“A Glimpse at PLN” is the series of analysis created in cooperation with the InterTrader broker. You can track all these analysis every Tuesday and Thursday on Comparic. The aim is to present the current market situation on the currency pairs connected with the PLN.

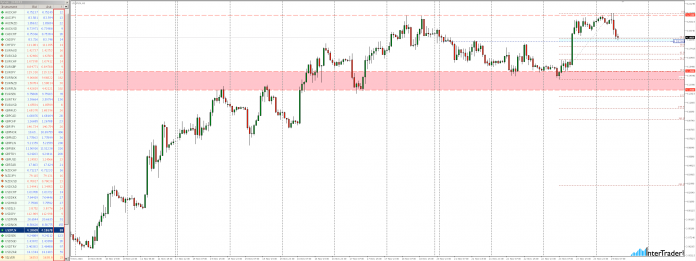

EURPLN

The emergence of a strong supply response rejecting the 4.4560 resistance over a week seeing declines.

Looking at the chart H4 we see that yesterday market as a result of a strong push growth inside the top of the downward channel . Currently we re-test the upper limit of the channel, and if only the demand reject this support, we expect the growth in the area last week’s highs.

If, however, by the strong supply we find ourselves again within the channel, then we could expect declines to continue even in the vicinity of the level of 4.3680 (see chart Daily).

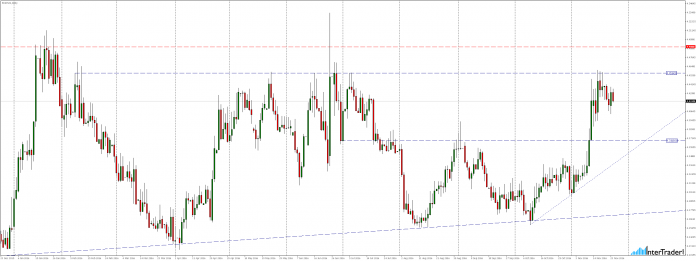

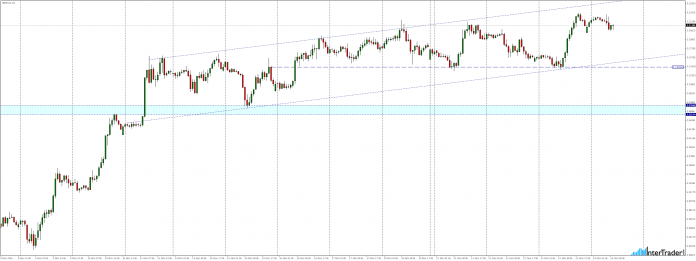

GBPPLN

For several days, the market oscillates around resistance zone coinciding with the downward trend line and the level of momentum 50% Fibonacci correction. From a technical point of view, in the near future we can expect a rejection of the current resistance and adjustments around the level 4.8750 coinciding with the golden ratio 61.8% Fibonacci correction of the ongoing increases from October.

If we look at the chart H1 we see that the market for two weeks is moving in the growth channel and to talk about the pro-downward scenario would be necessary break out and overcome the 5.1400 support.

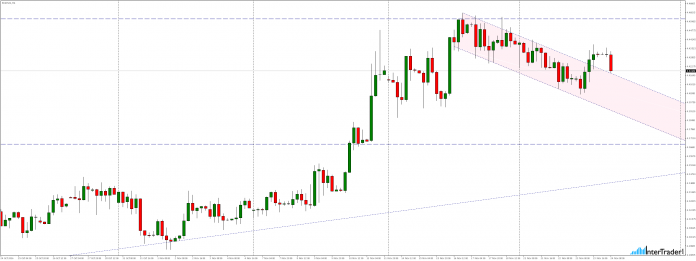

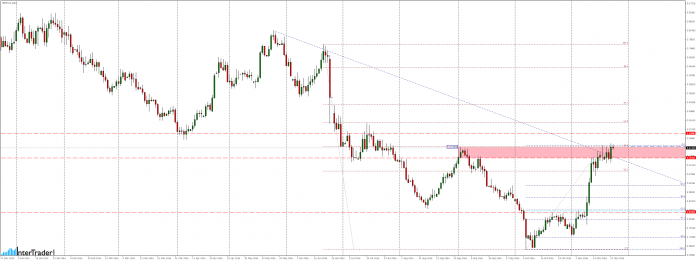

USDPLN

As a result of lasting for a long time increases, last week market beat level of 4.15 as a result of which ended up on the levels at which the last time we were in 2012. Despite the two-day decline yesterday, the market rejected the 4.15 level from the top (as support) and continues to increase. The key crucial in the near future may be whether we beat last week’s highs, which today have been violated or not.

Looking at the chart H1 we see that the market is currently testing the support area between local levels of 4.1820 – 38.2% Fibonacci correction, the rejection could pave the way for further growth.

The analysis was performed on the platform of the broker broker InterTrader, in which spreads at the time of the creation of the analysis for each instrument in turn were 10.2, 20 and 6.9 pips.