The fifth week of 2024 promises to be exciting given the accumulation of important events on the economic calendar.

As usual when we are expecting important Fed decisions that could impact the USD and its pairs Monday tends to be a relatively quiet day with nothing significant on the calendar.

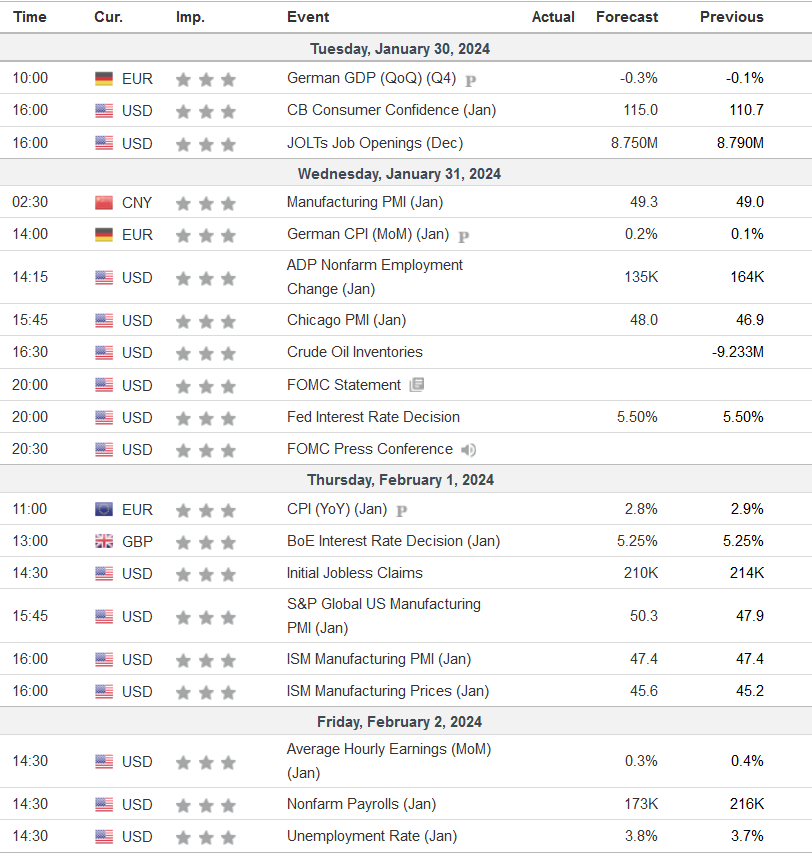

Moving on to Tuesday, Australia will report retail sales data, we will know the Eurozone GDP figure and the US will publish CB consumer confidence and JOLTS job vacancy data.

Wednesday will start with inflation data in Australia, followed by the consumer confidence index for Japan. In the afternoon, data from the US will start to emerge including ADP non-farm employment change and the quarter-on-quarter employment cost index.

However, the most important release of the day will be the FOMC policy announcement at 20:00 GMT+1, with interest rates expected to remain at the same level as before at 5.5%. At 20:30, there will be a conference call by Fed chairman Jerome Powell. During this meeting, special attention will be given to Federal Reserve Chairman Powell’s comments on whether inflation is on track to 2% and what, if any, steps will be taken to achieve it

Thursday’s noteworthy events include the OPEC-JMMC meetings and the publication of the BoE monetary policy report, the official interest rate for the UK. Meanwhile, in the US, attention will be on initial unemployment claims, the final manufacturing PMI, the ISM manufacturing PMI and ISM manufacturing prices. Also inflation rate in EURO zone will be published

In the UK, the BoE refrained from cutting interest rates at its last meeting in December due to the fact that inflation remains higher than the desired 2% target. At Thursday’s meeting, the market will focus on what BoE Governor Bailey has to say about future decisions, given that inflation is showing some downward bias and the market expects around a 1% cut this year.

Friday will close the week with a strong beat, with the US reporting average hourly earnings m/m, the change in nonfarm payrolls (NFP), the unemployment rate and revised consumer sentiment and inflation expectations.

LIVE EDUCATION SESSIONS

This WEEK (29 Jan – 2 Feb 2024 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo