ExoticTrading is a series of analyzes, which is created in collaboration with the broker InterTrader and is published on Comparic every Monday, Wednesday and Friday. The theme as the name suggests are so called- exotic currency pairs.

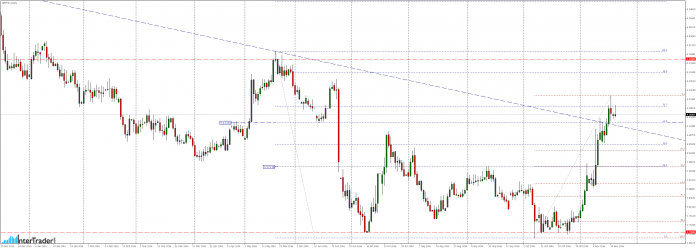

GBPTRY

From the beginning of November we observe a dynamic growth which resulted that in last week market defeated the downtrend line which coincides with the level of 61.8% Fibonacci correction. If in the near future supply doesn’t negate tthis breakout, we expect to continue moving to north, even i around of the level of 4.3650.

However, if the price will return below 4.1330, then we could expect a deeper downward correction at least in the area of support 3.9712 coinciding with the level of momentum 50% Fibonacci correction of the whole last upward movement.

GBPZAR

For over a week, the market moves in a consolidation between levels 17.490 and 18.130. Given formation of double top in the vicinity of the said resistance, in the near future we expect to breakout thru the bottom and re-test the defeated earlier level of 17.040 coinciding with the 61.8% Fibo correction of previous increases.

USDNOK

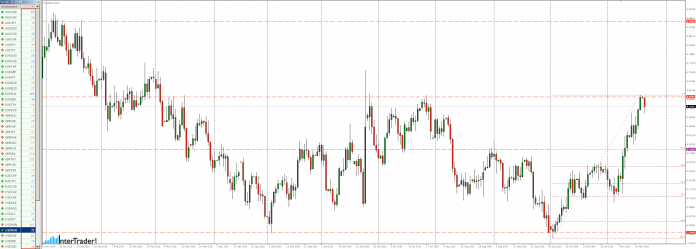

As a result of ongoing growth since the beginning of October we arrived in the vicinity of an important resistance 8.6000, where defeated could pave the way for growth even in this year’s highs around 8.9500.

Today, we observe a strong supply side response rejecting the current level and if only supply will have enough strength to continue to decline, in the near future we expect a re-test of level 8.3560 coinciding perfectly with the measuring of 38.2% Fibonacci correction.

To invest in exotic pairs, we recommend use of low spreads the broker InterTrader that at the time of the creation of the analysis for each instrument in turn were 17.1, 1.7 and 7.2 pips.