Yields on 10-year US Treasury bonds surpassed the 4.17% level on Monday, extending two-day highs to 30bp and creating strong selling pressure on government bonds around the world, as strong US economic data pushes back expectations that the Fed will begin a cycle of interest rate cuts.

The ISM Services PMI exceeded expectations (52.0) and stands at 53.4 in January, supporting signs of a buoyant US economy. On Friday, the US non-farm payrolls employment (NFP) report indicated a much higher than expected net job growth, while wage growth accelerated further.

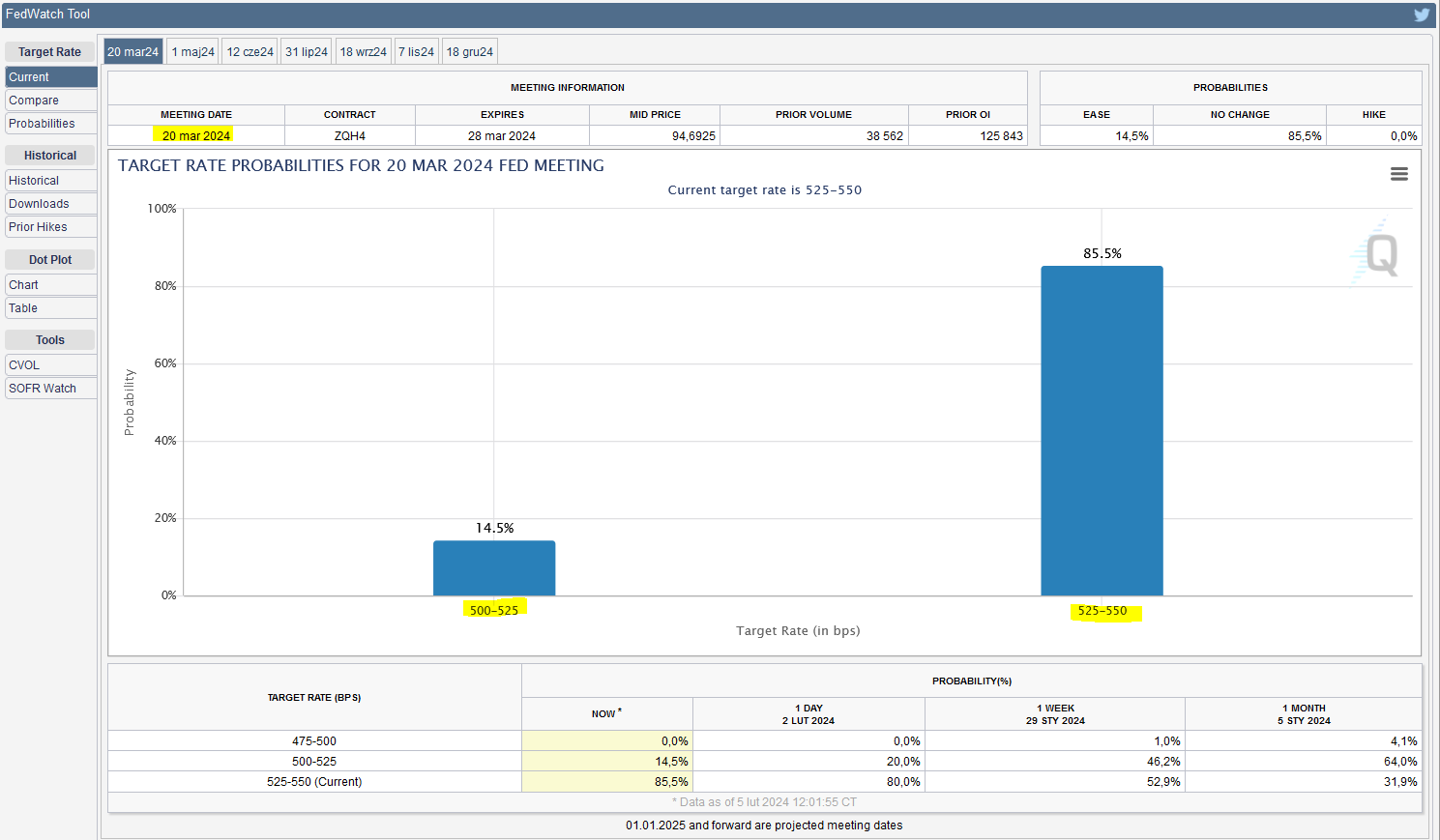

The data supported Chairman Powell’s hawkish comments during the Fed’s post-decision conference on Wednesday last week. The chairman noted that while inflation is slowing, further data are needed to confirm the slowing trend. The market continues to reject the likelihood of a rate cut in March and only 15% expect such a Fed decision. Some 55% of the market expects a US rate cut in May.

This week’s economic calendar does not contain too many items likely to affect financial markets, especially if we compare it to this past week. Of the events worth noting, I would mention tomorrow’s (Tuesday) interest rate decision in Australia – 4:30am and Thursday’s US unemployment data, which will be released at 2:30pm.

H&S formation on USDCAD and AUDUSD

H&S formations – head and shoulders – have emerged on the two currency pairs USDCAD and AUDUSD. On the first pair it is an iH&S – inverted H&S, which usually suggests a trend change or upward correction. The price today has overcome the neckline and if it holds above-possible further increases. The nearest target could be the 1.3590 supply zone. More on the situation in the markets tomorrow during the live session.

LIVE EDUCATION SESSIONS

This WEEK 5-9 Feb 2024 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo