About 01:30 our time Reserve Bank of Australia released a statement on monetary policy – the document should not be confused, however, with a standard statement, which appears immediately after the meetings of the institution. The so-called SoMP is published 4 times a year (once a quarter) and updates the bank’s forecast regarding the economy.

Australia cuts short-term forecasts

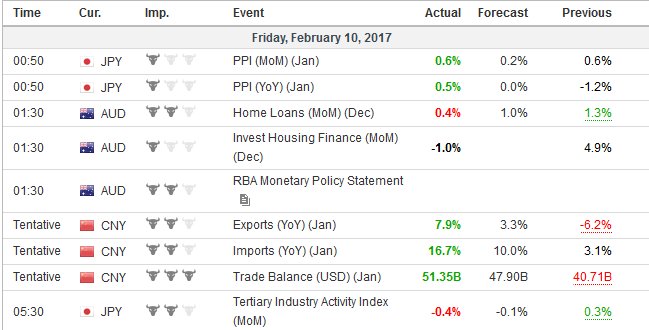

The full text of the statement can be found under the link. Below are but the most important headers, which were included in the publication:

- Further strengthening AUD could hinder the implementation of economic change

- GDP forecast cut to between 1.5-2.5 (to June 2017), the December unchanged at 2.5-3.5.

- Inflation in June 2017 should amount to 1.75% in December 2018 in the range 1.5-2.5%, while the June 2019 certainly defeat the range of two percent

- RBA also assumed declines in the unemployment rate around 5-6%

- GDP is likely reflected in Q4, weakness in Q3 was only temporary

- Slower growth in household income will adversely affect the dynamics of consumption

- Inflation stabilizes, over time should increase gradually

- Prices of goods within the next two years will continue to grow

It is worth to recall the content of the polmone statement which was published after the monetary policy meeting on Feb. 7.

The tone of the document is rather mixed and so was reaction of pairs with AUD. At the time of publication we have not seen too strong movements, but in next two hours came a strong appreciation against the dollar and other currencies.

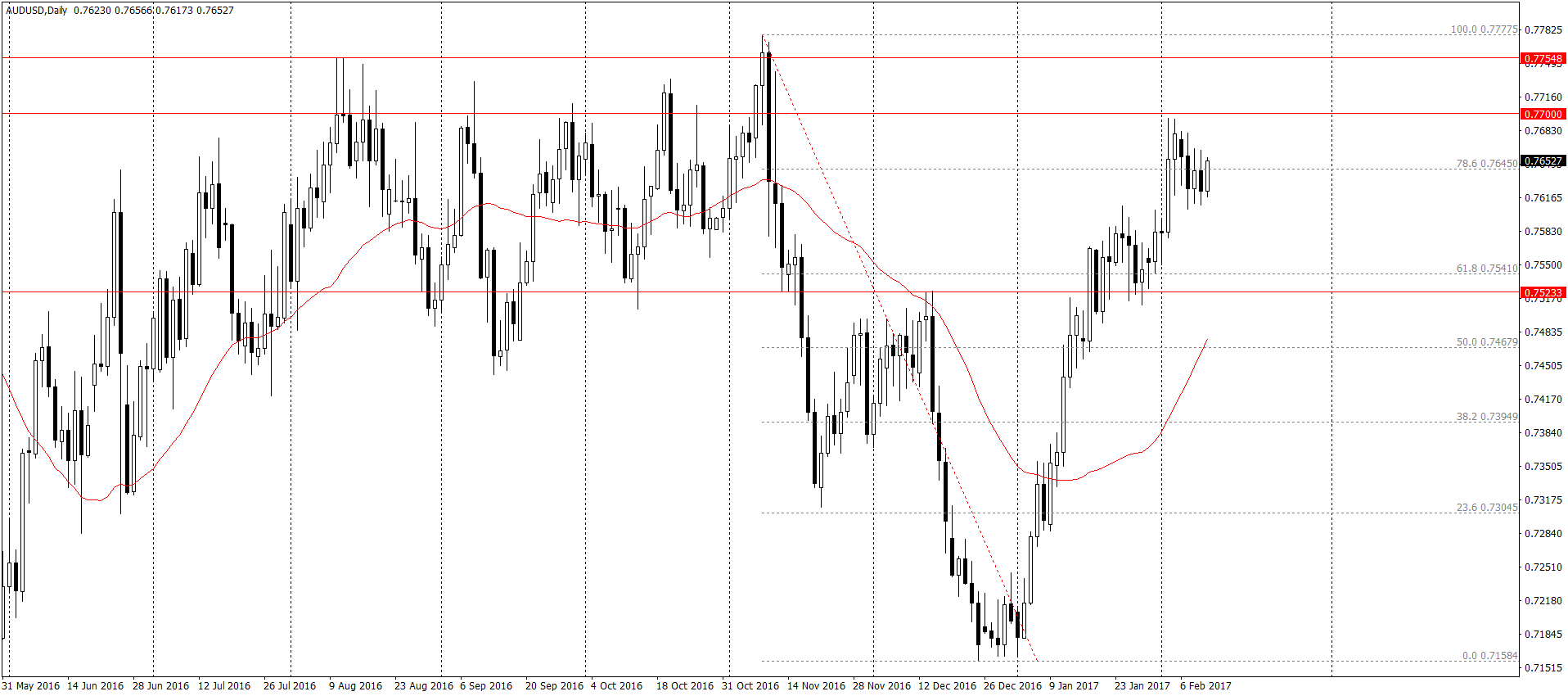

D1 chart shows that AUD/USD in the last four months made a very interesting trip. First, slumping 620 pips and than making up the greater part of the movement in the same time. At this point, growth halted at 0.7700, which in 2016 repeatedly blocked the bull’s aspirations. Price Action is here quite irregular and from the technical side we can determine a lot of more or less important levels. One thing is certain – if the AUD/USD want to continue to grow must first reach surrounding of 0.7755.

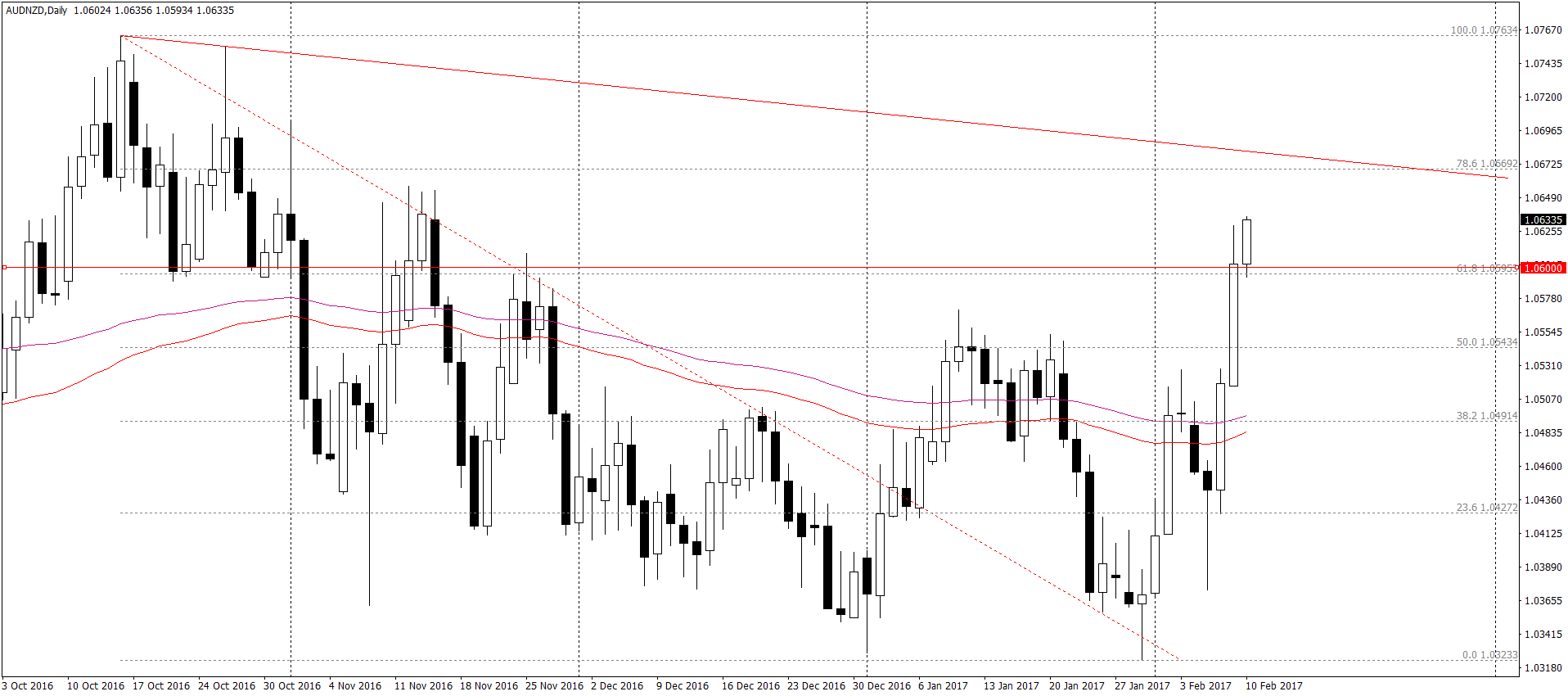

Growth third day in a row is trying to continue the AUD/NZD. After pin bar formed at the beginning of the week it is the Australian currency which dominates the antipodean pair. Quotations defeated the last resistance zone defined by a circular level 1.0600 and the 61.8% Fibonacci retracement. Today we have seen the re-test from the top, but there is no formation allowing to enter into a long position. First clearer resistance draws on combining the downward trend line and 78.6% Fibo.

Before we move to the calendar for Friday, a summary of the events of the night:

UK, Canada and the United States ruled in the calendar

The last session of the week in terms of macroeconomic publications will focus mainly around the UK and North America:

As you can see in the above screenshot in the morning we will know the results of industrial production and trade balance in the UK, and the new data will appear at 14:30 and will concern the report of the Canadian labor market. Calendar will close after the data from 16.00.