We can see deep decrease of commodities which caused volatility on Australian and Canadian Dollar. There can be some opportunities of showing up another signals consistent with the trend.

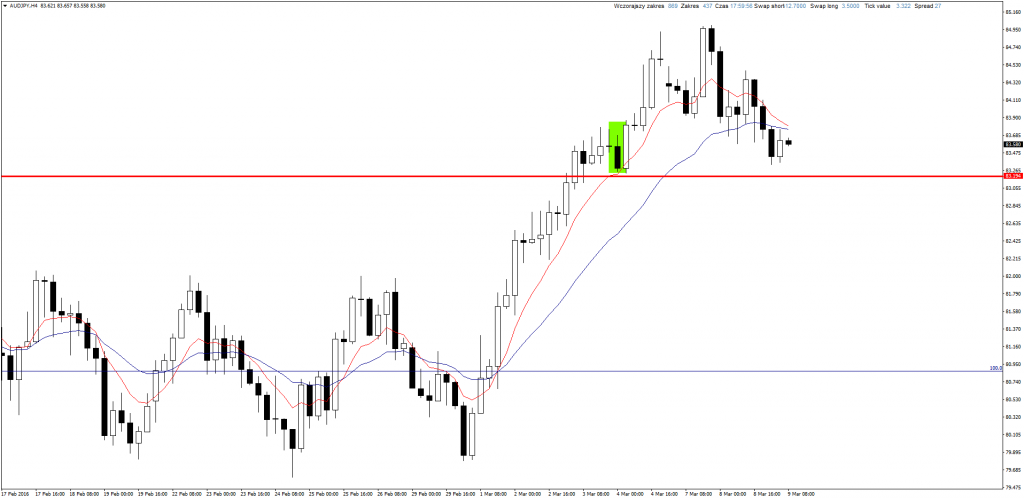

AUDJPY

One of mentioned positions. After quick gain yesterday there was a decrease and price came back to support area. There is a chance of opening another longs because trend is bullish and Price Action buy signals will help opening them.

If you are interested in Price Action Strategy description, you can read it here.

AUDUSD

Similar situation on Aussie. There is also strong correction which can turn into perfect ABC wave where the end of C wave will be in the support area. It can be good setup to open long positions.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

EURAUD

Yesterday there was sell signal on this pair. Earlier support was tested (now a resistance), clear Pin Bar showed up and I entered short position with market price. Later 50% retracement was tested so it would be opened anyway.

GBPCHF

We can see sell signal on this pair too. Long H4 candle tested resistance area, another 3 were totally inside it and then there was correct break out of Inside Bar. Currently price came back to the range and we can think about further moves. I think about opening short with market price, securing it above mother candle (SL 70 pips) and Take Profit above last low (400 pips).

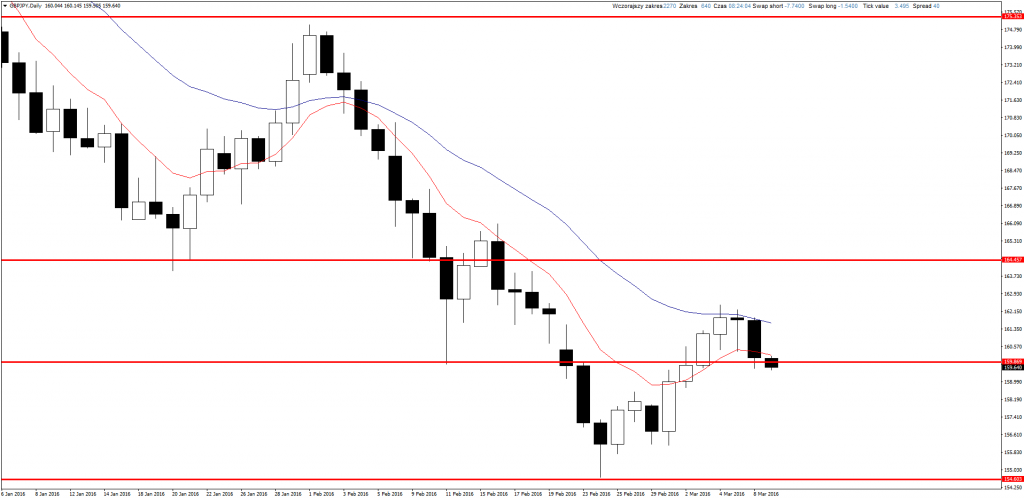

GBPJPY

Interesting situation on this pair. correction ended a little too soon and didn’t reached the resistance. Now it is testing earlier resistance which can be new support. If buy signal will show up on H4 with small SL, I will think about opening long position with the target at closest resistance. Correction should take a form of ABC pattern and another bullish impulse is quite probable.