Yields on 10-year US Treasury bonds are hovering around 4.17% little changed from last week’s levels, with investors eagerly awaiting the US CPI (inflation rate) report, which will be released at 1:30pm GMT today.

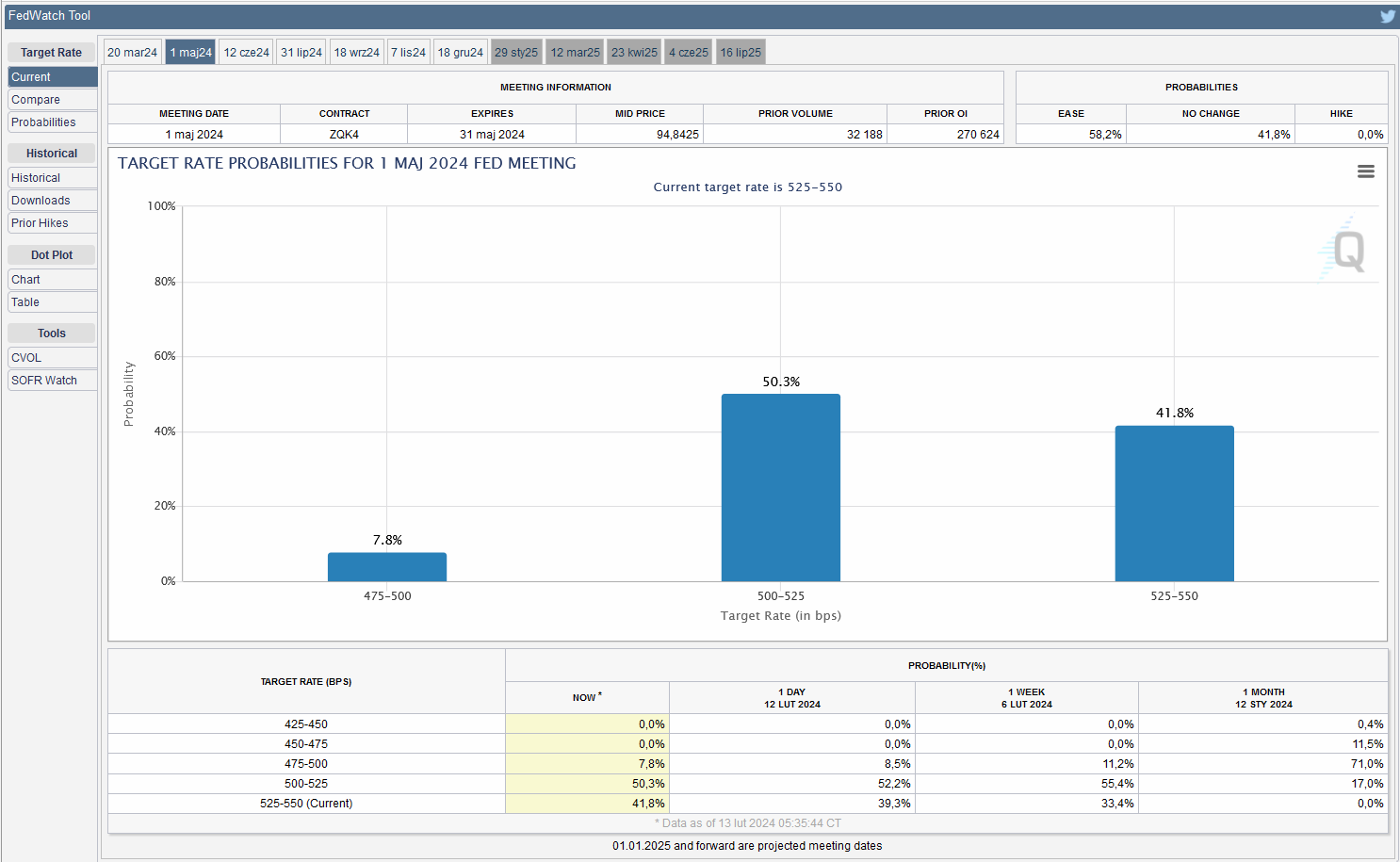

Inflation is expected to be lower again, reinforcing expectations of an interest rate cut by the Fed this year. Investors have largely stopped counting on a March rate cut, for which the odds are now around 16%, while the chance of a May easing is around 56%.

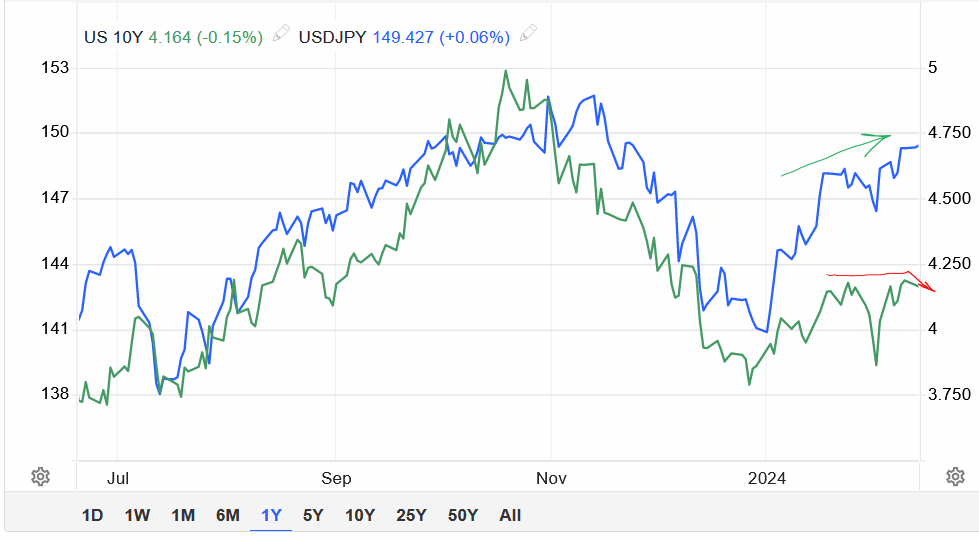

We can expect high volatility at the time of the US data release. There is a noticeable divergence on the usually highly correlated charts of US 10-year bond yields and USDJPY. With US10Y yields relatively stable, the USDJPY chart is setting new peaks. This could signal a correction on the USDJPY. A lot will become clear after the US data.

A divergence has emerged between the US10Y yield and the USDJPY, a possible correction on the USDJPY. Today’s US inflation data will clarify the situation on these correlated pairs.

A divergence has emerged between the US10Y yield and the USDJPY, a possible correction on the USDJPY. Today’s US inflation data will clarify the situation on these correlated pairs.

I invite you to my live session every day from Monday to Friday

LIVE EDUCATION SESSIONS

This WEEK 12-16 Feb 2024 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo