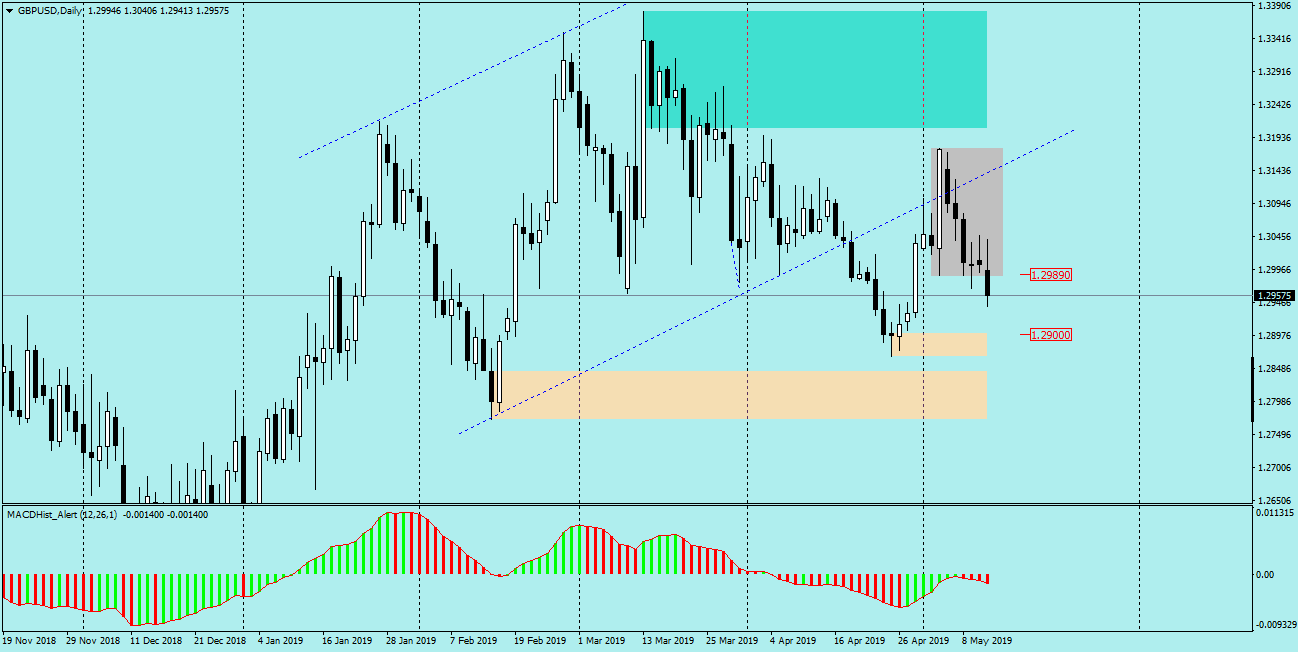

GBPUSD – a currency pair susceptible to situations around Brexit, so be very careful, keep track of UK news and secure your orders with Stop Loss . Nearly 200p candle from 3 May created Inside Bar, which today (Monday 13.05) was broken down. Today’s daily candle has a fairly large upper wick which suggests that this breakout may be effective and the quotes for the following sessions will also be heading south.

Based on the daily chart we can assume that the supply target may be the nearest demand zone starting at 1.2900.

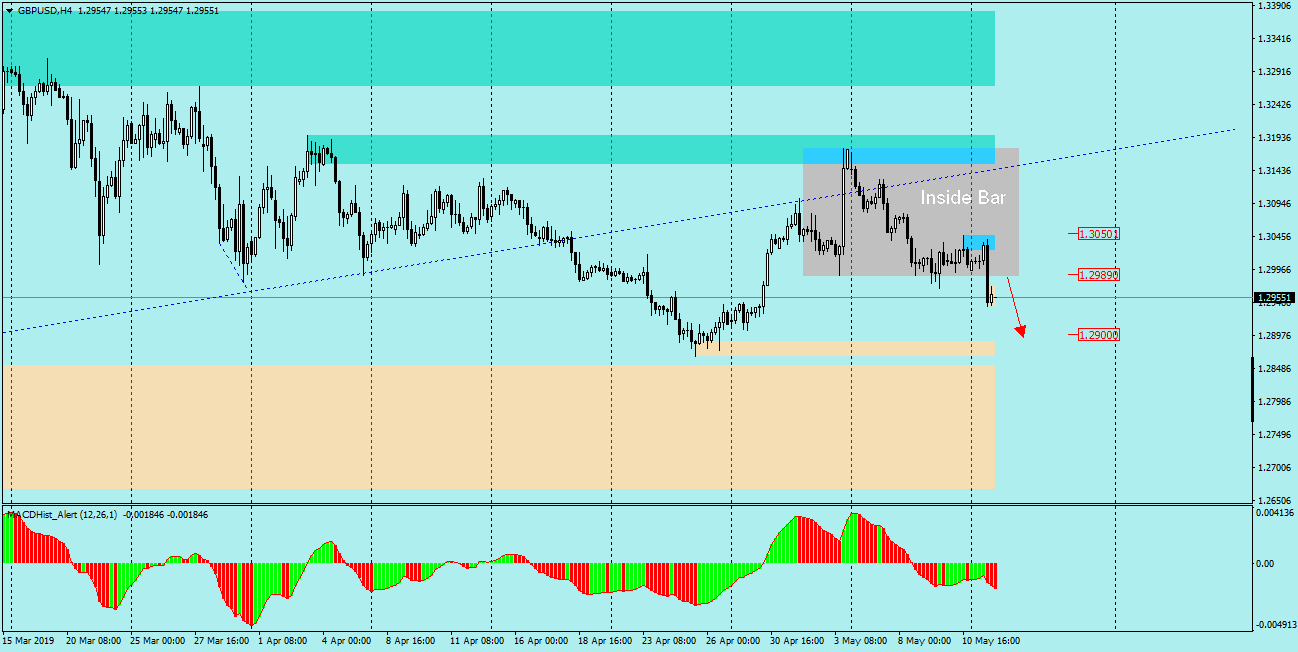

If you look at chart H4, this zone seems to be an even more likely target for sellers. A good place to take a Sell position is the bottom edge of Inside Bar at level 1.2990 if there is an upward correction in this direction. For Sell orders the Stop Loss defensive order should be above 1.3050 that is the last local maximum.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based.