Flat consolidation (that took almost a month) was ended at each described index.

Flat consolidation (that took almost a month) was ended at each described index.

German DAX30 was like a train that helped the bulls in Europe. Upward movement wasn’t finished at historical top 12940 pts or even 13000 pts psychological level.

Each levels described in this analysis concerns Future market. You can find this indices at Windsor Brokers platform: GER30, FRA40, EU50.

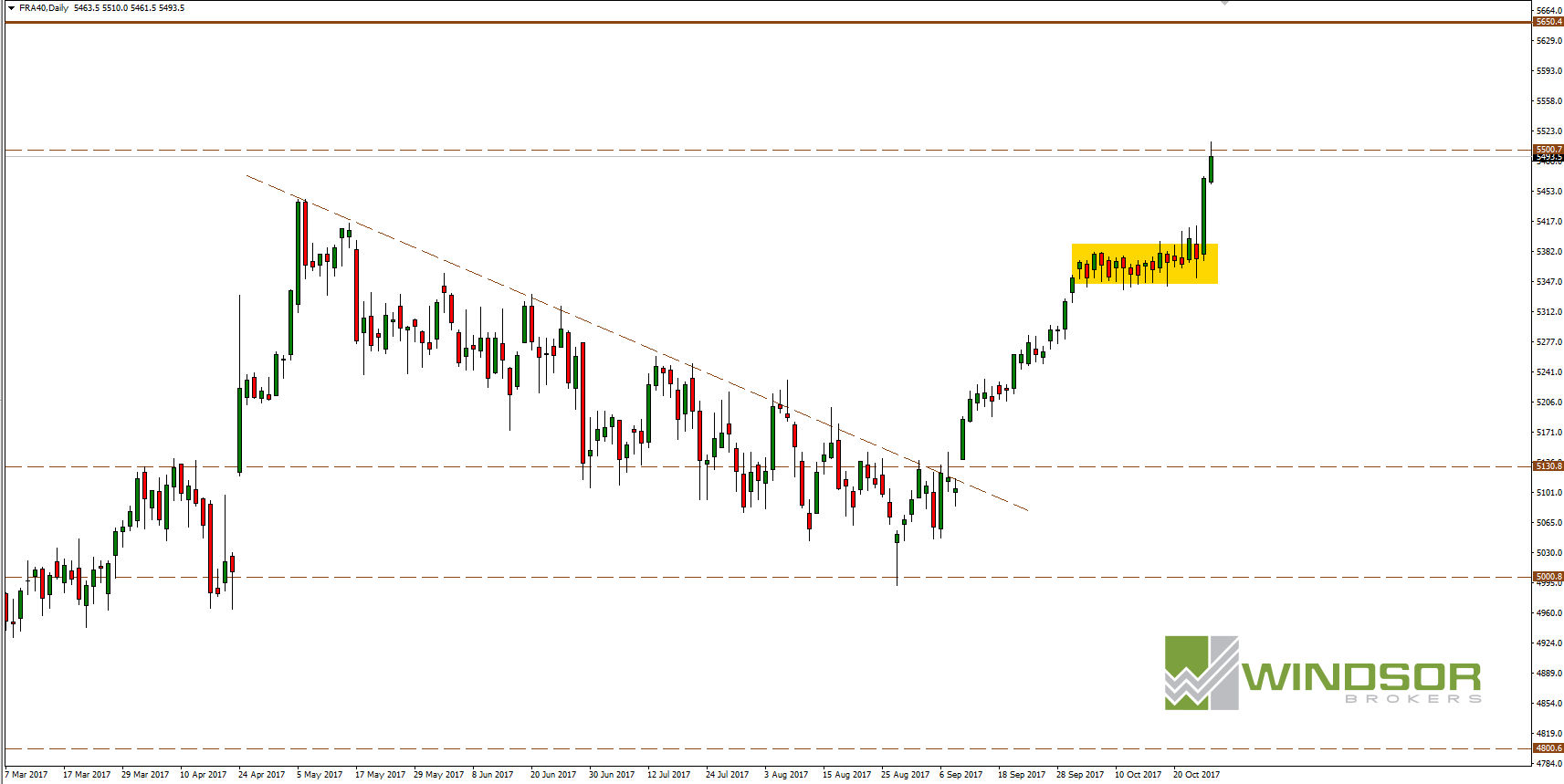

CAC40 (French index grouping the 40 largest companies):

The French index was moving at side trend between 5350 pts – 5390 pts for almost entire October. Last Thursday, demand broke the upper line of consolidation and on the next day, CAC40 tested 5500 pts level. That level was the highest level since January 2008.

Level 5500 pts can be broken during this week. However, more important resistance is at 5650 pts. That level was in the game between 1999 – 2008 year.

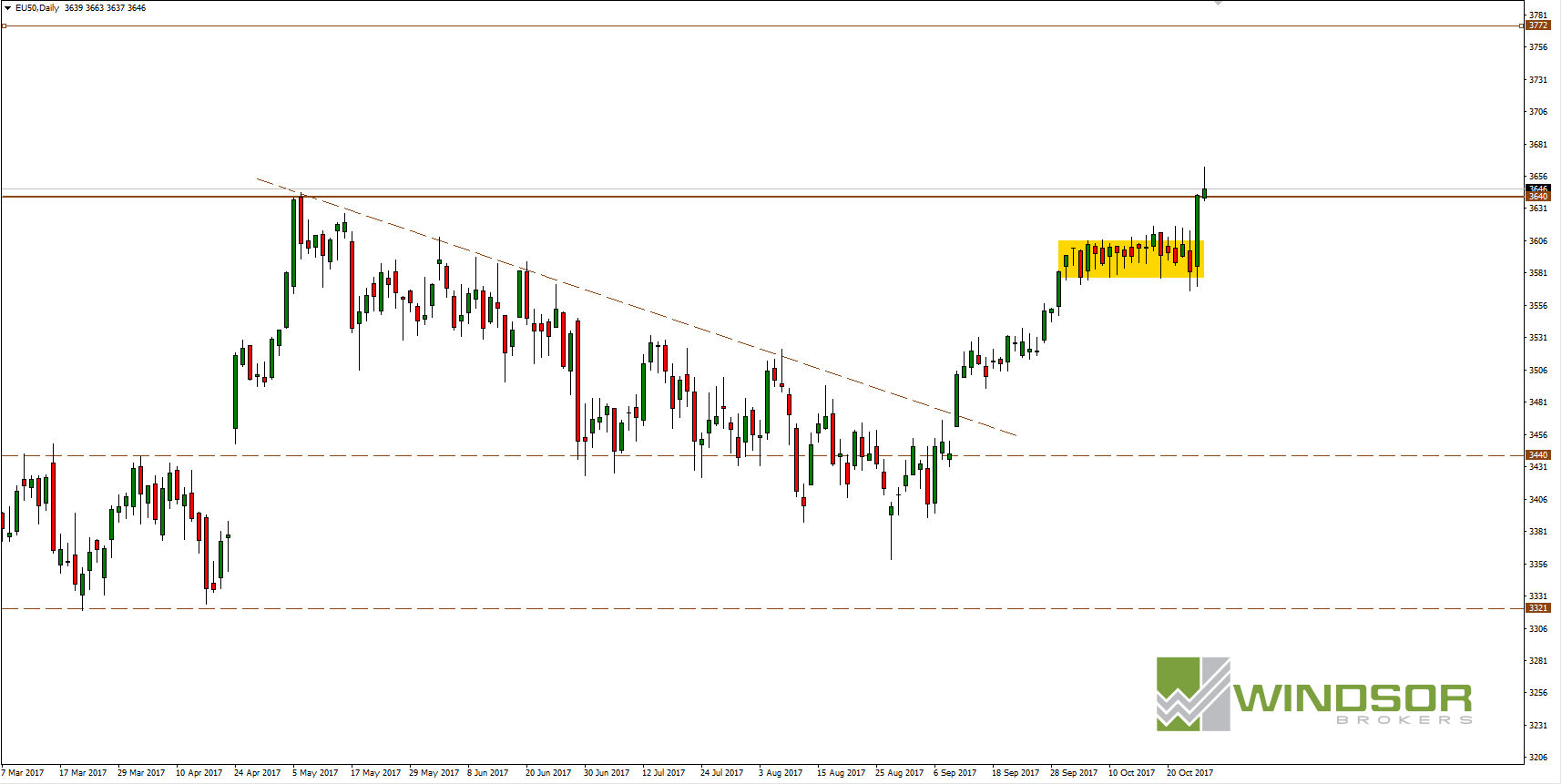

Euro Stoxx 50 (index grouping 50 largest European companies from 11 countries in Europe):

Euro Stoxx 50 traveled the same road as CAC40. After it breaks above the consolidation it finished at 3640 pts level. If that level is safe and index stays above it, the target for the bulls will be at 3770 pts. That level was also in the game between 1999 – 2008 year.

We can expect that supply will be much more active at the last mentioned resistance. There should be consolidation or even downward movement over 100 pts.

Try trading on indexes. I am trading on a Broker’s account with Windsor Brokers, which offers all the listed indices available on the MT4 platform.

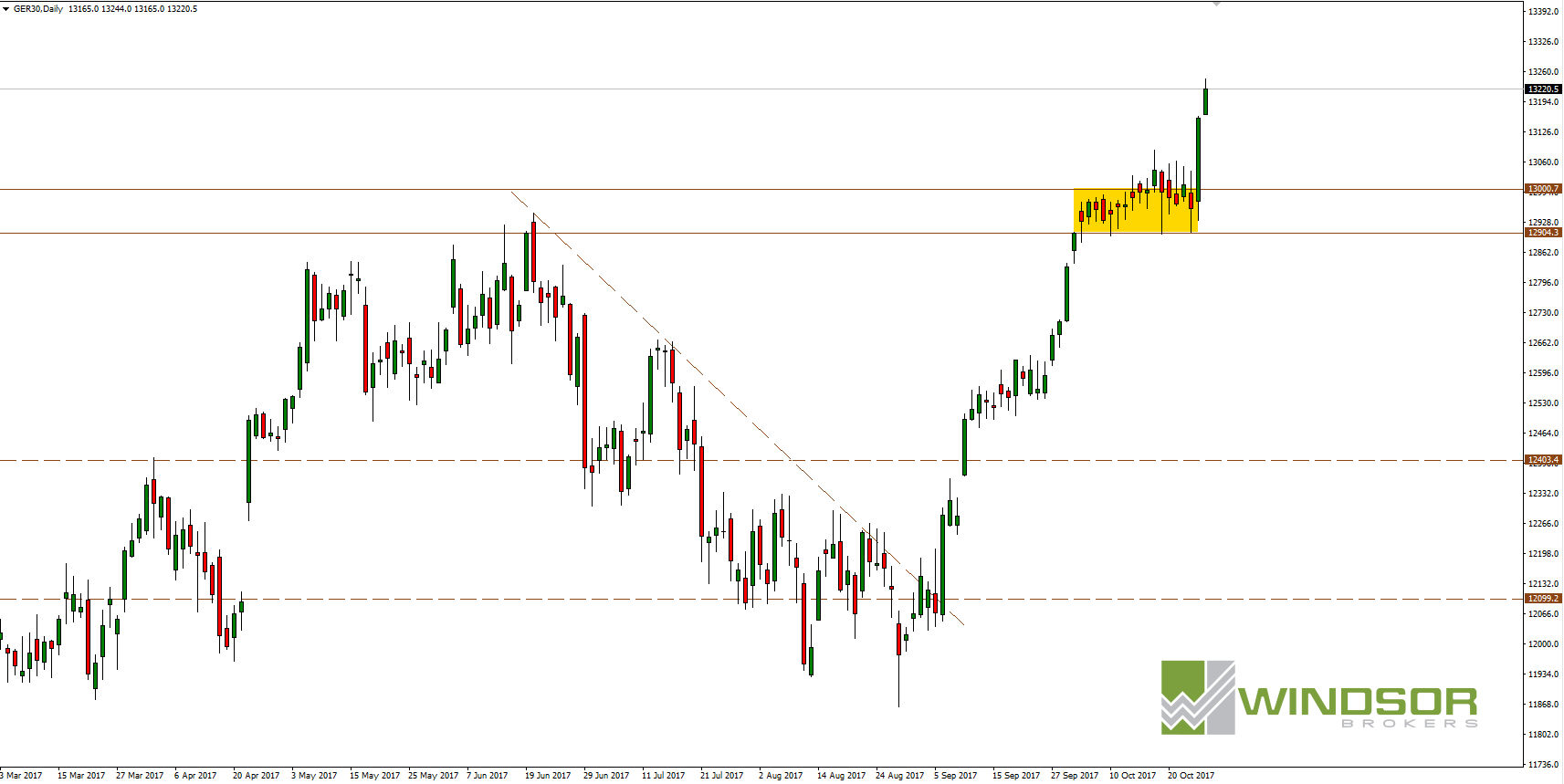

DAX30 (German index grouping 30 biggest companies):

DAX30 had a little different situation. Consolidation between 12900 – 13000 (that took place in October) was also the side trend below psychological 13000 level.

The demand was able to broke 13000 level on Thursday with a very impressive bullish candle. On Friday the bulls started trading with a bullish gap. That gives more chances that upward movement will be continued in the nearest future. DAX30 doesn’t have any resistance above so looking for the correction isn’t right now a good idea.