In recent days, there has been a strong turnaround of the British currency. So far, the pound has ignored all the worse signals, and the narrative of quickly signing a new trade agreement with the European Union has prevailed. Subsequent press agencies have reported that signing the agreement is a matter of a week. The latest news, however, is that there is a strong supply-side reaction to the pound’s rate. Euphoria evaporated when it turned out that the negotiations were likely to fail. The EU is preparing a contingency plan for a non-contractual brexit, and the last chance may be an EU summit convened after Christmas.

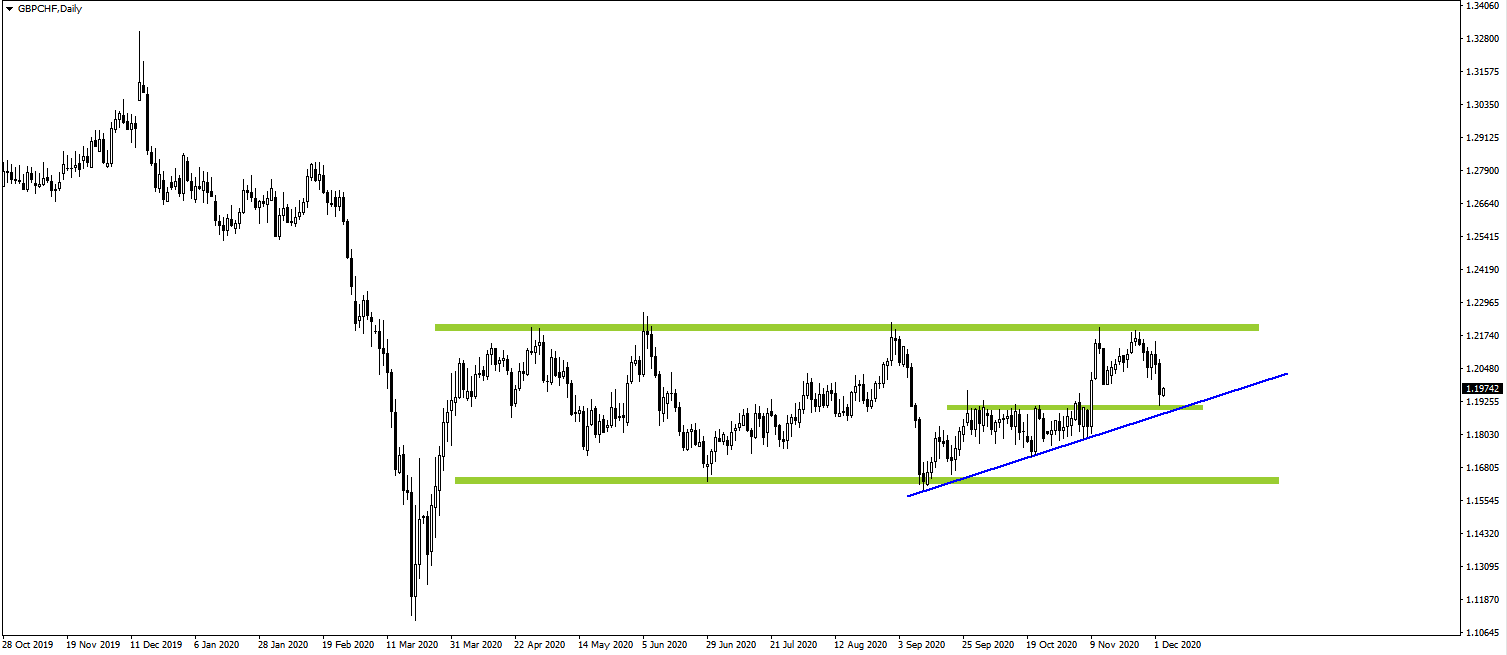

The coming weeks may therefore mean supply pressure on the British currency. Interestingly, the technique outlook coincide with the fundamentals on the GBP/CHF chart.The coming weeks may therefore mean supply pressure on the British currency. The daily interval shows how well respected resistance in the region of 1.22 so far has stopped the growth once again.

The wider picture shows that the pair is in a consolidation so it can be assumed that the course will fall at least to the line connecting the last lows, i.e. to the support at 1.19. If this level does not hold, it will be possible to fall even to 1.16, i.e. the main support of the lateral trend.

I also recommend this stuff:

Trading with PA+MACD, or how to increase the probability of winning

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo