Australian 4Q16 house price data (ABS) released overnight underscored the RBA’s assessment that “there had been a build-up of risks associated with the housing market” in its March meeting minutes, which is likely to rule out further rate cuts for the near future.

Australian 4Q16 house price data (ABS) released overnight underscored the RBA’s assessment that “there had been a build-up of risks associated with the housing market” in its March meeting minutes, which is likely to rule out further rate cuts for the near future.

However, the extent of the accumulation of household debt and weakness in wage pressures pose risks to domestic demand, and are also likely to keep rate hikes off the table, with the policy emphasis shifting to macro-prudential tools. With 10bps of hikes still priced in over the next 12m, we believe the risk to the AUD of a more emphatic “on hold” policy is to the downside.

Try out free trial of FxWatcher service and check out the rest of today’s big banks commentaries!

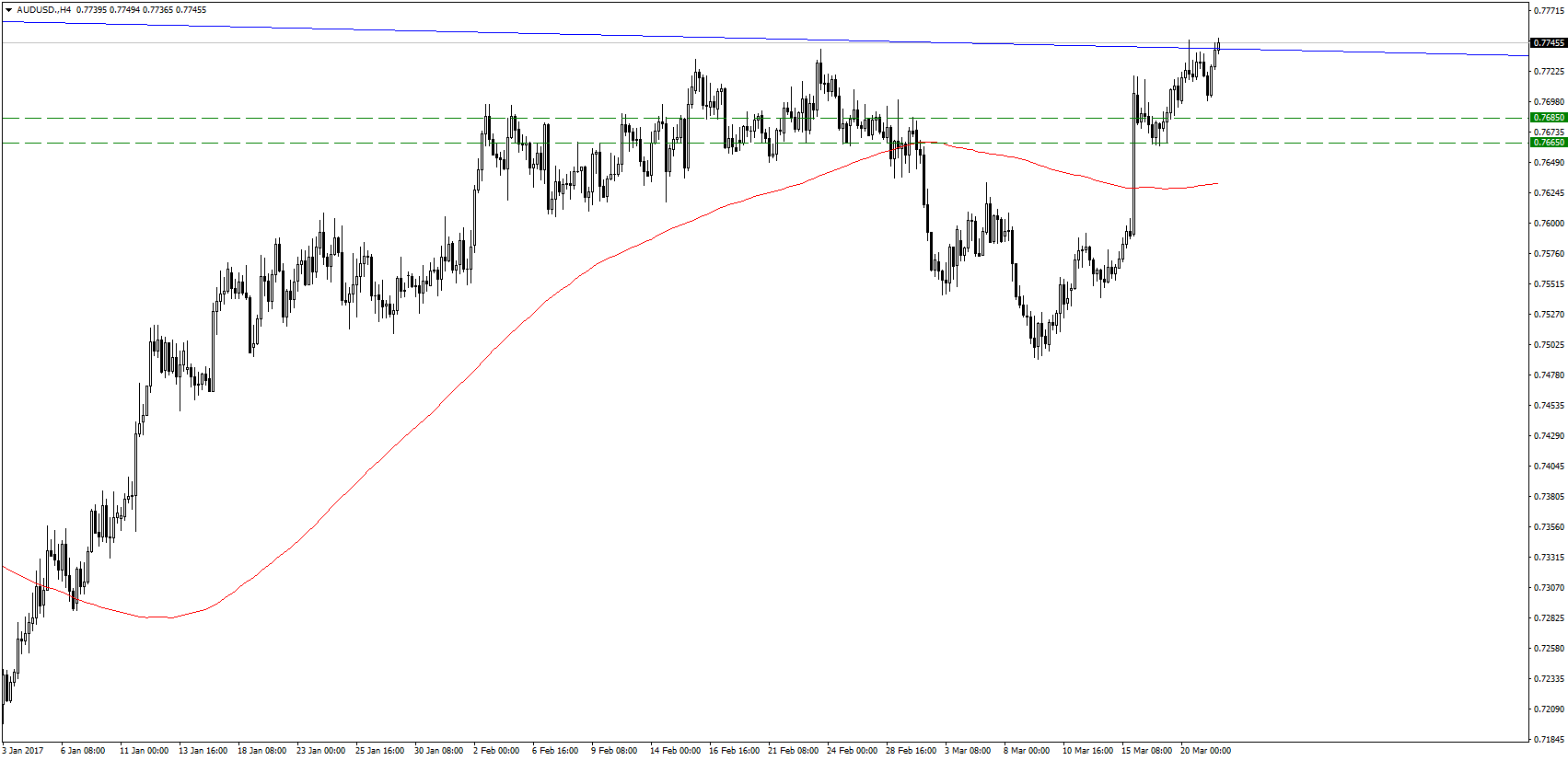

AUDUSD attempted a push above key resistance at .7743 yesterday – the February high and downtrend from last April – but closed lower. A clear break above .7743 can see the risk stay directly higher for .7779 next, the November 2016 high, then stronger resistance at .7835/50 – the high of 2016 itself and the 38.2% retracement of the entire 2014/2016 downtrend. Above here would see the completion of a medium-term base to signal the start of a much stronger bull trend, for .8163/67 initially.

Immediate support is now seen at .7685, then .7663 below which can see a retreat back to .7637/33 – the 21-day average and basing support.

Immediate support is now seen at .7685, then .7663 below which can see a retreat back to .7637/33 – the 21-day average and basing support.

Strategy: Flat. Buy at .7685/65, stop below .7650, for .7830.