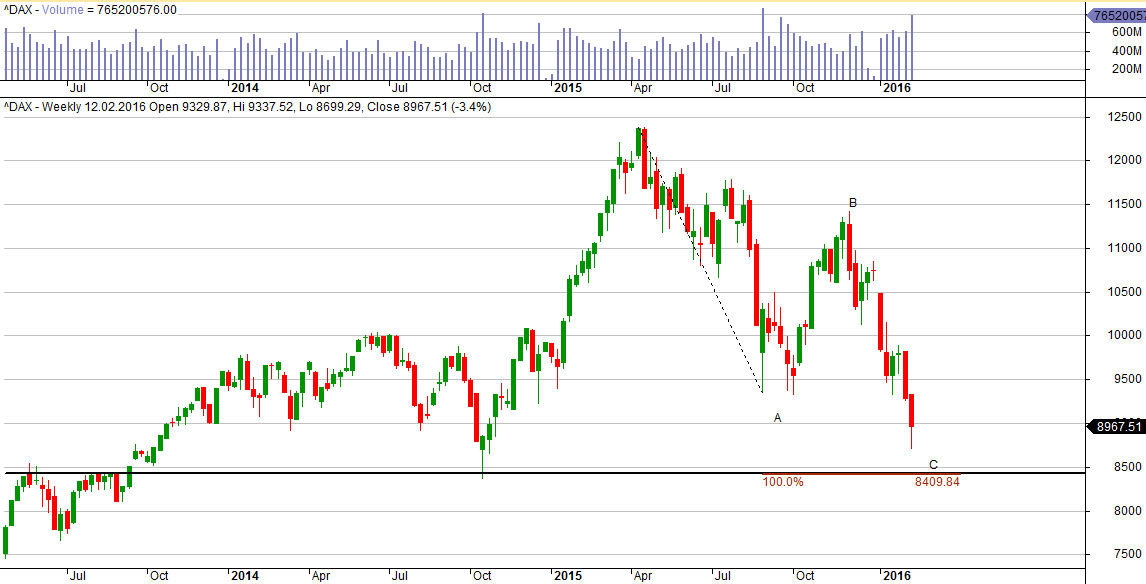

Last week started in 9,300 pts area on DAX what gave some chances of bulls attacking. It didn’t happened and confirmation of breaking 9,300 pts support set negatively all week.

Last week big hopes were connected with Janet Yellen report in front of US Congress commission. There were some dovish elements in her speech but central bank policy will go now in direction of careful rates hikes. Investors were expecting more and after Wednesday’s upward candle on Thursday there was new low set on DAX.

On weekly time frame we can see huge volume of last bearish candle. Index is getting close to 8,400 pts area which I pointed out as target of current correction and beginning of new bullish impulse weeks ago.

On Monday after long break Chinese investors will be back and considering moods on the stocks last week, Chinese session can be bearish. Wall Street investors will have work-free day because of President’s Day so session in Europe should be less volatile.

On the daily time frame we should also take a look at volume. Since 9,500 pts level it is on really high level. On the chart it doesn’t look like panic sell out of stocks, more like collecting them. If there will be any world rebound of indices, the bullish move can be really huge. The key to this scenario is American stocks, if Wall Street will decrease despite ECB moves, European indices won’t rise. Currently 9,300 pts is key level and DAX should return to this area. Break above 9,300 pts will be a very good signal for bulls and rebound from this level and come back to decreases will confirm strengthen it as new resistance.

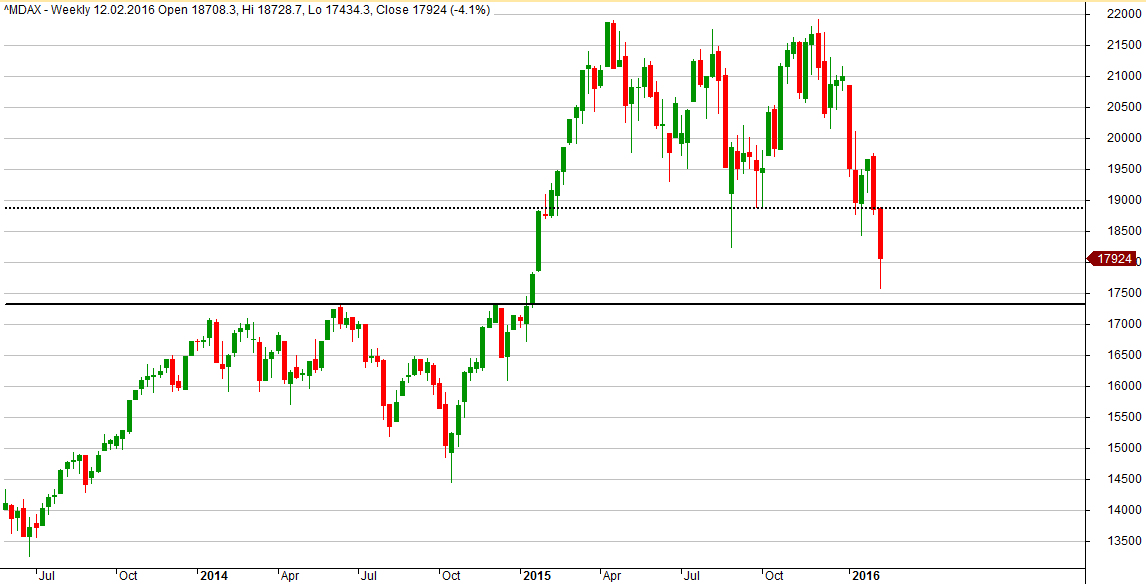

Average stocks MDAX is much stronger than his more important brother. There also are decreases, but 2014 highs are still not tested.