Daily Forex Market Preview, 18/08/2017

The minutes of the meeting from the ECB that was released yesterday showed that while officials of the governing council discussed tweaking the forward guidance, concerns about further gains in the exchange rate kept officials from making such changes. The euro initially gains on the release of the ECB minutes but soon gave back the gains.

The Japanese yen continued to strengthen on the back of the fresh terror attacks in Spain as investor’s risk appetite declined. In the UK, retail sales figures were slightly better than expected but remained low compared to the month before.

Looking ahead, the economic calendar today will focus on the Canadian inflation data. Economists are expecting to see a flat print for the month following a decline of 0.1% previously. In the US, the UoM consumer sentiment data is forecast to rise to 94.0 from 93.4.

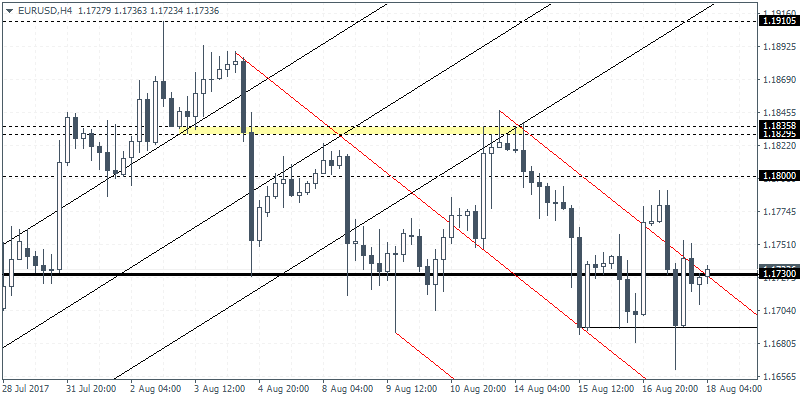

EURUSD intraday analysis

EURUSD (1.1733): The EURUSD was a bit volatile yesterday with price action seen consolidating near the support level of 1.1730. Price action is likely to continue this way until further clear direction is established. In the short term, a minor support level has been formed at 1.1691. A break down below this level will suggest further declines to 1.1635 as suggested previously. To the upside, if price continues to push higher, then support is likely to be established at 1.1730. A bounce off this level will signal a move towards 1.1800.

GBPUSD intraday analysis

GBPUSD (1.2887): The British pound managed to post a modest rebound yesterday. Slightly better than expected labor market data helped to improve the sentiment in the cable which weakened earlier in the week on account of inflation data. The rebound off 1.2835 is likely to see some upside in prices. Near-term resistance is seen at 1.2980 – 1.3000 which could be tested. If resistance is formed here, then GBPUSD could be forming the final right shoulder in the head and shoulders pattern that is evolving on the daily charts. This would suggest further downside in prices on a break below 1.2835.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

USDJPY intraday analysis

USDJPY (109.42): The USDJPY gave up the gains from a previous couple of days. Price action was seen falling back to the 109.58 support. A recovery off this level is required in order for any potential upside in USDJPY to be realized. Currently, prices are seen trading below the 109.58 support. The potential inverse head and shoulders pattern is still in play but could be at risk of invalidation. Thus, a daily close above 109.58 is essential to confirm the upside. A bearish close below 109.58 will suggests a retest back to the previous lows.