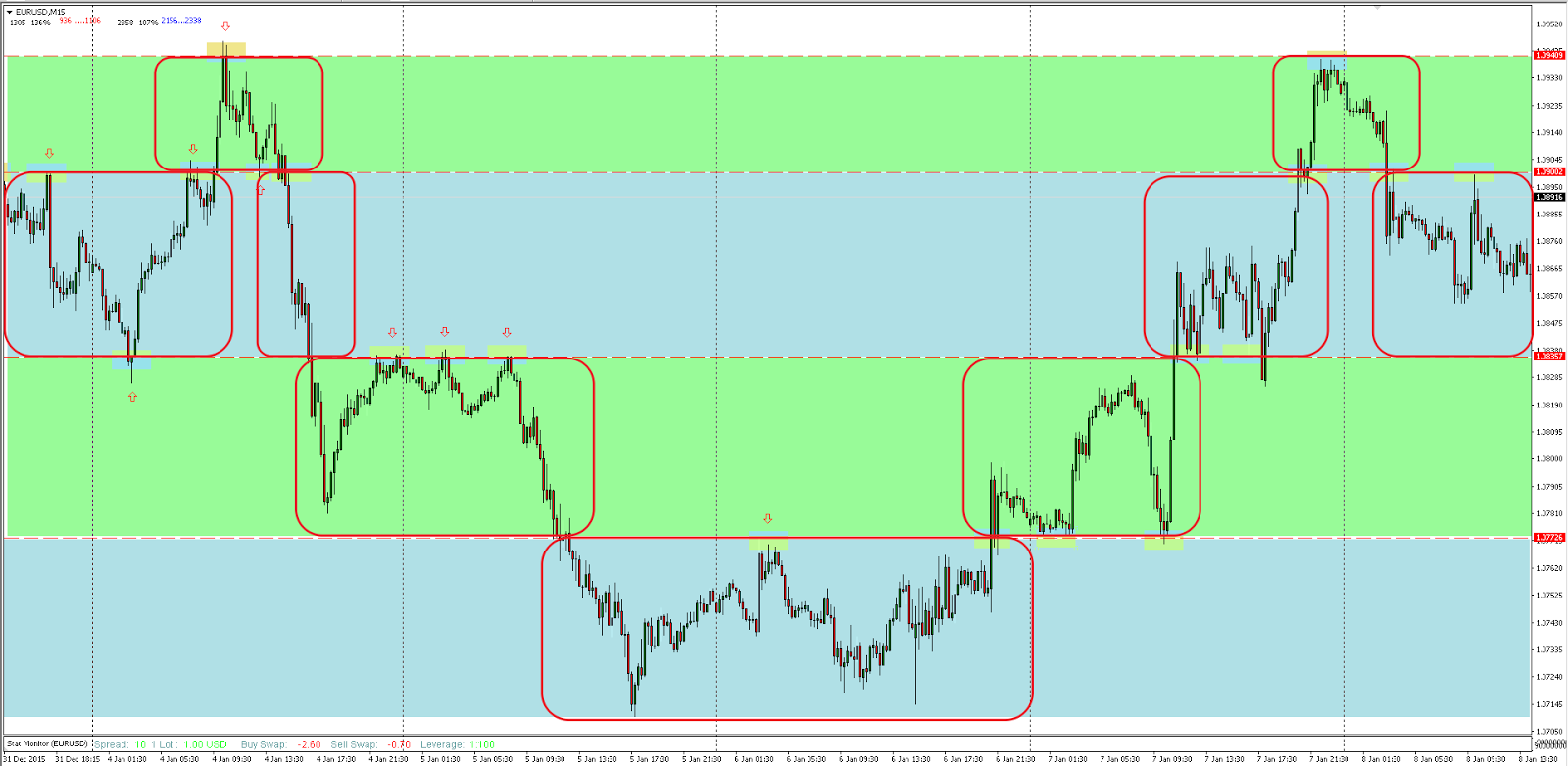

As you can see market moves in “so called” boxes. More about boxes you can read over here.

You will notice that the price moves from box to box and when breaking a box it will move to another level often set in the past. It is not a rule but very often we can notice a strong impulse of two boxes after which we can see correction.

Many novice investors have a problem with setting main supports and resistances. They draw a lot of levels and because of that they have a problem with setting the most important ones which provide an opportunity to invest.

On the chart below, there are two levels which probably would be identified as supports by novice traders.

As you can see, the green level was not tested either in the past nor in the future, so we can assume that it is not relevant. The blue level was tested twice before and we should consider it during market observation.

YOU CAN START TRADING ON FOREX MARKET USING FREE WINDSOR BROKERS ACCOUNT

Take advantage

To sum up, it is crucial to set key supports and resistances correctly.

There is high probability that the price will change direction when it reaches these levels. That gives us some advantage.

Being able to set strong support and resistance levels can minimize losses and boost profits. Box analysis then gives us an opportunity to make money during consolidations.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)