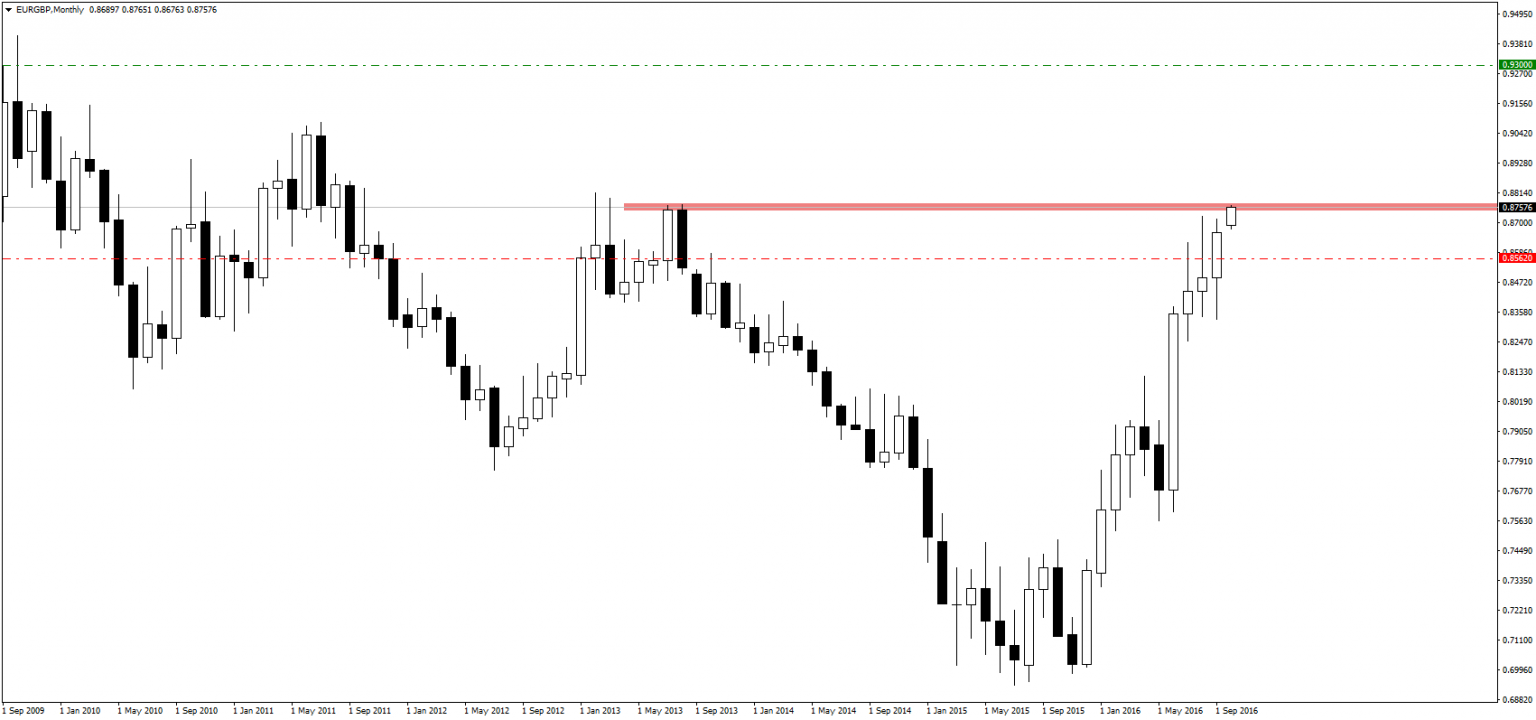

In today’s recommendation, UniCredit extend their target for long on EURGBP:

“On 4 July 2016, we recommended a basket of 50% short GBP-USD and 50% long EUR-GBP. On 5 September 2016, we closed our short GBP-USD position to ensure minimal losses (-10bp on this trade) but maintained our long exposure to EUR-GBP (keeping the 50% weight) as a reflection of our conviction that material downside existed in sterling on the back of widespread uncertainty due to the Brexit referendum result.

So far, the EUR-GBP spot has moved by 4.2% since the basket was initiated, providing us with a spot profit of 2.1%.

Given that EUR-GBP has risen sharply since early September – by more than 5%, to a year-high of 0.8756 – we think it is prudent to trail our stop-loss to below 0.8562 (previously below 0.8150), effectively locking in a 1% profit, and to extend our target to 0.93 (from 0.89 previously).

The target extension is predicated on our reading of Prime Minister Teresa May’s speech on Sunday in which it became quite clear that access to the Single Market (the point of focus for financial markets) is not at the top of her priority list. In effect, this makes a “hard Brexit” scenario more likely than previously thought, something we believe the market is not pricing in sufficiently. We expect sterling to weaken further against the EUR over the coming weeks and months.”

Would you like to get more such informations directly on your email? Try out FxWatcher service for 5 days for free!