DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of the session 03/08/2018

DAX grew on Friday 0.55% on low volume, but during the whole week is on minus 1.90% and remained below 12,700 points. On Friday, the German PMI for services did not surprise and was consistent with the consensus (54.1 vs. 54.4), while the July report on the US labour market surprised with the key indicator negatively. NFP in July increased by 157 thousand. against expected 195 thousand, data for June have been revised upwards to 248 thousand from 213 thousand.

Among the components of the DAX index, the best result was recorded by Adidas, which gained 2.51%, while Vonovia increased by 2.07%. The worst result was ThyssenKrupp falling 2.45%, while Siemens lost 1.80%. The total number of growth companies on the Frankfurt Stock Exchange exceeded the number of losing 472 to 232

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

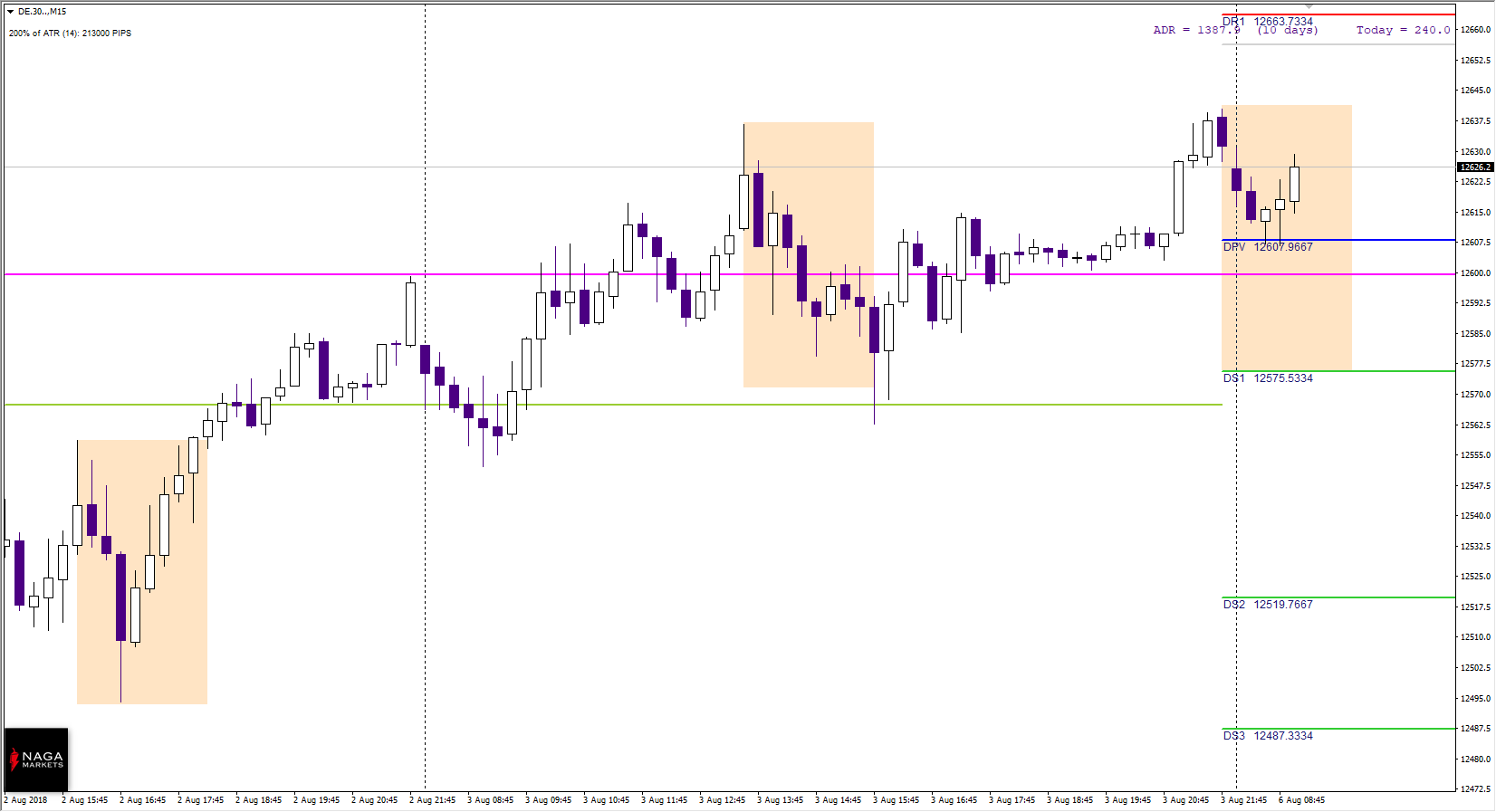

DAX Intraday

On Monday the DAX keeps an upward trend, in the morning it reflects from the directional point and the monthly pivot is slightly above 12 600 points. The index maintains the level of equality of bearish corrections, on Friday it rebounded from 12.575 and today in this area there is local support S1, so bulls can still feel safe on the stock. If the level of defence is breached, the next stop point should be 12 520 points, a narrow but important resistance zone defends from the top 12655/66.

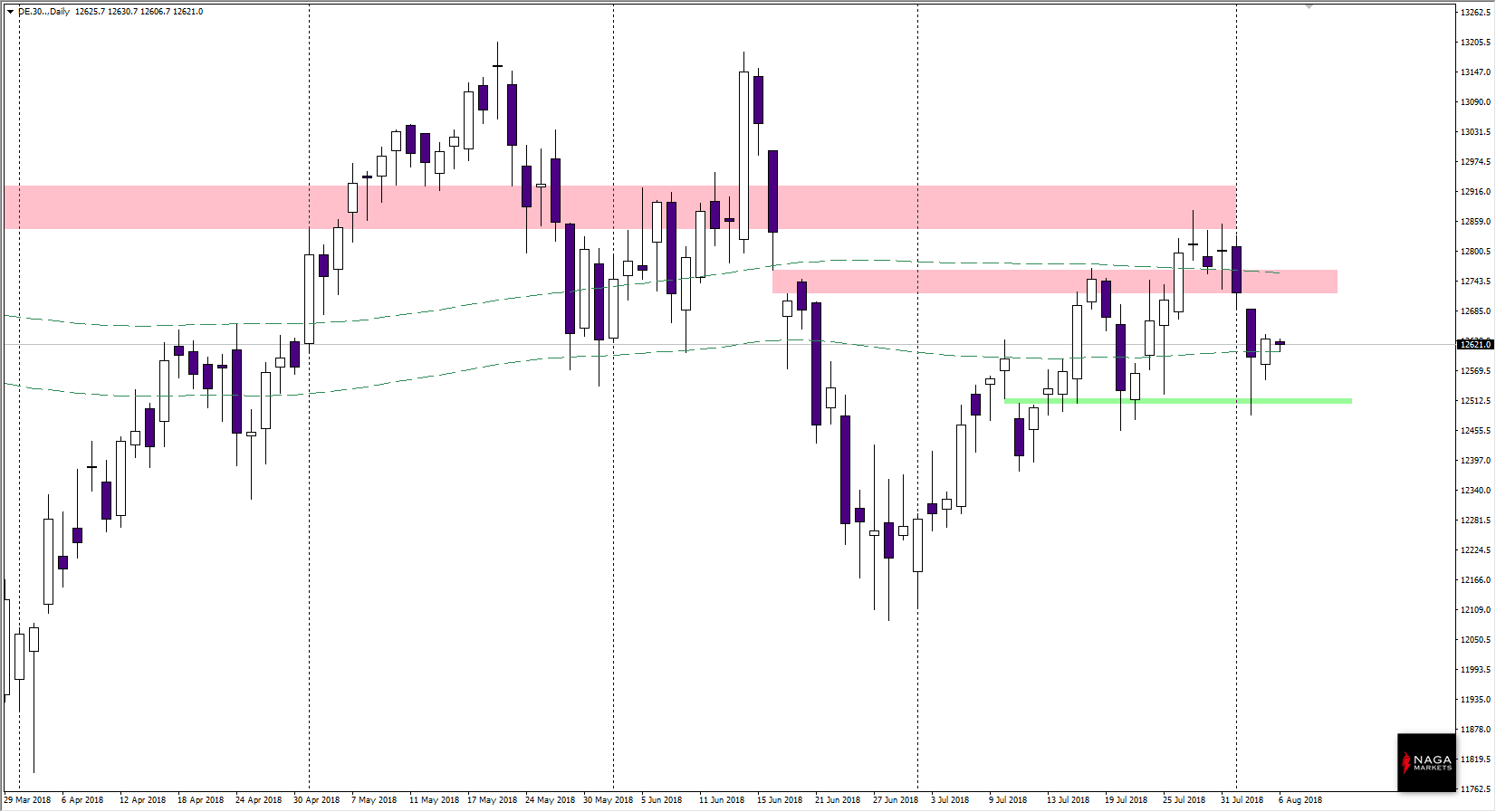

DAX Longterm

DAX Longterm

Looking at the higher interval, the two-day drops are part of the correction pattern on the German market and in an optimistic variant, we should not see a move below Thursday’s minimum. However, the price stays in the broad 200-session MA range, which may suggest the prolonged side trend, from the top we have a resistance zone resulting from the June bearish gap: 12,720/60.