The economic calendar on Monday looked empty…. but the next few days are already starting to look a little more attractive in terms of events that could affect more volatility in the markets.

Today 22.08 begins the conference of the BRICS organization – which has the ambition to create a counterweight to the dollar zone. Some observers believe that a currency to compete with the USD will soon be introduced. Brazil, Russia, India, China and South Africa, a coalition of countries under the BRICS name, is to introduce a new currency based on gold parity. An official announcement on the matter (perhaps?) will be made at the bloc’s August summit in Johannesburg, South Africa.

This could be a strong support for gold

Thorsten Polleit, chief economist at Degussa Bank and professor at the University of Bayreuth, said that such a BRICS common currency could be a shock to the global fiat money system. A new international transaction unit backed by gold sounds like good money – and could, above all, be a serious challenge to the hegemony of the US dollar. He added, however, that the devil is in the details. He noted that for the new currency to be as good as gold and truly solid, it must be convertible into gold on demand. And this will not be so easy to achieve. However, if it were decided to fulfil the conditions of convertibility – gold will regain its shine for a long time.

Opinions are divided on whether such a common currency will harm the dollar’s dominance. “It is unlikely to replace the dollar and would only exist as an addition to the established dollar-based global monetary system,” reads a report by the Official Forum on Monetary and Financial Institutions. – It could serve as a regional currency similar to the EUR, which was created for a similar purpose.

The Jackson Hole Symposium, an annual meeting of key figures in the financial markets and, in particular, the presidents of the major central banks, begins Thursday. At the end of the symposium, Jerome Powell will speak at 4pm on Friday. Information coming from there could move the markets.

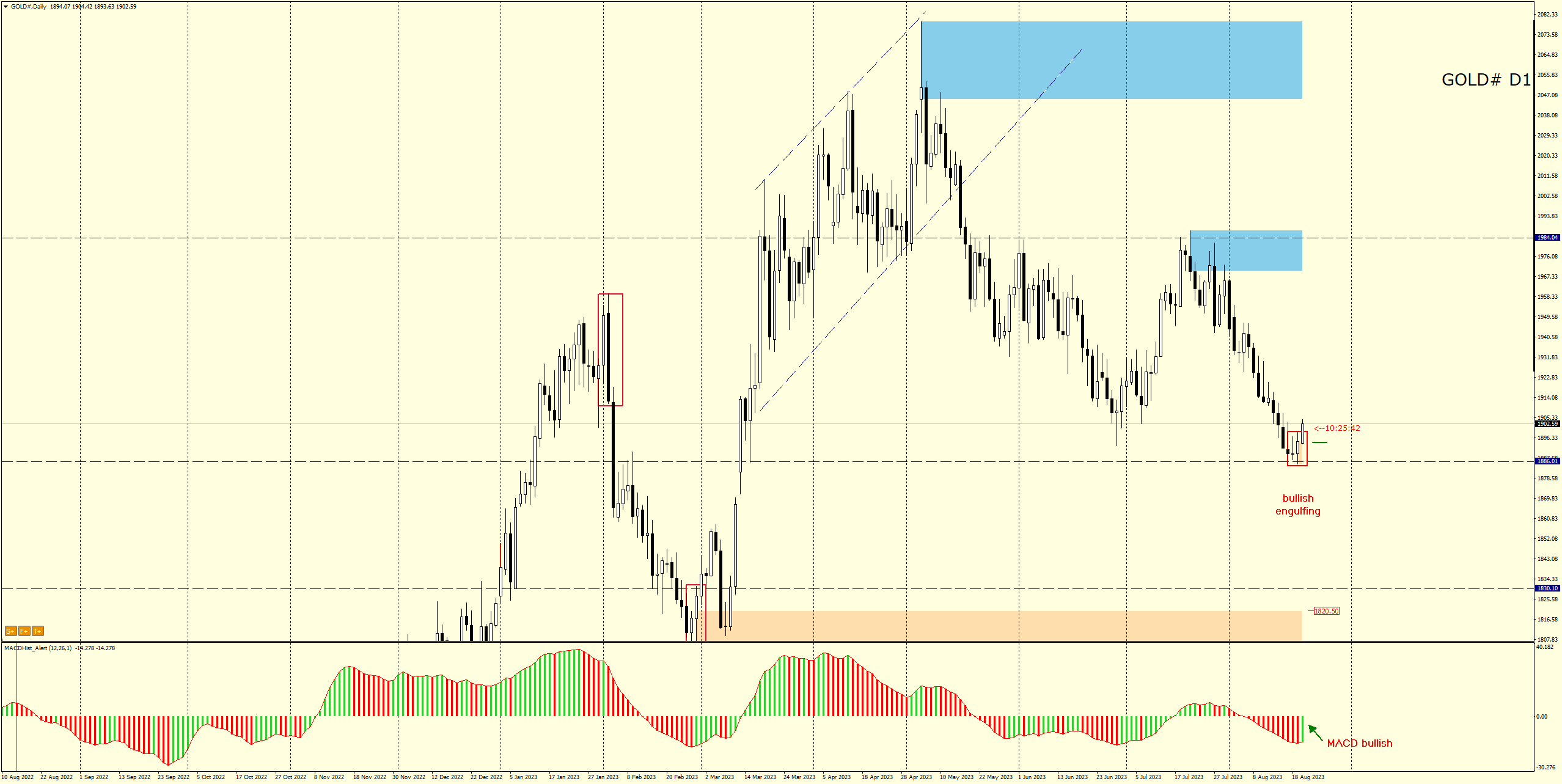

A technical look at Gold

Analyzing the daily chart of Gold, we will notice that yesterday’s daily candle formed a bullish engulfing formation. This could be a signal for the start of a correction of the recent declines. The upward scenario is supported by the MACD, which entered an upward phase today after establishing a minimum.

Also interesting formations appeared on NZDCAD and EURNZD…. but about it during my live sessions:

LIVE EDUCATION SESSIONS

This WEEK (21-25 August 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo