Friday begins with market rumours allegedly Bank of Japan would next year follow Federal Reserve and start cycle of interest rate hikes. As usual, we will look at charts of most popular currency pairs and discuss scheduled for today macroeconomic publications.

Friday begins with market rumours allegedly Bank of Japan would next year follow Federal Reserve and start cycle of interest rate hikes. As usual, we will look at charts of most popular currency pairs and discuss scheduled for today macroeconomic publications.

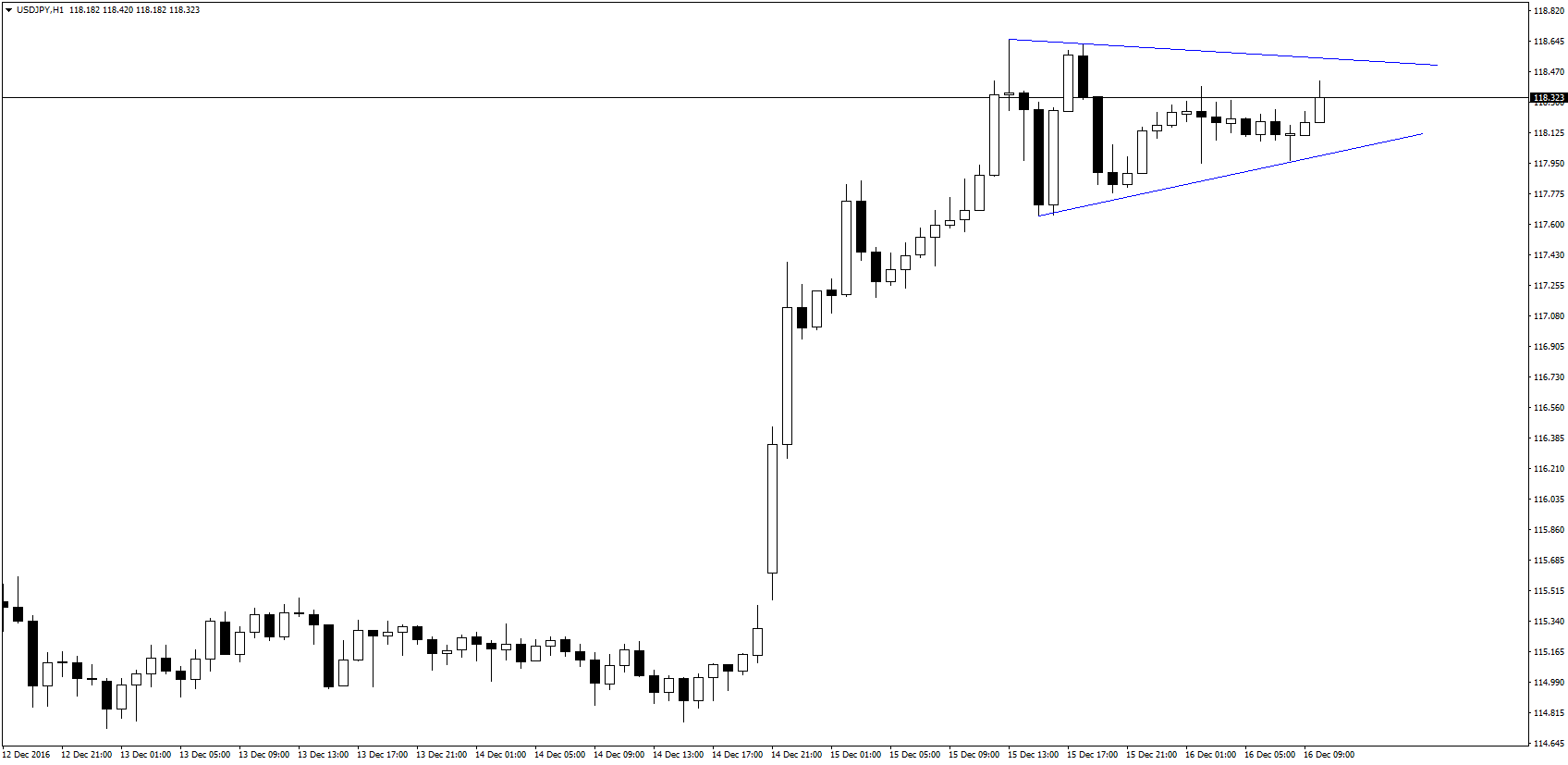

Will Bank of Japan leave policy of low interest rates and start the cycle of increases? Such news Reuters agency posted this morning . Citing its sources in close proximity of the BoJ, Reuters argues that next year the Bank will not consider further easing of its monetary policy. Immediately appeared speculation about possibility of increase in Japanese interest rates, which the most important, short-term is at -0.1%. The cycle of increases would certainly be unique in terms of policy of BoJ, which since 2007 assumes continuing monetary easing. USD/JPY consolidates at the end of the week in area of 118.30:

Looking towards Europe, BBC informs that current British Prime Minister, Theresa May tried to convince EU leaders yesterday on Summit in Brussels that her country wants a quick agreement on Brexit. It is already known that the conversation between London and Brussels will be conducted by representative in the European Commission Michel Barnier. GBP/USD is approaching local resistance around 1.2450:

Looking at today’s macroeconomic calendar will notice its rather empty, especially after so rich in data Thursday.

The most important report of the morning will be publication of the European CPI scheduled for 11:00 am. In relation to the index on an annual basis, it is not expected to change.

Another important highlight of the day will be 14:30 and the planned publication of the US Building Permits report indicating the number of building permits issued in November. This report will be the last important data for today’s session