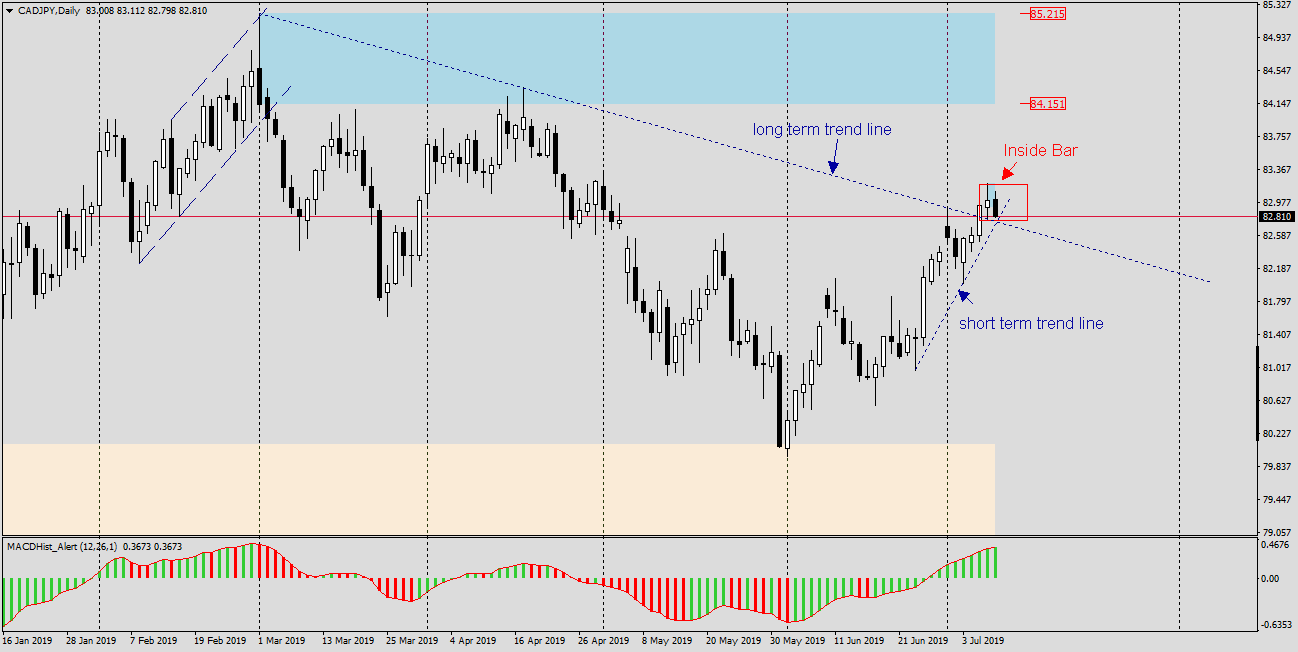

An interesting situation appeared on the CADJPY chart. On Friday the long term downward trend line was overcome and yesterday’s daily candle turned out to be the mother candle for today’s Inside Bar formation.

We can also draw a short-term upward trend line in which the price has been heading north since the beginning of June. The intersection of these two trend lines and the lower IB limit is at 82.75 so we have a triple confluence of supports, overcoming this level will be a strong SELL signal and perhaps we will witness the end of the upward correction and the pair will return to declines. The maximum of the “mother” candle is exactly 61.8% of the Fibonacci abolition, calculated from this year’ maximum, which can also support the downward scenario.

The Bank of Canada’s monetary policy position tomorrow and the decision on interest rates may be an important event for the future of the pair. If it is reduced from 1.75 to 1.50, the Canadian currency may weaken in relation to the others, including the Japanese yen.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities