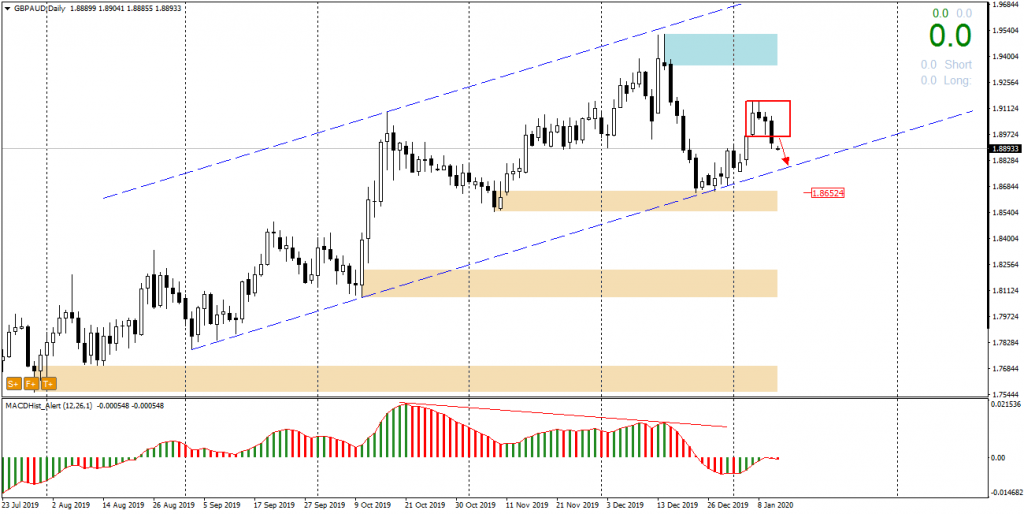

GBPAUD has been moving in the growth channel since 30 July last year. The distance between support and channel resistance is nearly 1000p, which is not surprising, as GBPAUD belongs to pairs with high volatility.

Last week, daily candles from January 7th and 8th formed an inside bar formation. On Friday, the price overcame the minimum of the formation and is moving in the direction of support of the mentioned channel.

From Monday to Friday – Live trading at 13:00 (London time) chat, analyse and trade with me: https://www.xm.com/live-player/basic

This week, a trade agreement is to be signed between the US and China, which may have a positive impact on increasing the export of raw materials from Australia to China and thus supporting the value of the Australian currency. The agreement obliges China to purchase U.S. agricultural products worth between $40 and $50 billion a year and a total of $200 billion of U.S. goods over two years in exchange for no further duties on goods exported to the USA.

On the other hand, there are voices that there are more and more chances for the Bank of England to reduce interest rates, which will certainly weaken the pound against other major currencies.

Under the influence of these fundamental factors, the pair may accelerate the falls and perhaps this week the price will reach 1.87.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities