DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually every day there is very high volatility which gives many trading opportunities.

Session Summary 27.06.2017

This week is the annual forum on central banking organized by the ECB. Yesterday, the ECB chief Mario Draghi slightly shook the stock markets and strengthened the euro. Draghi said that the factors for higher inflation are temporary and that the ECB will respond to the economic recovery in the euro area and the world. Naturally, he added that changes in monetary policy will be gradually introduced and that inflation is still to be pushed to the target, ie around 2% in the medium term, but investors believe that this is a signal of monetary policy normalization in the euro area. The reactions did not have to wait long. DAX went down hard, and the euro skyrocketed into the area unseen from November last year.

Yesterday also the Americans had no reason to be happy. Because of the lack of votes that have guaranteed the Republicans to push through the Obamacare in the US Senate, the vote on its draft yesterday was postponed. Let us remind you that the House of Representatives has had a lot of problems with its enforcement, and this is one of Donald Trump’s key promises.

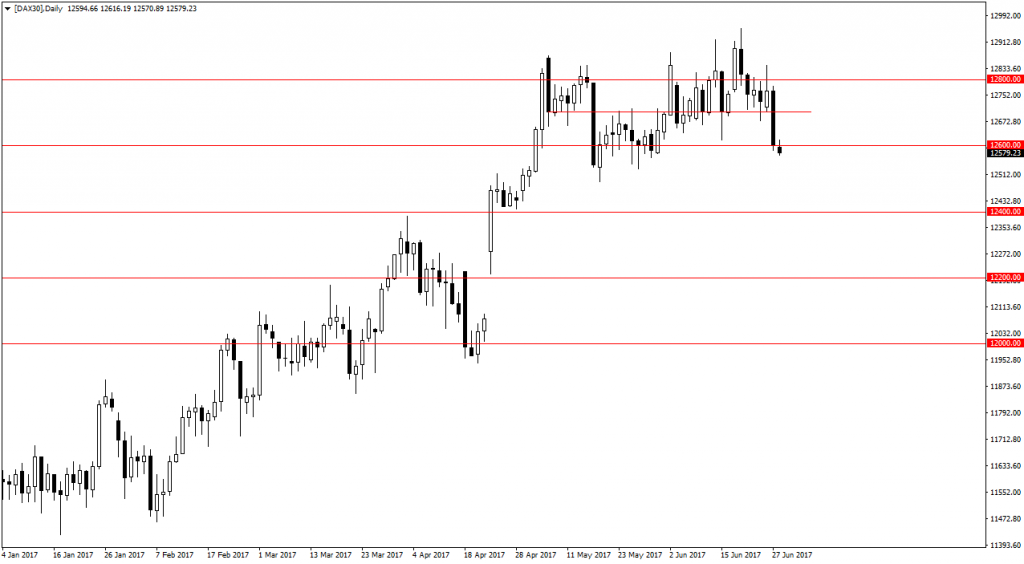

Today morning Nikkei ended the day with -0.47%. Yesterday the S&P 500 also closed down 0.87% and DAX fell 0.78%. The German index set a new record around 12951 points. However, he has not been able to stay on this level for too long. Yesterday, the index fell sharply in the support area of 12,600 points, which will open the way to 12400 points.

DAX Intraday

DAX Intraday

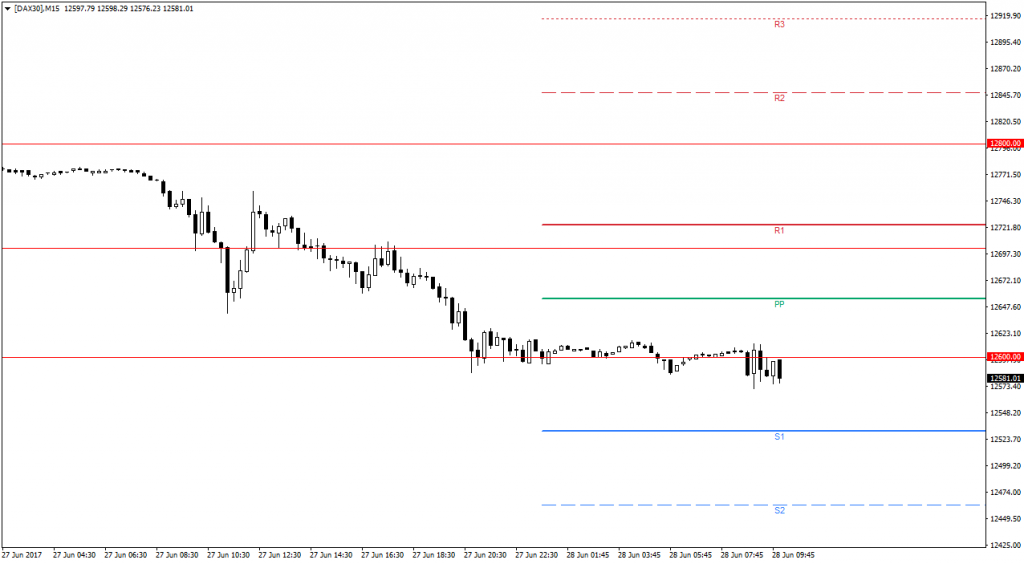

After the opening of the cash market, the DAX index broke the level of 12,600 points, which opens the way to S1 at around 12530 points, or maybe even S2 near 12460 points.

Key data for the DAX index

Key data for the DAX index

15:30 – ECB President Draghi Speaks