Last week was very successful for German bulls. Rebound happened and during the week index gained 400 pts. What’s also important both on DAX and MDAX investors managed to return above key supports. It is 9,300 pts on DAX and 18,300-18,600 pts area on MDAX.

Rebound wasn’t that easy, because 2 out of 5 sessions during last week ended with decreases. So far there is no sign on positive change in volume, last week’s daily candles were supported by smaller volume. It means that big capital still doesn’t believe in end of decreases on DAX. Whole image of the chart also doesn’t indicate reasons to be optimistic. Another highs and lows – set on screen with horizontal lines – show that trend is still bearish.

Positive signal for the bulls will be breaking high from the end of January, which is at 9,900 pts. It would destroy negative look of the chart, on which you can clearly set lower highs and lows. If bulls will be too weak more probable will be new bearish impulse with target at 8,400 pts.

MDAX is currently in similar situation. Rebound was successful and during last week index came back above important area, however as long as local high created on the February 1st will not be broken, we can only set perfect bearish trend.

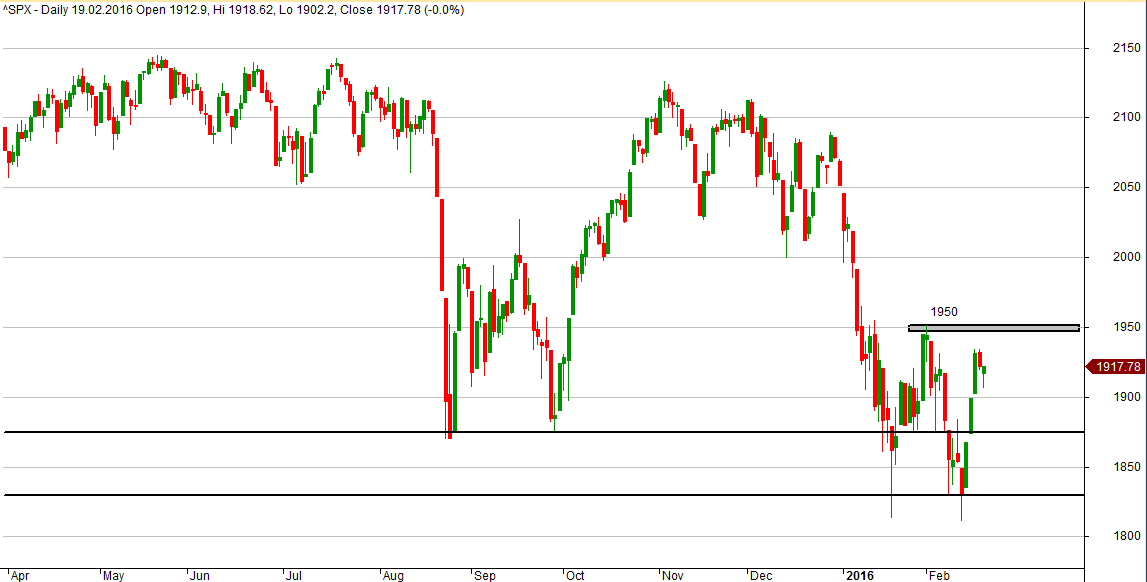

It is also worth to look at S&P500 chart because it is strongly correlated with European indices. Support at 1,830 pts is still defended, but also low is deeper. Good signal for bulls is breaking last month’s high at 1,950 pts. If it will succeed the road to resistance at 2,000 pts will be open. In current situation every variant is possible so we should observe the behaviour of the index in the high/low area.