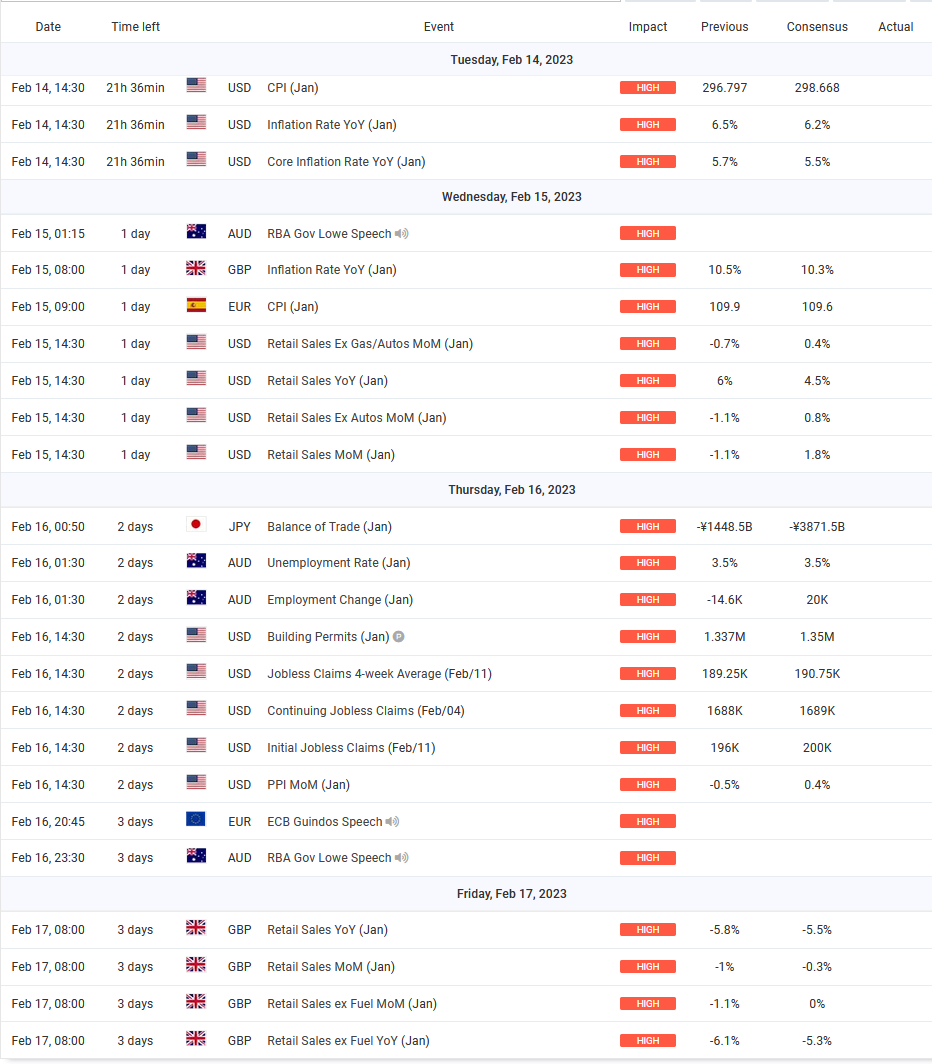

This week’s economic calendar contains quite a few important events. Among the most important I would include tomorrow’s CPI (14.02) inflation data in the US. US inflation has been falling steadily since June 2022 and tomorrow’s forecasts point to a further decline from the previous 6.5% to 6.2% y/y.

US January inflation – 6.2% expected

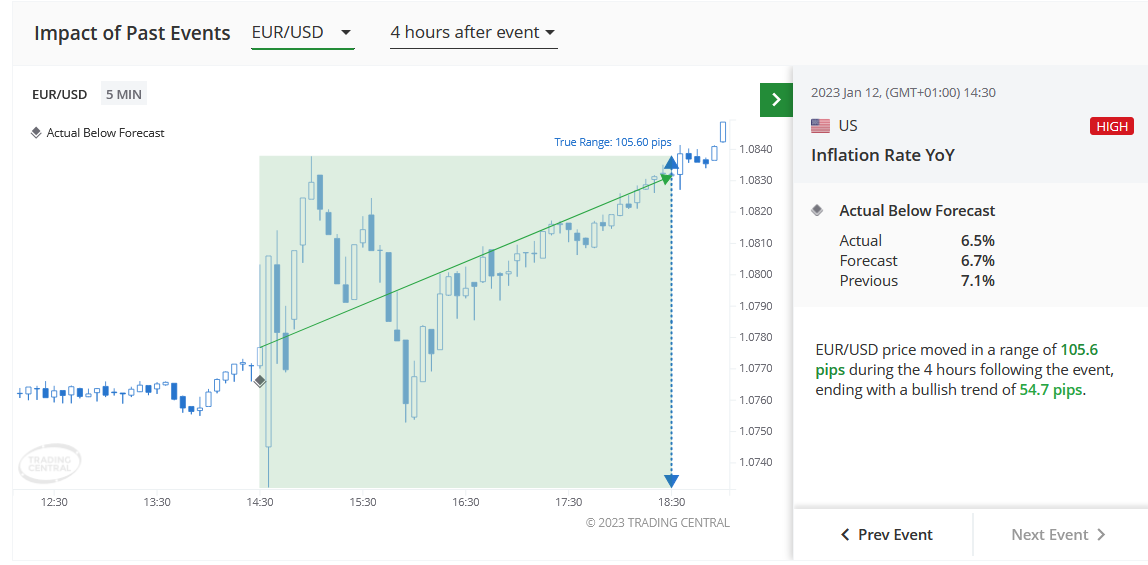

With tomorrow’s US inflation report in mind, it is difficult to predict how the major dollar pairs will behave. A month ago when the data turned out to be lower than expected by 0.2% volatility was high and on EURUSD the range after 4 hours was +105 pips and on USDJPY close to -160p.

Inflation for January was expected to be 6.2%. If it turns out to be lower then we could see a repeat on the charts of what we saw in January following the release of the December data.

Tomorrow we will also know the candidate for the position of Bank of Japan governor. A few days ago, Masayoshi Amamiya was leading the pack, but in recent days Kazuo Ueda has come to the fore and is likely to replace the current chairman Kuroda in March.

The market does not expect much change in BoJ monetary policy after the change of chairman in office, but Ueda is seen as a little less dovish than Amamiya so this could strengthen the Japanese currency a little. Macro data on the other days of the week could also provide some strong changes on the charts – but I’ll talk more about them tomorrow in my live sessions which shedule you will find on the bottom of the analysis

AUDNZD – a pair for swing traders

Swing trading involves holding positions for more than a day, but less than a few weeks.In swing trading, we try to open positions as soon as possible after noticing that the market is changing direction.

A currency pair well suited to this type of trading is AUDNZD. It is an instrument that has been moving since 2014 in a wide consolidation of more than 1,000 pips built from numerous upward and downward swings. On the chart we can see that the last down swing ended with a breakout from an inside bar formation.

The current upward swing has taken the shape of an ascending wedge and this may indicate that buying pressure is waning and the end of the swing is approaching. Breaking the support of an ascending wedge usually leads to intense declines. The closest target for sellers may be the demand zone of 1.0885. The possibility of an upward breakout of the wedge should also be taken into account – beating 1.1040 would negate the downward scenario.

LIVE EDUCATION SESSIONS

This WEEK 7 (13 FEB-18 FEB) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo