Exotic Trading- EURNOK, EURSEK, USDDKK

ExoticTrading is a series of analyzes, which is created in collaboration with the broker InterTrader and is published on Comparic every Monday, Wednesday and Friday. The theme as the name suggests are so called- exotic currency pairs.

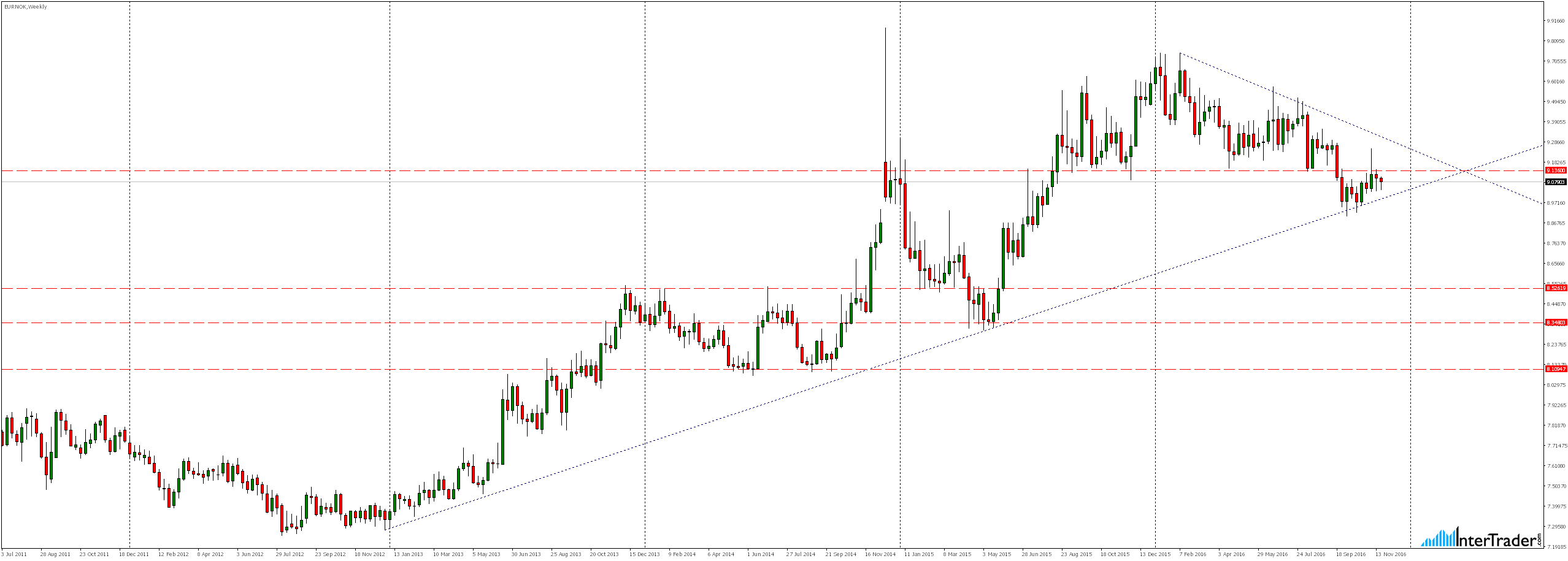

EURNOK

For several weeks, the market moves in a consolidation but looking at the current situation we see a forming from two weeks triangle formation.

Looking at the weekly chart we see that the upper limit of that consolidation is a very important resistance, and rejection of which could pave the way for further declines, which after the defeat of the uptrend line could change the attitude of the market in the longer term.

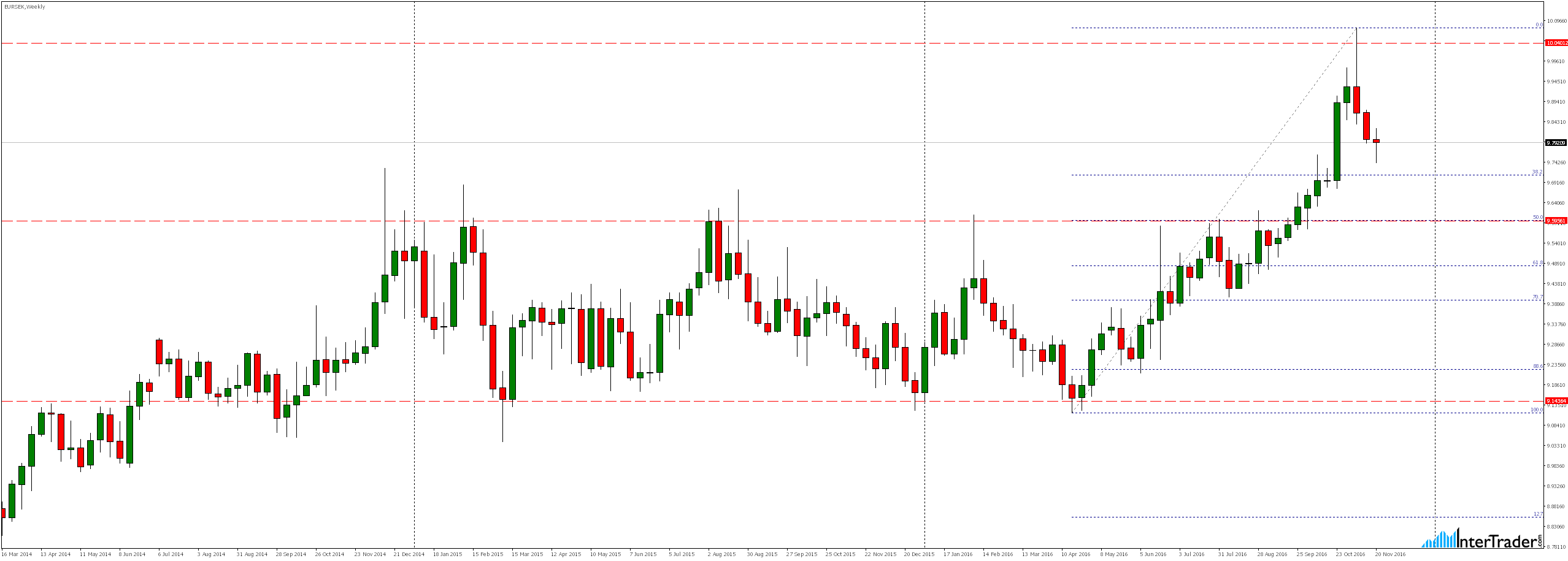

EURSEK

For two weeks we observe dynamic declines. Given how important resistance in the past was the level of 9.5956, coinciding currently with measuring 38.2% Fibonacci correction, we could expect in the near future retesting it.

Looking at the daily chart, we see that on the way to the declines stands re-tested current level of 9.7550, the rejection of which could pave the way for further growth without testing the aforementioned support 9.5956.

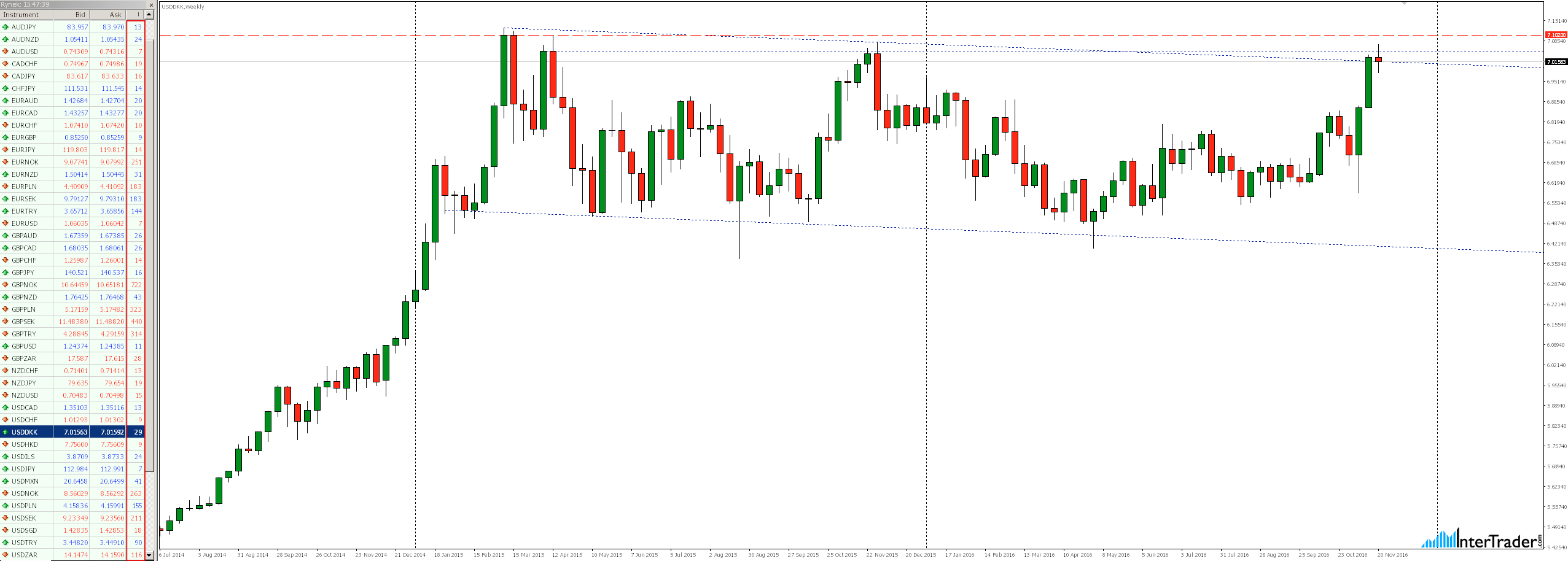

USDDKK

US to the Danish crown is first time analyzed in our “Exotic Trading ” cycle. As shows the weekly chart market almost two years is moving in a downward channel forming a flag formation .

Now we are in the area of the upper limit of the formation and extremely important resistance 7.0480, which overcome could open demand the way to 7.1020.

To invest in exotic pairs we take advantage of low spreads the broker InterTrader that at the time of the creation of the analysis for each instrument in turn were 25.1, 18.3 and 2.9 pips.

Looking at the chart H4 we see that the rejection of the current zone could cause a decline at least in the vicinity of the level of 6.8530.