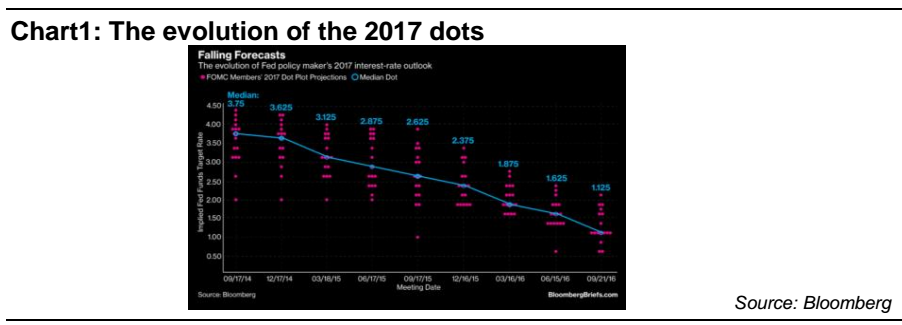

Citi’s analytic Brent Donelly in his short commentary convinces us that FOMC dots are dumb. I think the market has sort of believed that in the past but has truly embraced it now. This chart shows the meaninglessness in all its full-colored glory, he wrote.

Citi’s analytic Brent Donelly in his short commentary convinces us that FOMC dots are dumb. I think the market has sort of believed that in the past but has truly embraced it now. This chart shows the meaninglessness in all its full-colored glory, he wrote.

I am torn between two trains of thought:

1. FOMC meetings with pressers have tended to be dovish. Even when it felt like nothing was priced in and the market could not get any more dovish—Janet has dropped dovish bombs leaving Hellas Planitia sized P&L craters on multiple occasions. The March 2016 FOMC meeting springs to mind immediately but there have been many others. With today + 2 more hikes priced, it seems kind of easy for the Fed to sound dovish. The extremely strong dollar is a factor that triggered very dovish outcomes in the past and that condition also fits today.

2. We are in a new regime where the Fed is following the market and not the other way around. Historically US 2-year yields almost always show the way for Fed Funds as the market leads the Fed, especially during hiking cycles. The dots are meaningless and inflationary psychology has shifted dramatically. Even if the Fed comes in dovish, the market will not believe it and so any sell off in the dollar will be very short-lived. The market will breathe a sigh of relief as the event risk has passed and with positioning clean(ish), everyone will start piling into the Trade of the Year for 2017 (short EURUSD).

2. We are in a new regime where the Fed is following the market and not the other way around. Historically US 2-year yields almost always show the way for Fed Funds as the market leads the Fed, especially during hiking cycles. The dots are meaningless and inflationary psychology has shifted dramatically. Even if the Fed comes in dovish, the market will not believe it and so any sell off in the dollar will be very short-lived. The market will breathe a sigh of relief as the event risk has passed and with positioning clean(ish), everyone will start piling into the Trade of the Year for 2017 (short EURUSD).

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

I am leaning much more towards 2. Note that while everyone remembers the 2015 hike as the ding dong highs in the dollar, it actually wasn’t. Chart2 shows that the USD rallied for a couple of days before peaking. Have a spiky day.