Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

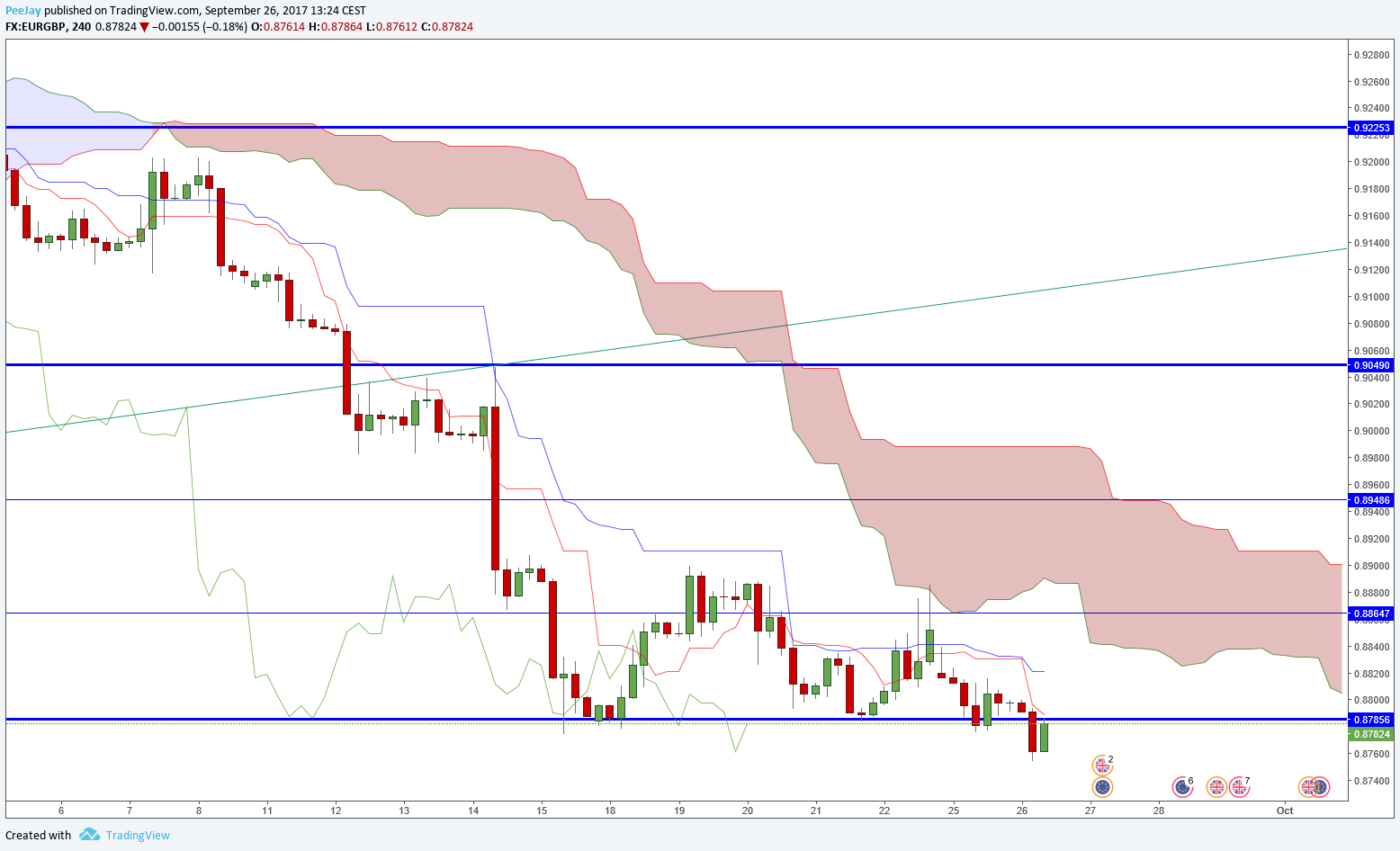

EURGBP

On the H4 chart we can see that after a long consolidation bears finally managed to break below key resistance at 0.8785. Tenkan line is below Kijun and bearish Kumo cloud is really wide. We can think about opening short position, however it is better to wait for clear signal of further depreciation.

GBPUSD

Opened position on Cable is clearly losing since yesterday, however it is a long way to the Stop Loss so far. Today in the afternoon there will be a speech by Janet Yellen what can cause stronger moves of dollar, the situation should clarify then.

USDCAD

On the daily chart we can see that USDCAD for some time is gaining and currently it reached important resistance at 1.2415, which was broken in the beginning of September. In this place there can be another bearish reaction. I opened short position with 24option, I believe that price will fall eventually. Stop Loss is set above 61.8% Fibo retracement of last wave of losses. Cloud is bearish, Tenkan is below Kijun and Chikou Span is below the chart, so all conditions to open the position are fulfilled.