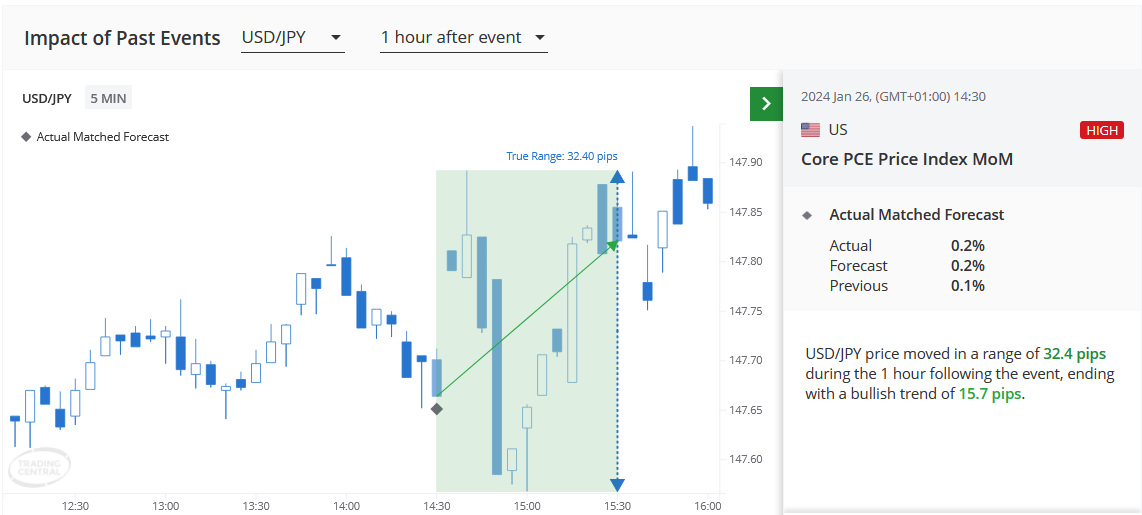

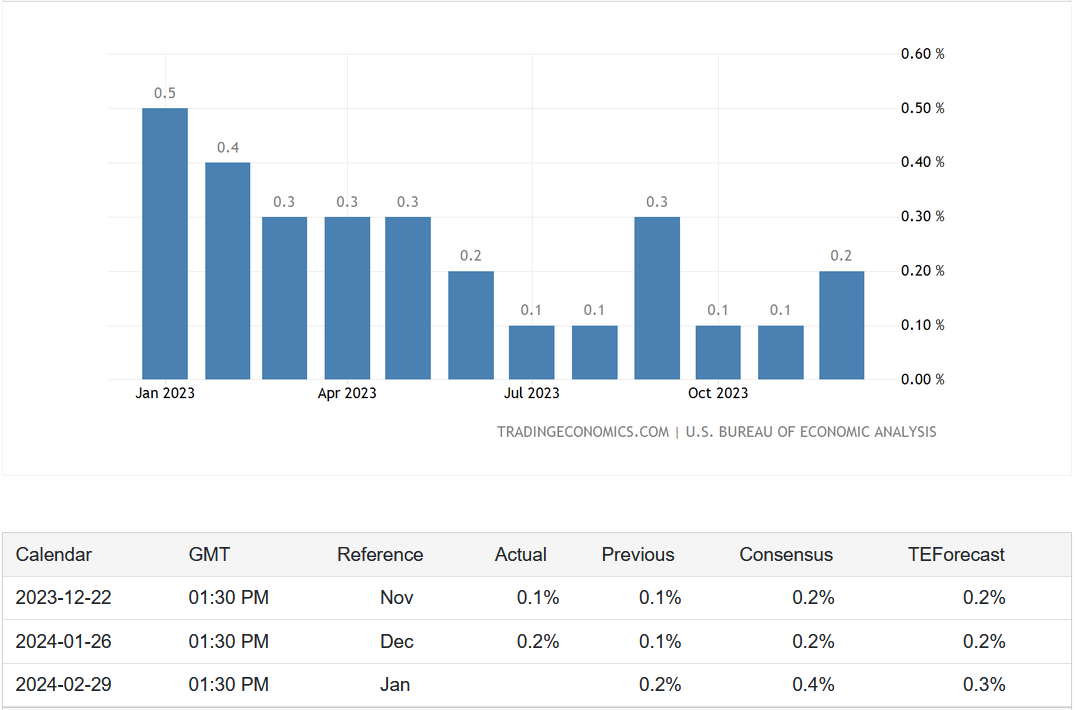

Tomorrow we can expect more volatility due to the data to be released at 2:30 p.m. It will be the PCE inflation index in the US.

PCE: The change in prices of goods and services purchased by consumers, excluding food and energy;

Currency impact: If “Current” greater than “Forecast” USD will gain to other currencies;

Frequency: Published monthly, about 30 days after the end of the month;

Next publication: March 29, 2024.

Differs from Core CPI in that it only measures goods and services targeted towards and consumed by individuals. Prices are weighted according to total expenditure per item which gives important insights into consumer spending behavior. CPI is released about 10 days earlier and tends to garner most of the attention;

Why there may be more volatility:

It is the Federal Reserve’s primary measure of inflation. Inflation is important for currency valuations because rising prices prompt the central bank to raise interest rates because of the Fed’s role in curbing inflation;

The Personal Consumption Expenditures (PCE) index is a measure of prices paid by consumers for goods and services. It is a key indicator of inflation in the United States and is closely watched by the Federal Reserve (Fed) in its monetary policy decision-making process.

The Fed’s main task is to achieve stable prices and maximum sustainable employment, and it uses monetary policy tools such as interest rate adjustments and quantitative easing to achieve these goals. Inflation, as measured by indicators such as the PCE, is a key factor influencing Fed decisions.

When the PCE index indicates that inflation is rising above the Fed’s target rate (usually around 2%), the Fed can respond by implementing tighter monetary policy measures. This could include raising interest rates to cool spending and investment, which in turn could help ease inflationary pressures.

Conversely, if the PCE index suggests that inflation is below the Fed’s target, or if there are concerns about deflation (falling prices), the Fed may pursue accommodative monetary policy. This may include lowering interest rates or implementing other stimulus measures to encourage borrowing, spending and investment, thereby boosting economic activity and inflation.

In general, the PCE index provides the Fed with important information about the state of inflation in the economy, which in turn influences monetary policy decisions. However, the Fed also considers a number of other economic indicators and factors in making its decisions, including employment data, GDP growth, financial market conditions and global economic trends.

I invite you to my live session every day from Monday to Friday

LIVE EDUCATION SESSIONS

This WEEK Feb/March 2024 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions, which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo