Exotic Trading is a series of analyzes, which is created in collaboration with the broker InterTrader and is published on Comparic.com every Monday, Wednesday and Friday. The theme as the name suggests are so called- exotic currency pairs.

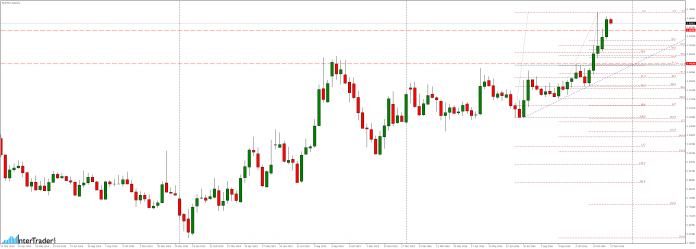

EURTRY

The market for five weeks is moving rapidly north as a result of which were established new highs. Given that the level of 3.4424 has not yet been tested from the top (as support), in the near future we expect a downward correction especially that it coincides up with three consecutive Fibonacci levels.

Looking at the chart H4 we can see that on the way to so distance declines still stands support 3.6040 coinciding precisely with the golden ratio 61.8% of Fibonacci correction of last week’s gains.

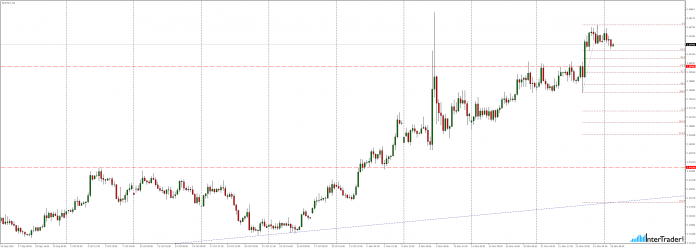

GBPTRY

Following the rejection of support 3.7306, from over six weeks we see dynamic growth, thanks to which two weeks ago, the market broke the downward trend line and the British pound strengthened against the Turkish Lira as much as 12.74%.

Looking at the daily chart we see that the potential growth could reach up to around the level of 4.3650 .While taking into account ongoing since last Thursday falls more likely is re-test of the support 4.1330.

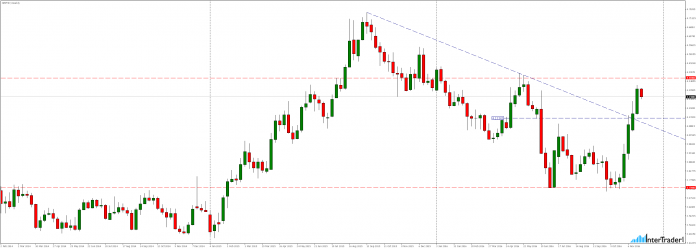

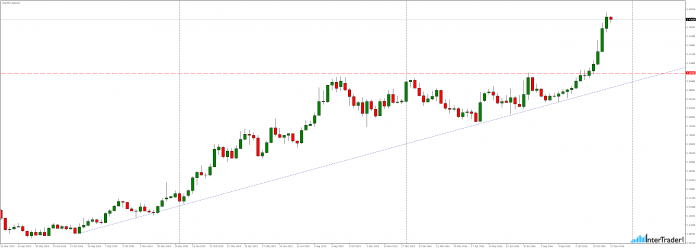

USDTRY

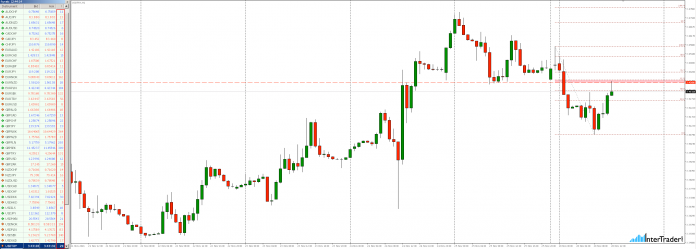

Although on this currency pair we observed bullish trend for a long time, really strong dynamics started from time of breaking the 3.0938 level. Looking at the weekly chart we see that for 14 consecutive weeks we see continued growth as a result of which the US dollar strengthened against the Turkish Lira as much as 16.33% establishing each week new historical highs.

Given there that 3.0938 has not yet been tested from the top (as support), in the near future we can expect a downward correction in that area.

An argument in favour of bearish scenario may be fact that we have decreasing lows and highs in the graph H1.

To invest in exotic pairs we take advantage of low spreads at the broker

InterTrader that at the time of the creation of the analysis for each instrument in turn were 25.1, 18.3 and 2.9 pips.