After a year of waiting, the Fed finally delivered another hike, raising rates by 25bp as expected. But the market reaction will instead be driven by the more hawkish than expected shift in the Fed’s outlook. The “dots” were unexpectedly pushed higher with an additional hike pencilled in for 2017.

After a year of waiting, the Fed finally delivered another hike, raising rates by 25bp as expected. But the market reaction will instead be driven by the more hawkish than expected shift in the Fed’s outlook. The “dots” were unexpectedly pushed higher with an additional hike pencilled in for 2017.

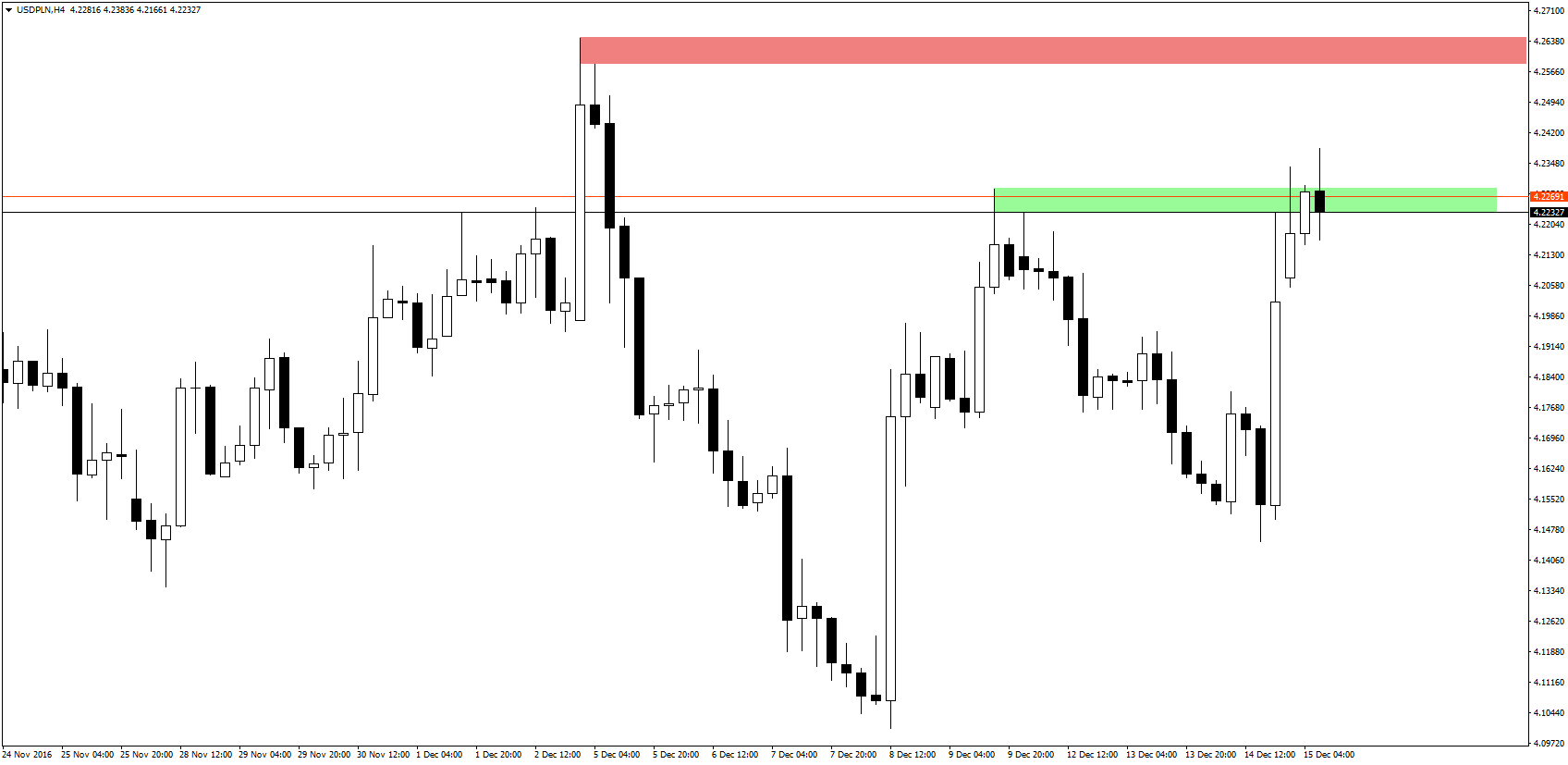

The long-run “dot” has been moved up from 2.875% to 3.00%. This suggests the Fed, like financial markets, has decided to factor in some impact from a Trump presidency although the GDP projections changed only modestly. The USD has already echoed the move higher in US yields since the US election. These Fed projections mean a further rally is likely.

The outcome of the December FOMC meeting in terms of the rate decision was in line with expectations but other elements of the meeting were more hawkish than expected. The Fed, it seems, has decided to incorporate some assumptions about the likely shape and timing of changes in policy under a Trump presidency even if there is no clarity as yet. Like the USD, the path for the Fed now has to incorporate political drivers as well as cyclical considerations, the two now closely intertwined.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

The USD rally, which has tracked Treasury yields higher since the election, suggests the currency market had already assumed that we would get many of the favourable bits from Trump’s cocktail of policy proposals. A bullish USD likely reflects hopes for fiscal expansion, lower taxes, deregulation and improved infrastructure spending. Concerns about a possible trade war, an aggressive immigration policy or geopolitical tension have been relegated to the background. Time will tell whether this selective approach proves warranted.

But the December FOMC meeting suggests the Fed is now also sympathetic to this more growth positive profile, and the rate trajectory has been revised accordingly. The USD may have been ahead of the Fed in digesting what the US election result might mean for growth, but it will still likely strengthen further on the Fed’s swifter than expected conversion to a possible fiscal reflation theme. The USD changed into a politically-driven currency in the wake of Trump’s victory. It seems that the Fed is also incorporating politics into its projections.

The flipside to the bullish USD reaction is likely to be additional selling pressure on EM FX. Thoughts of fiscal expansion have pushed up long-end US bond yields, slicing into the carry offered by EM FX. Now there may be some added selling pressure from thoughts of a more activist Fed at the short end of the curve. Currency markets have become increasingly sensitive to even small changes in relative interest rate expectations so the likely recalibration of US rate expectations in light of the December FOMC is destined to have a material impact on FX.