The first full week of December starts just like in Alfred Hitchcock movies – from earthquake. The vast majority of Italians opted for no ‘in the referendum organized during the weekend. Premier Renzi announced his resignation which again increases the level of political risk in Europe. Both the euro and the Polish zloty are suffering.

The first full week of December starts just like in Alfred Hitchcock movies – from earthquake. The vast majority of Italians opted for no ‘in the referendum organized during the weekend. Premier Renzi announced his resignation which again increases the level of political risk in Europe. Both the euro and the Polish zloty are suffering.

Surprisingly high electoral turnout and, more importantly, over 59% of votes cast for ‘no’ cause that future of Italian government is questionable. On Sunday the Italians decided on the reform of the role of the Senate and the current Prime Minister of Italy Matteo Renzi made their political “to be or not to be” to the result of the vote.

Skeptical attitude of the Italian public as to the direction of government policy Renzi means that once again this year Europe plunged into political turmoil. A change of government is not only a chance to take power by the eurosceptic groups (already talking about the possibility of Italexit), but above all also a strong blow to the debt-ridden Italian banking sector. In the result of the referendum are also quite significant declines in valuation of EUR markets. EUR/USD slumped in the night to a level of 1.05:

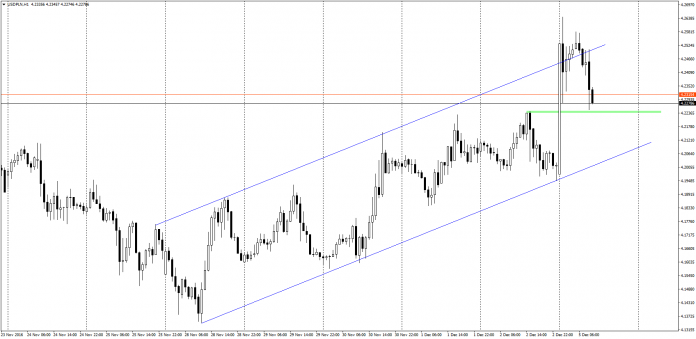

You can say, as usual in cases of uncertainty and fear, the value of PLN also lost. The zloty weakened to all major currencies, USD/PLN firmly corrects:

PLN lost despite Friday’s decision by Standard & Poor’s, which again updated the Polish credit rating. Rating remained at the same level, but changed its perspective – from negative to stable. More on this subject we wrote on Friday.

What are we waiting for?

Despite the fact that we have a Monday, the number of publications during the next hours is pretty impressive. Shortly before 10:00 we will know the value of the German PMI. Projections for the overall index remained unchanged in relation to October and similarly with the Service PMI.

Promptly at 10:00 Markit will publish a summary PMI for the whole euro area and again, service PMI. Half an hour later, the same index for November will publish the United Kingdom.

About 11:00 we will know the change in the level of retail sales in the euro zone for October. Projections for the index y/y are at the level of +1.7% (+ 1.1% recently).

The US session starts from the speech of William Dudley, who sits in board of FOMC. Half an hour later we will hear what has to say the president of ECB, Mario Draghi.

Fifteen minutes before 16:00 Markit will publish a summary PMI and PMI service index for the United States. Exactly at 16:00 we’ll look at another important data, that is, the ISM non-manufacturing PMI. Day on markets symbolically ends speech of Mark Carney from the BoE