AUD/CAD have recently been highly technical. First of all, I’m thinking about respecting the formation of the wedge. As can be seen on D1 chart it was recently broken thru the top. The turn of December and January gave a correction that performed a full re-test of the upper edge of the wedge. Currently, the price is growing dynamically, which indicates the end of the correction on the Australian dollar. In just two sessions, the entire losses from the previous dozen or so days have been completely recovered. Currently, the demand is trying to break the key level of resistance that would open the way to bigger increases.

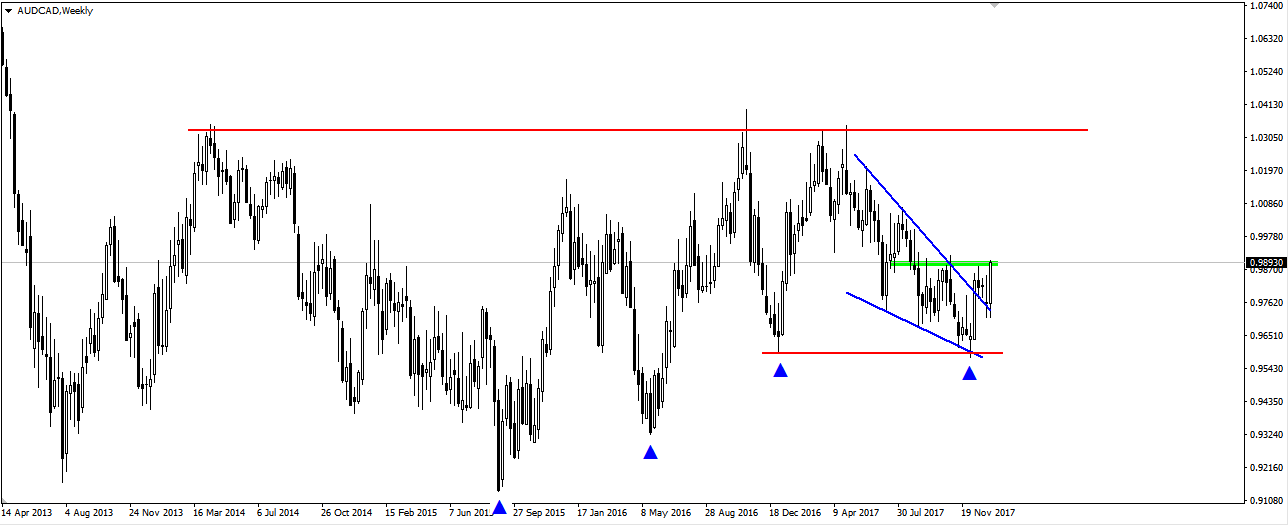

The potential for increases is also visible at the higher, weekly time interval. One can see here the arrangement of ever-emerging lows. The last one slightly violated the level of the previous one, however, a very strong demand response indicates that this upward trend is sustained. Quotations inside the wedge formation look very poor compared to previous impulses, both upward and downward. It seems, therefore, that it was a very large and time-consuming correction. Breaking the mentioned resistance should confirm the return of the buyers’ domination, and as you can see, the potential space for growth in the long term is quite large.

I trade on this instrument at broker XM, which has in its offer more than 300 other assets >>