Trading for an experienced investors can be very enjoyable and extremely profitable.

Unfortunately it isn’t always easy for a rookie. Many traps are waiting for novice investors. Some behaviours which are appropriate in your life can be devastating in the stock market.

These are two from many traps, which are waiting for novice investors:

1) Following the crowd

On the stock market following the crowd is nearly always wrong.

That is how traders sentiment is being tested. Sentiment operates in a contrarian way. A stock usually rises for a particular reason. A novice trader having noticed that rise often buys just as the stock turns and starts to fall or occasionally plummet. This is because as the novice entered those who had discovered a reason to buy already had and now having seen all the value they could get extracted exit the position.

This is unique to the stock market and is possibly an oversimplification. Searching for value on the the web is foolhardy. What are you searching for? A trading guru? How will you know when you find him or her?

2) Hot news trading

“What do we do with a hot news flash? We stash that flash right in the trash”. That’s how Ed Seykota (famous American investor and coach) teaches his students.

This is one of many good expressions (up there with the trend is your friend), because hot news from the stock market or from the companies trading on stock exchanges typically create short-term movements, after which the price returns to the main trend.

An example of such a situation was the terrorist attack in Paris (November 2015). This may be a distasteful example, but it illustrates the point perfectly

On financial sites over the weekend there was speculation and analysis about a collapse and disaster in financial markets.

Certain investors were spooked by the rumours and took short equity positions This cart of the DAX shows that investors, without proper study, entered shorts at what proved to be close to the low.

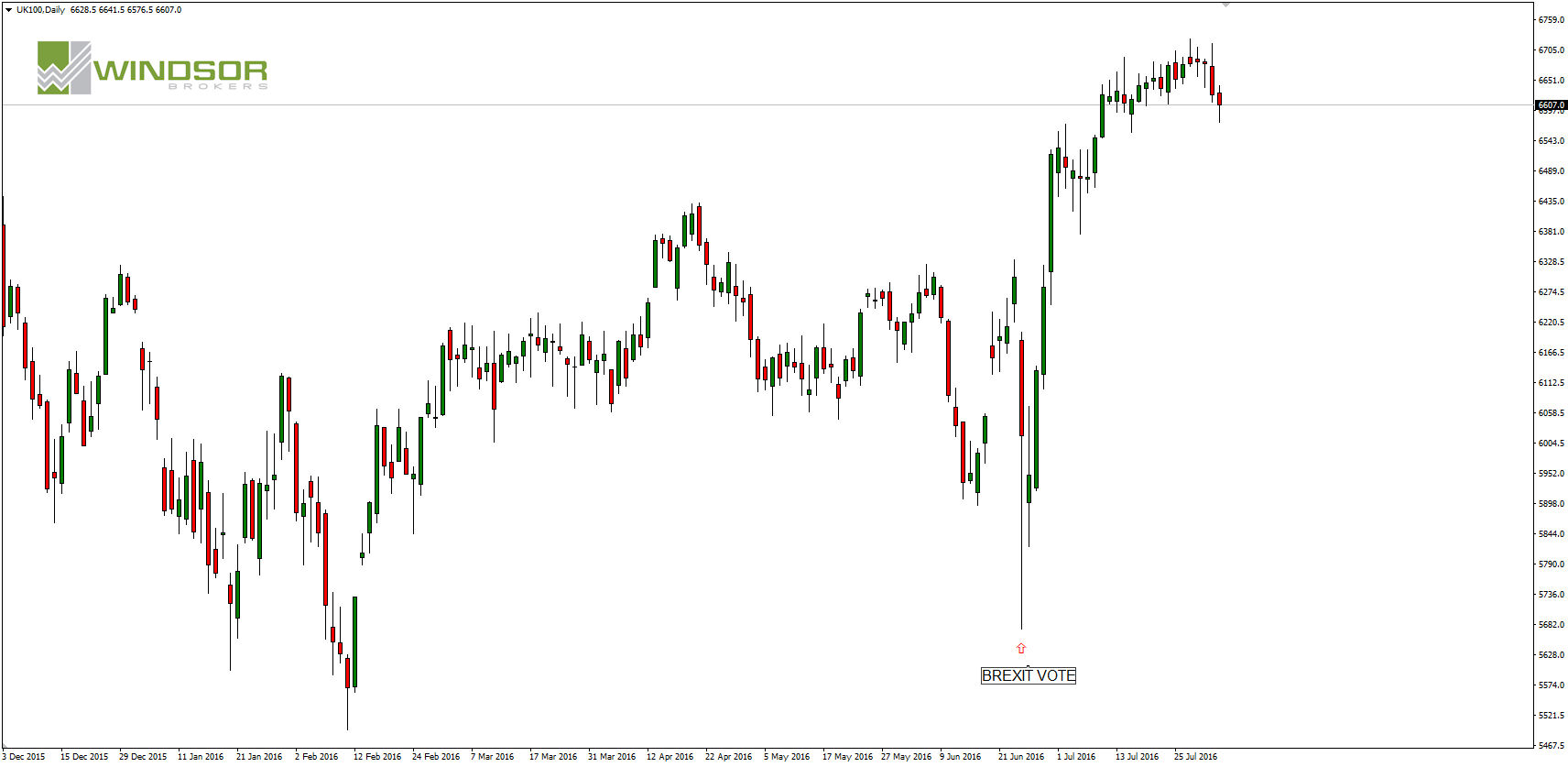

The reaction of the FTSE following the Brexit referendum was, after study, predictable, but the knee jerk was to sell. Anyone wanting to sell a reaction should have sold Sterling. A weaker currency and an interest rate cut was a sure-fire but signal fundamentally. As I say 20/20 hindsight is always perfect!