The Australian dollar was already the subject of my analysis this week –” EURAUD – 4 months in consolidation – 19.10.2020″ I have already mentioned the possibility of breaking out of consolidation and weakening of this currency. The predictions worked out already on the same day, the strike was far beyond the expected range and amounted to 330p.

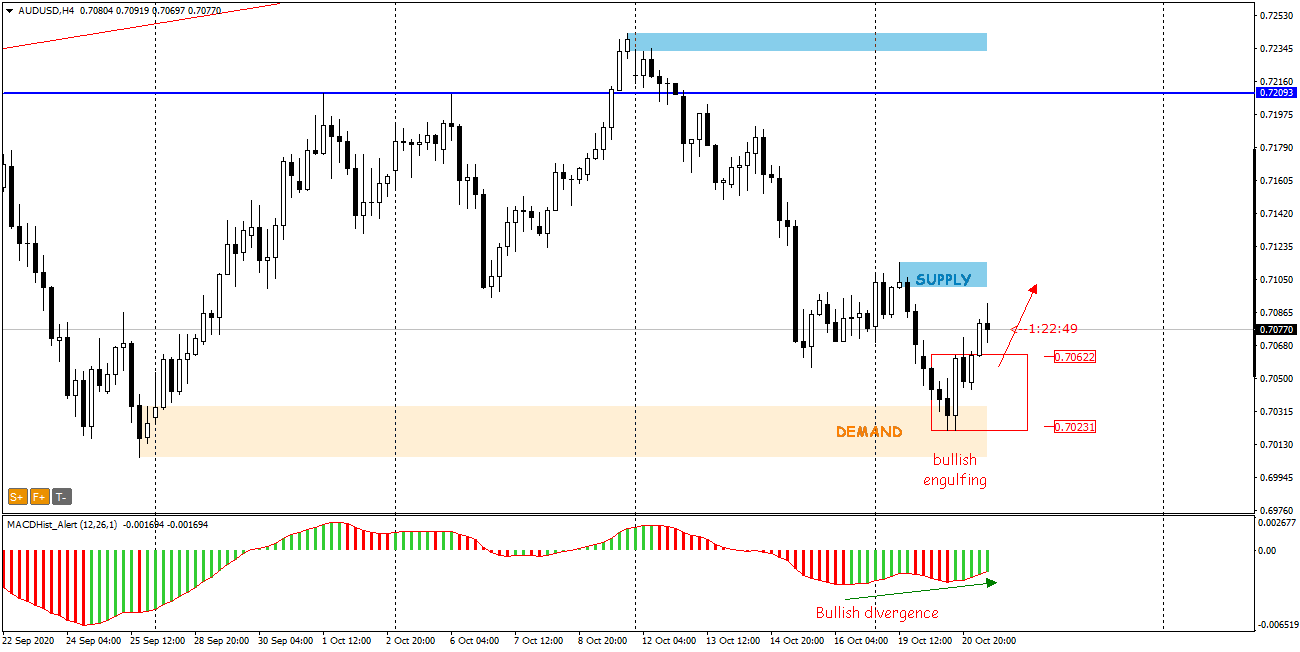

For the last 7 days the Australian dollar was systematically losing to the US dollar. From the maximum of this month the drops were 220p. Undoubtedly, such a course of quotations is influenced by unofficial information about the planned cutting of interest rates during the next RBA meeting on November 3, 2020.

Yesterday -20.10.- the price reached the demand zone created by buyers at the end of September 25.09. Then the demand managed to break the series of drops and pushed the price up by 230p

In the H4 chart, a large growth candle appeared, which formed the formation of the bullish engulfing.

On the chart, the range of the pattern (0.7023-63) is the size of the engulfing candle (mother candle) marked by a red rectangle.

Today, the price has successfully broken out of this pattern and a bullish divergence has appeared on the MACD oscillator.

The target of demand may be the nearest supply zone starting at 0.7100.

I also recommend:

Trading with PA+MACD, or how to increase the probability of winning

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo