In last week’s USD/CHF analysis I wrote about a setup, which this week could be an opportunity for sellers. The exchange rate of the dollar against the franc went down according to the presented concept for trading and reached the first goal.

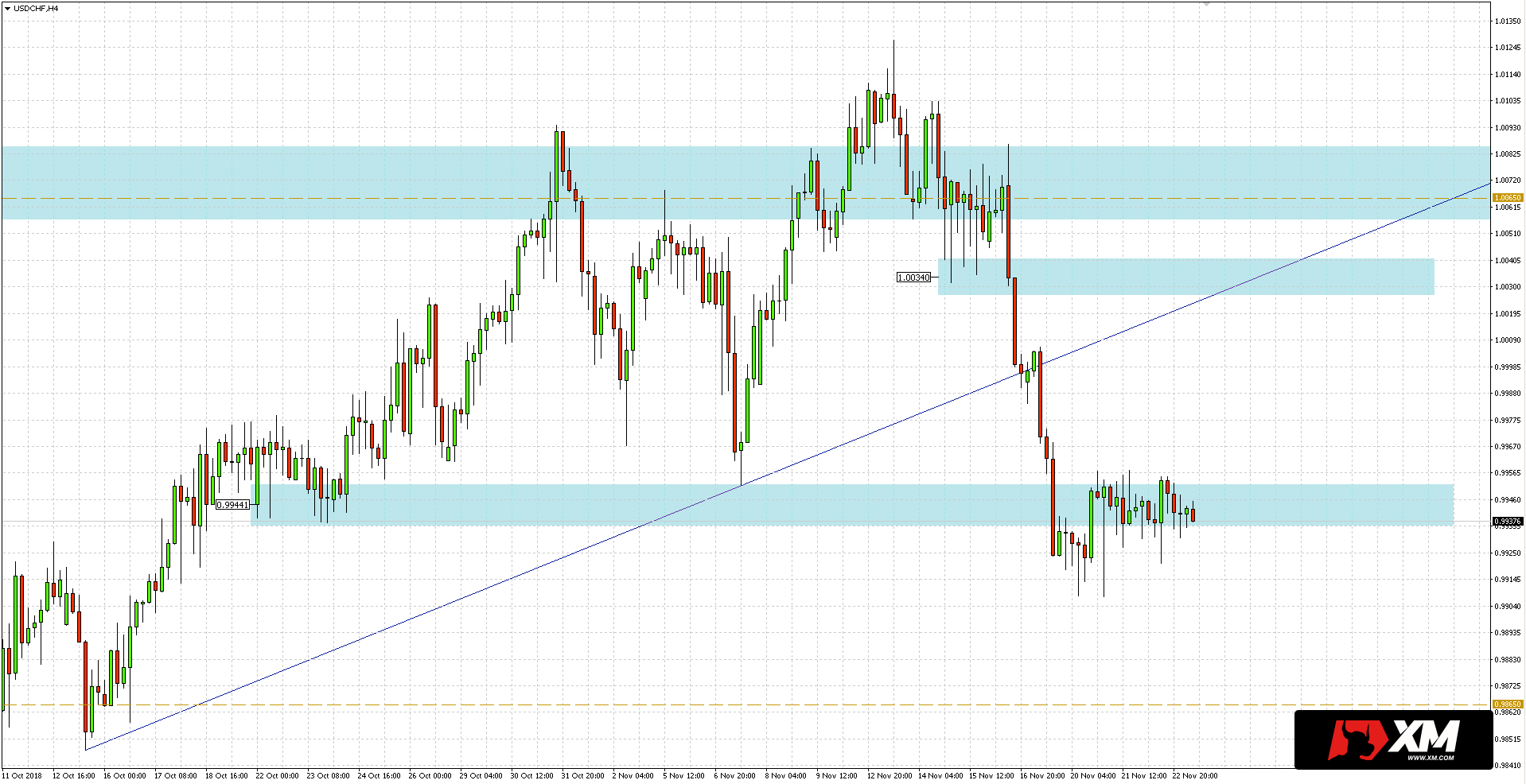

As you can see in the 4-hour chart below, USDCHF quotes have fallen to a short-term trend line, which was then broken. The price dynamically moved to the local support zone within 0.9944.

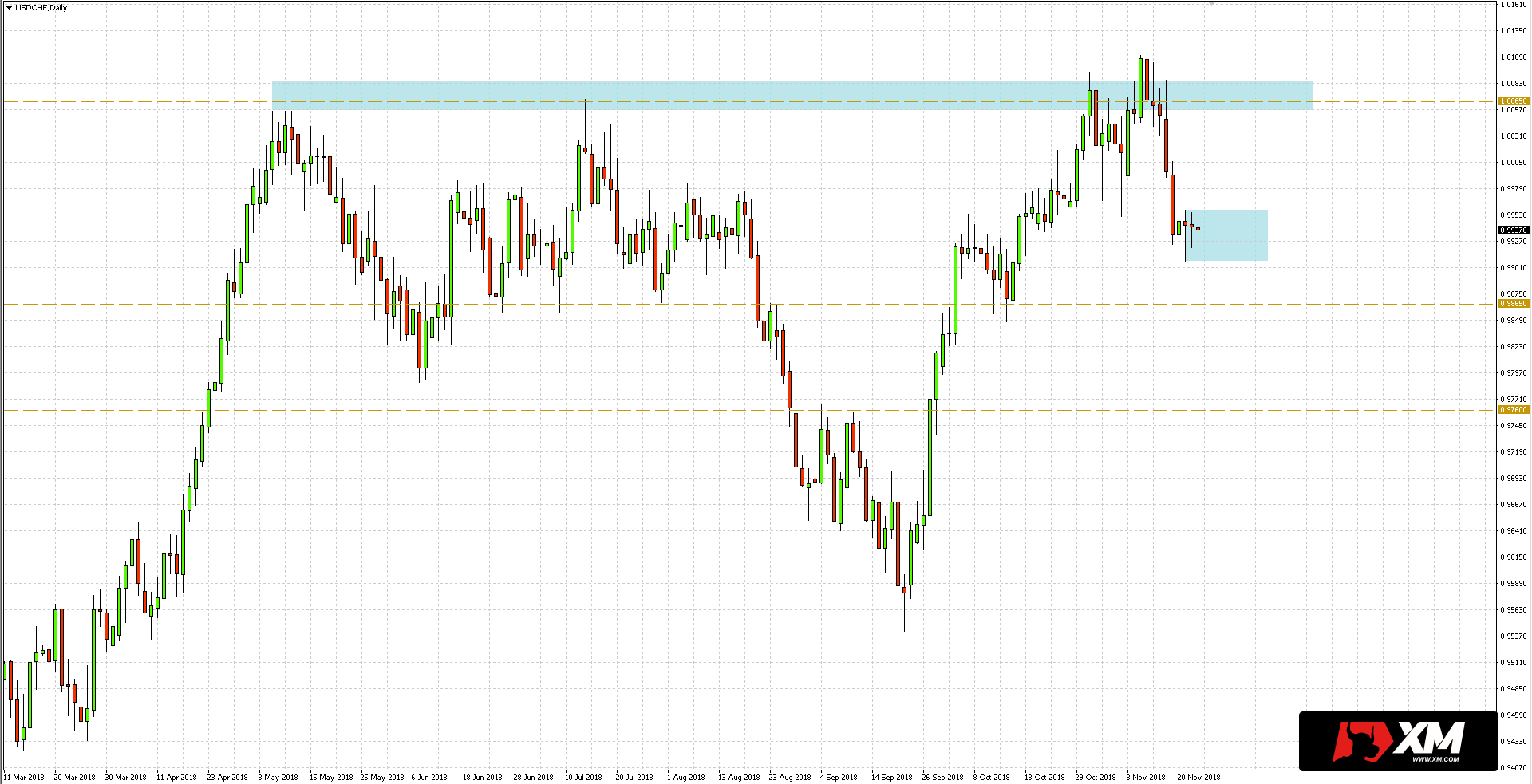

Once the support zone (first goal) was reached, consolidation within the support zone started. On the day chart, it took the form of an inside bar setup, where the Thursday’s price action is trapped in Wednesday’s session. In addition, it is worth noting the last three closed candles, which have long shadows.

Once the support zone (first goal) was reached, consolidation within the support zone started. On the day chart, it took the form of an inside bar setup, where the Thursday’s price action is trapped in Wednesday’s session. In addition, it is worth noting the last three closed candles, which have long shadows.

It may now be important to break out of the inside bar formation. If the price goes down (the preferred scenario) this would mean breaking the short-term support at 0.9944 and open the way to a key level of defence at 0.9865. In case of further landslides, another important goal is visible at 0.9865. Alternatively, knocking up from the inside bar would re-expose the resistance area at 1.0065. This would also temporarily question the bearish attitude.

It may now be important to break out of the inside bar formation. If the price goes down (the preferred scenario) this would mean breaking the short-term support at 0.9944 and open the way to a key level of defence at 0.9865. In case of further landslides, another important goal is visible at 0.9865. Alternatively, knocking up from the inside bar would re-expose the resistance area at 1.0065. This would also temporarily question the bearish attitude.