This week is expected to be relatively quiet in terms of economic events, although there are a few important data releases to keep an eye on. There are no events on Monday, but investors should remember that the United States and Canada have switched to daylight saving time.

Moving on to Tuesday, attention will shift to the UK, where we will receive data on the Claimant Count Change -(Claimant Count Change represents the change in the total number of people claiming unemployment benefits in a given month. The index is calculated from administrative data on the benefits and social support system. ), the 3 m / y average earnings index and the unemployment rate. Attention will then turn to US inflation data, probably the most important event of the week.

Wednesday will bring the monthly GDP reading in the UK, and on Thursday attention will return to the US with releases including core PPI m/m, retail sales m/m and unemployment claims.

Finally, on Friday, the US will publish the Empire State Manufacturing index, industrial production m/m, preliminary UoM consumer sentiment and preliminary UoM inflation expectations.

In my opinion, the most volatile event this week will be Tuesday’s CPI from the US and Wednesday’s GDP from the UK.

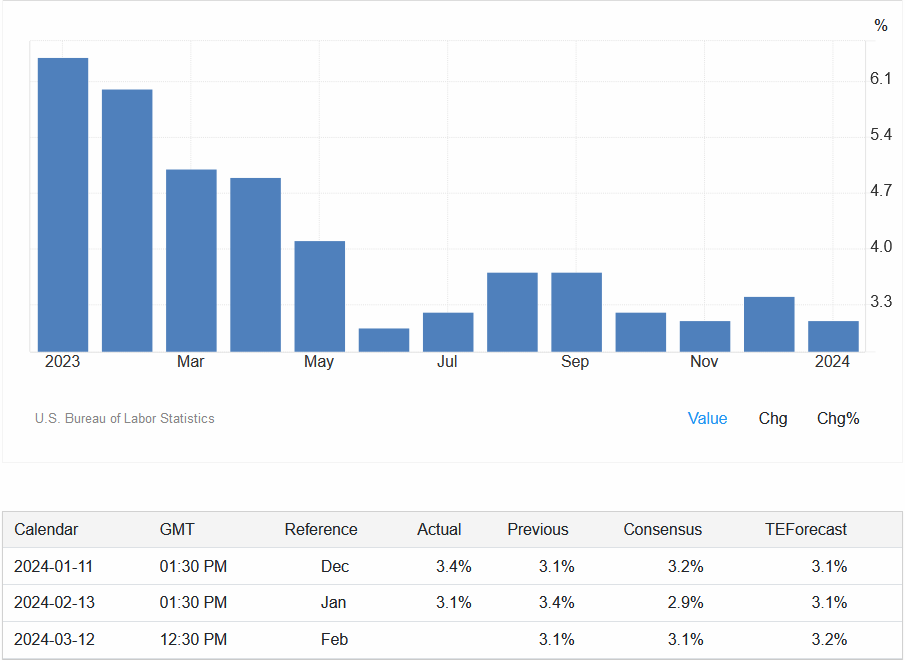

The U.S. CPI y/y is expected to be 3.1% vs. 3.1% previously, while the M/M rate is expected to be 0.4% vs. 0.3% previously. The core CPI y/y is expected to be 3.7% vs. 3.9% previously, while the M/M rate is expected to be 0.3% vs. 0.4% previously. Any difference from expectations could increase volatility in the USD and its pairs.

This week’s inflation data is very important, as it could provide clues on the timing of interest rate cuts. The market expects the first cut in June, but the Fed has stressed that more evidence of inflation’s progress toward the 2% target is needed to take action.

LIVE EDUCATION SESSIONS

This WEEK (11-15 March 2024 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions, which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo