Yesterday’s FOMC as expected brought long-awaited interest rate hike. Exactly one year after the first for many years hike to the level of 0.25-0.5%, the American Committee for Open Market Operations concluded that the macroeconomic situation in the country needs to raise interest rates by another 25 basis points. Markets reacted as expected – dollar strengthened against all major currencies. Even surprisingly positive night data didn’t change situation on the market.

Yesterday’s FOMC as expected brought long-awaited interest rate hike. Exactly one year after the first for many years hike to the level of 0.25-0.5%, the American Committee for Open Market Operations concluded that the macroeconomic situation in the country needs to raise interest rates by another 25 basis points. Markets reacted as expected – dollar strengthened against all major currencies. Even surprisingly positive night data didn’t change situation on the market.

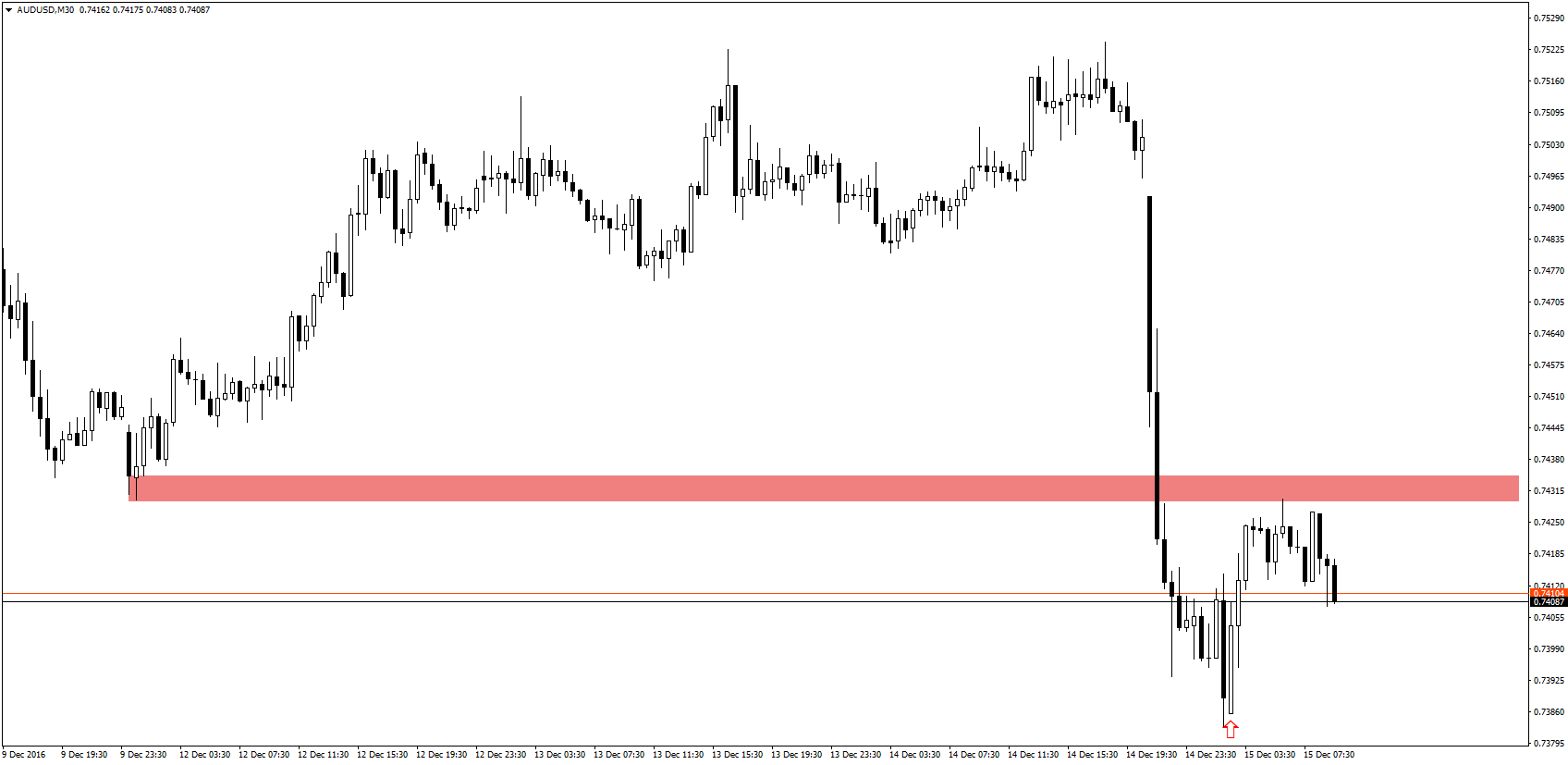

We are talking primarily about the night publications of the Australian labor market. Thirty minutes after one o’clock we read November report showing changes in the level of employment. Forecasts pointed to ( already solid) increase by another 20,000, the reality turned out to be much more positive. Not only was revised last reading (currently 15.2 thousand.), But in November was added 39.1 thousand new employment. The scale of participation increased to 64.6%. The positive tone of the night publication was spoiled somewhat by increase in the unemployment rate to 5.7% from the previous 5.6%. After all, increases in AUD as a reaction to today’s publications are noticeable on chart AUD/USD:

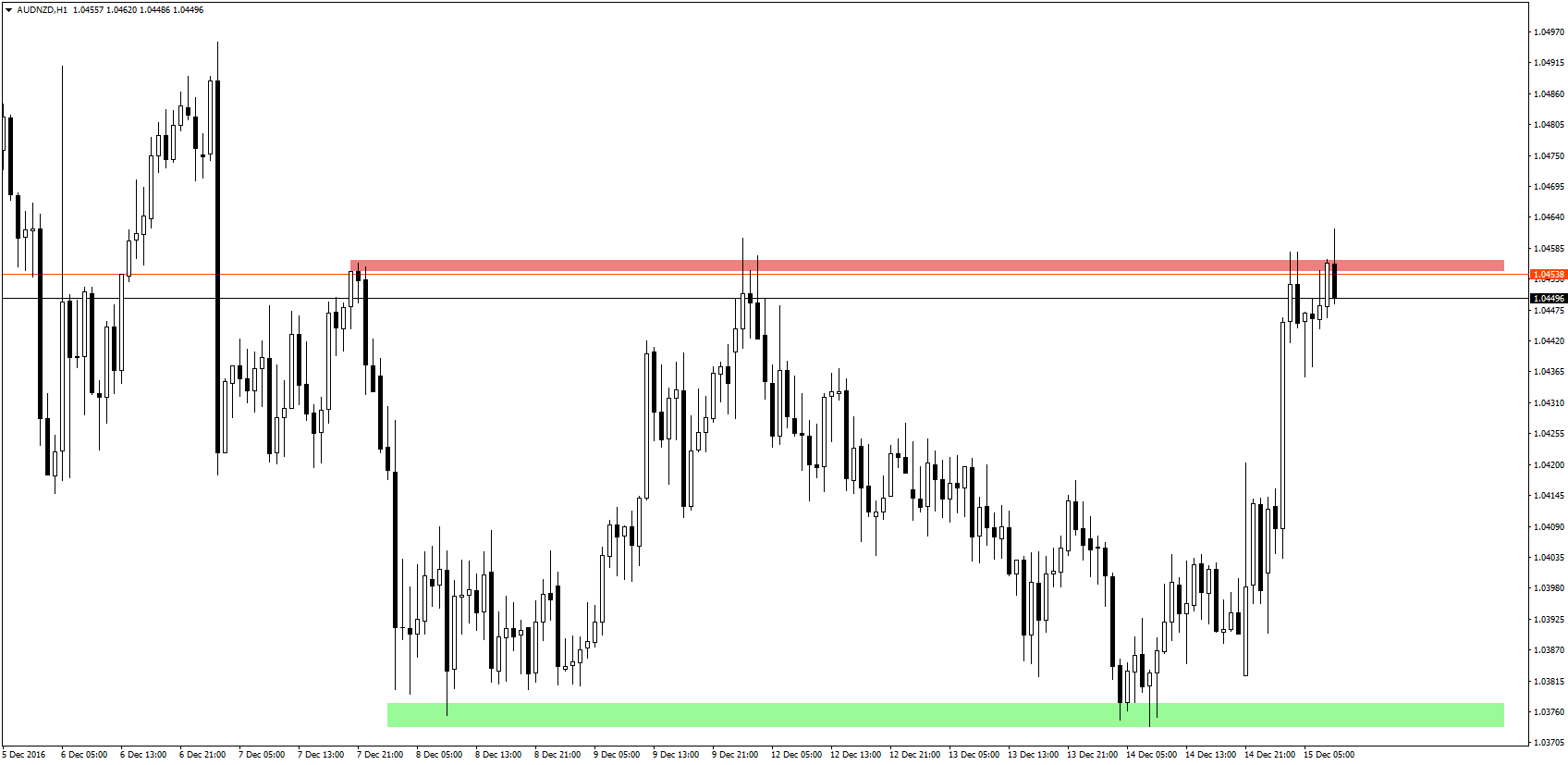

Much more reaction we saw on AUD crosses

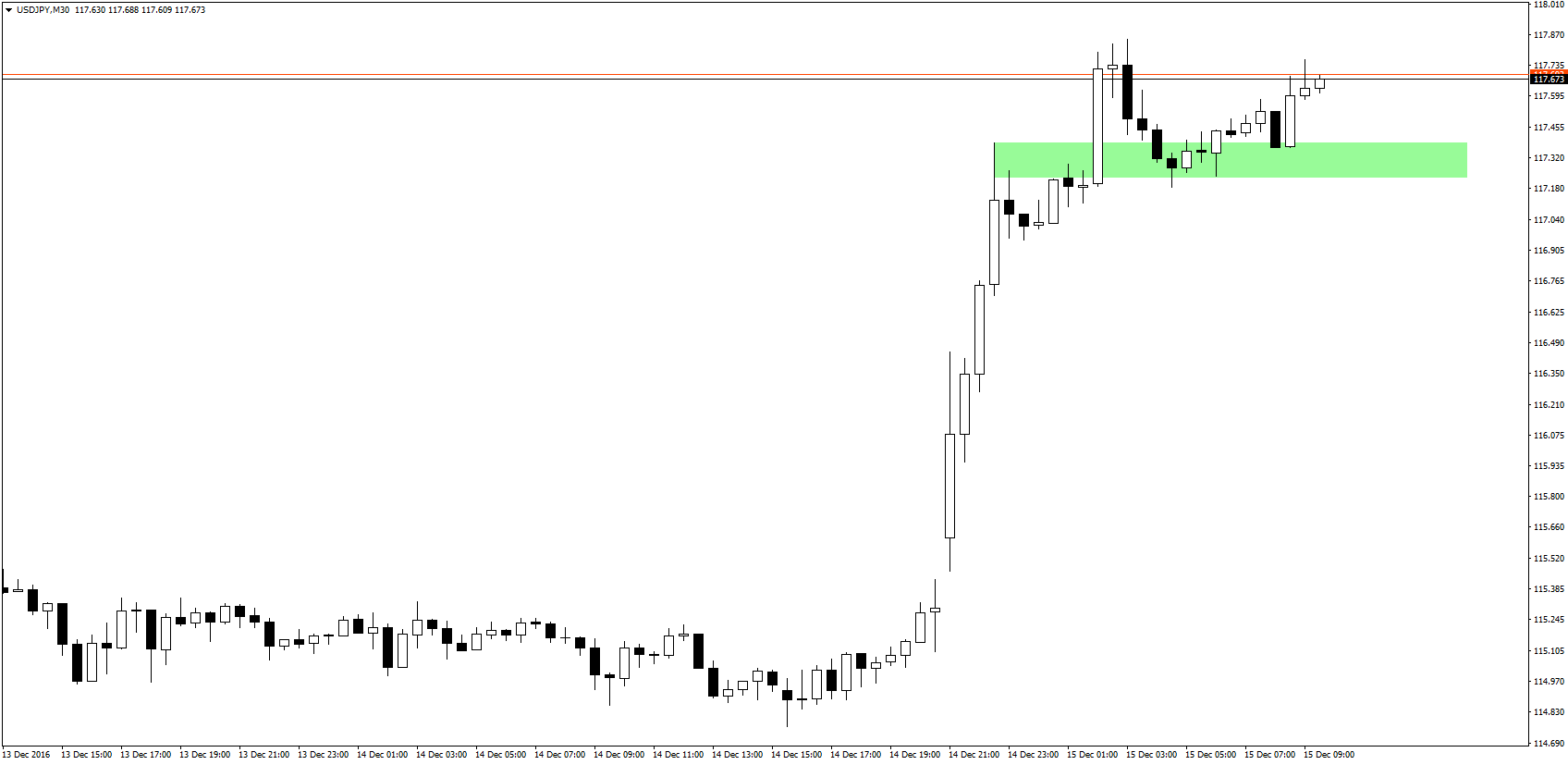

Positive data flow to us also from Japan. The first estimate of the December manufacturing PMI surprised positively with value 51.9. The market expected a rise to 51.5 from 51.3 released last month. The reaction of yen, especially in the USD/JPY was more like a technical correction:

What are we waiting for?

Today’s session will abound in all kinds of macroeconomic publications. The most important will be announced before noon.

About 9:30 SNB decision will be published on the amount of Swiss interest rates. The forecasts do not assume changes in the level of interest rates of which the most important one, the overnight rate should continue to be -0.75%. Together with the decision will be published a summary of the current monetary policy and forecasts for next months. After publications will come time for the most important part of the event, namely a press conference of the President of the SNB Thomas Jordan.

Simultaneously with the decision of SNB will be published German PMI for December. The publication will come both PMI Services and PMI for the manufacturing sector. Half an hour later (10:00) the same data will be published for the euro area.

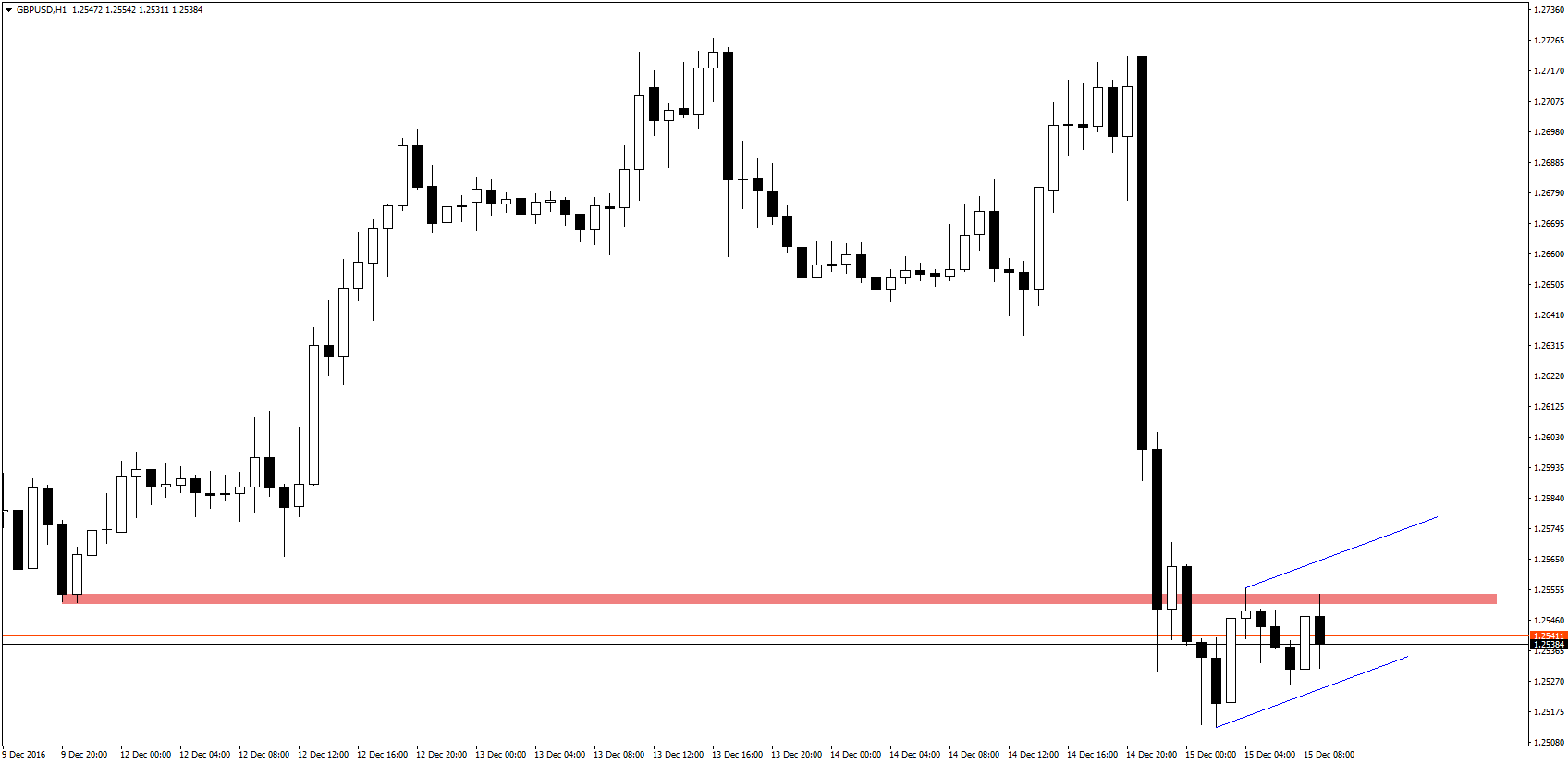

At 10:30 we will have publication of the report of retail sales in the UK. Both yearly and monthly is expected to decline in the growth rate, which should translate into a deepening declines of GBP/USD:

Already in the afternoon, at 13:00 awaits us next monetary decision of the central bank. The Bank of England will publish a summary of the ongoing meeting during which a decision is made about the amount of UK interest rates. According to the market – BoE decides not to reduce them this year and the rates will remain unchanged.

14:30 is the time when Americans will join the market. The US session will start from publishing CPI along with its base version. Forecasts assume gentle rise, which should support the ongoing appreciation of the USD. At the same time, a division of the Philadelphia Fed will release its index (known as Philly Fed), which forecasts also show very positive (9.0 to 7.6 before).

14:30 This is also the moment of publication of the report of Canadian Manufacturing Sales and estimation of American manufacturing PMI for December. This filled with macro-economic data day ends with occurrence of BoC Governor Stephen Poloza, scheduled for 17:15.