Few major events on the economic calendar today, with most instruments moving in a narrow consolidation. However, this is just the stillness before the storm, the next few days could shake the market strongly as several important events await us.

Friday, 9 December 2022 – Producer Price Index

At 14:30, we will learn the PPI in the US. What is the PPI?

It is the Producer Price Index (PPI) for the final consumer. It is used in the US to measure price changes. It is made up of six main price indices: final demand goods (which account for 33% of the total weight), which includes food and energy, final demand trade services (20%), final demand transportation and warehousing services (4%), final demand services less trade, transportation and warehousing (41%), final demand construction (2%) and general final demand (which accounts for 2% of the total weight).

A higher than expected number should be seen as positive (bullish) for the USD, while a lower than expected number should be seen as negative (bearish) for the USD.

How was it a month ago?

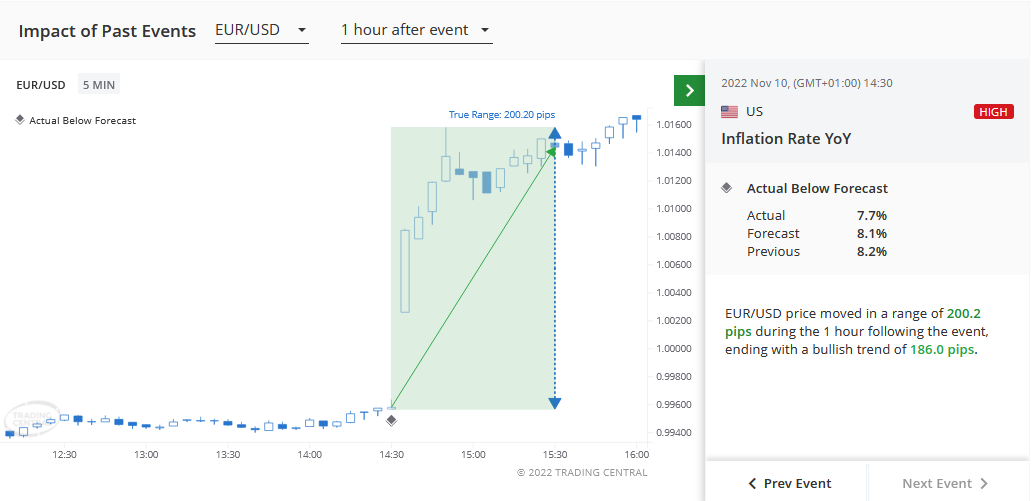

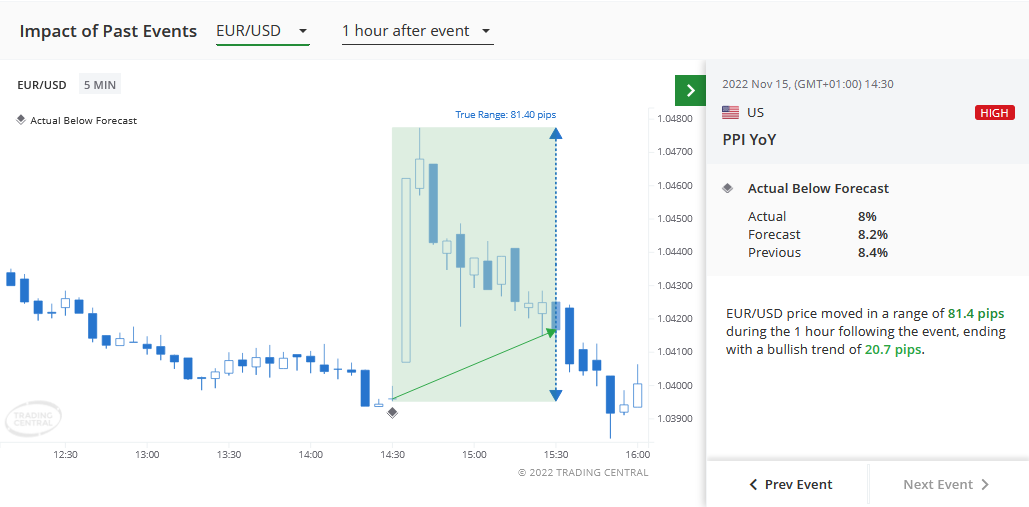

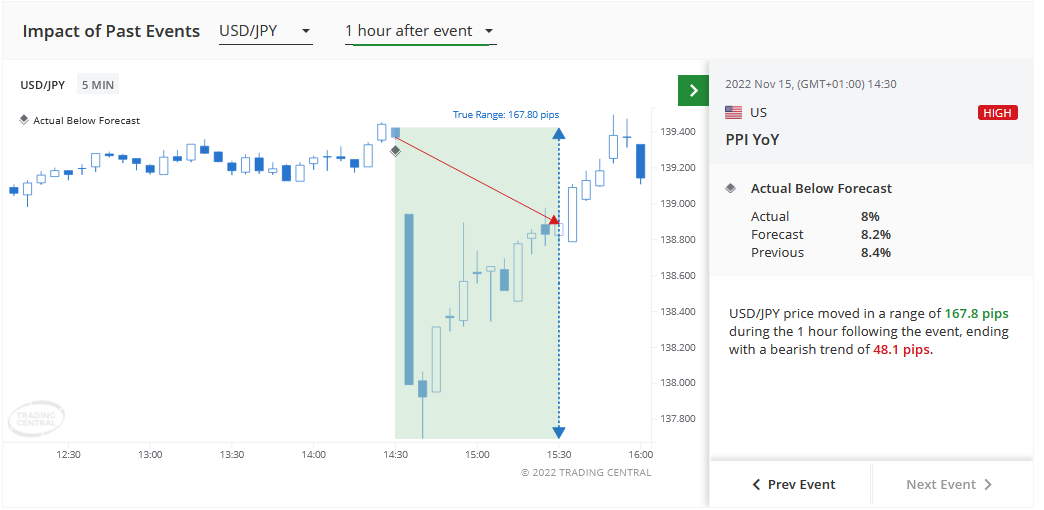

The last data released on 15 November turned out to be better than expected and there was a lot of volatility in the market. The charts above show how the market reacted to the better data. Initially after the data, the Yen gained +167p to the dollar and the EUR over +80p, but two hours later prices were back to pre-data levels. Will tomorrow be similar?

Tuesday, 13 December 2022 – US inflation

At the stage of the fight against global inflation , inflation data (CPI) is basically the new non-farm payrolls. We had an example a month ago of how strongly the market reacted when US inflation came in at 7.7%, which turned out to be 0.5 lower than the expected 8.3%.

The dollar lost sharply, indices soared. Expectations for a more dovish stance from the Fed and a reduction in the pace of interest rate hikes at the upcoming (14.12) Fed meeting increased. EURUSD shot up 200p within the hour and the move continued northwards in the following hours.

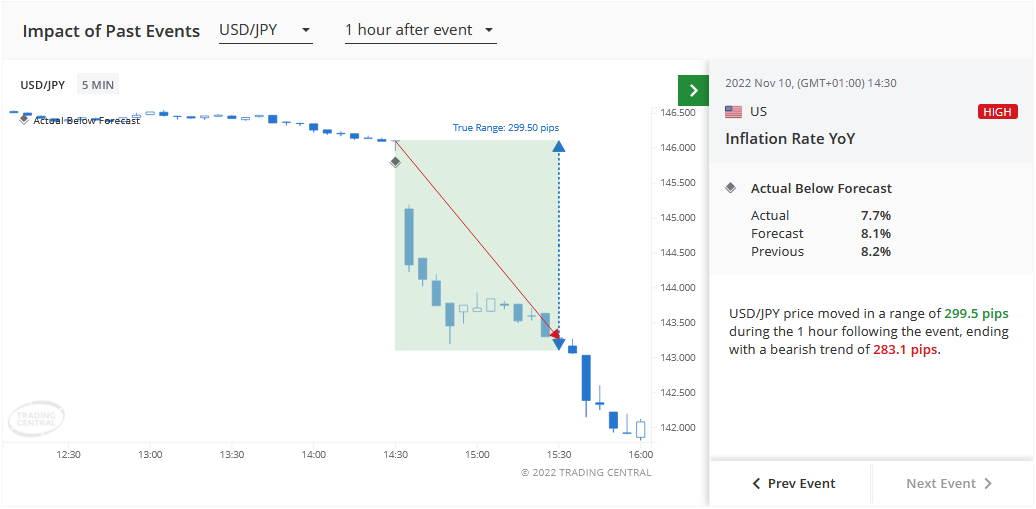

The USDJPY pair was already 300p lower after an hour , the next hours saw a continuation of declines. On Tuesday, inflation is expected to fall again year-on-year to 7.6%. Should the data turn out to be equal or better (lower) than expected then we can expect the dollar to weaken again.

Wednesday 14 December 2022 – Fed decision

On Wednesday at 20:00 we will learn the Fed’s decision on interest rates in the US. Before there were signs that inflation was falling the market was expecting a 75bp hike and this drove the dollar – it gained against most currencies. However, falling inflation and Powell’s dovish speech on 30 November caused expectations to shift. Currently, the market is pricing a 50bp interest rate hike with a probability close to 75%.

Starting tomorrow, we are in for some interesting and probably volatile days in the forex market. Maybe it will be like Hitchcock’s – it will start on Friday with an earthquake…and then the tension will only increase 😉

LIVE EDUCATION SESSIONS

This DECEMBER I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo