Last week was packed with economic events, but as we approach the end of the month, the year and especially the public holidays, activity is slowing down and the economic calendar is also getting poorer with important events.

On Tuesday, Australia will release its monetary policy meeting minutes, Japan will announce BoJ monetary policy and Canada will release inflation data.

The minutes of the RBA meeting scheduled for this week are likely to show that the bank is still allowing for the possibility of interest rate rises. The bank will want to leave open the possibility of further action next year if economic conditions warrant it, and strong labour market data will be one potential factor in favour of an additional hike, according to ING.

In Japan, the BoJ is widely expected to keep its policy unchanged. While some analysts had previously speculated that the Bank might raise interest rates in December, this no longer seems likely. The market now expects a 10 basis point hike at the April meeting.

In Canada, the BoC stressed at its last meeting that inflation continues to face inflationary pressures. The bank needs to see sustained signs of a cooling in core inflation, so it will be paying attention to surveys of inflation expectations. CPI data has seen a slower decline than expected and is not yet on a clear path towards the Bank’s 2% target.

In the UK, CPI y/y is expected to fall from 4.6% to 4.4%. As a reminder, in October headline inflation saw a sharp fall from 6.7% to 4.6% and core inflation fell from 6.1% to 5.7%. Some analysts say that the fall in food and energy prices will be one of the main factors cooling inflation.

Last week, the BoE decided to leave its monetary policy unchanged and stressed that it would have to be restrictive for an “extended” period of time. The market expects interest rate cuts sometime in May, but these expectations could be influenced by data releases, including this week’s.

On Wednesday, attention will focus on the UK with the publication of inflation data, while the US will publish the CB Consumer Confidence report.

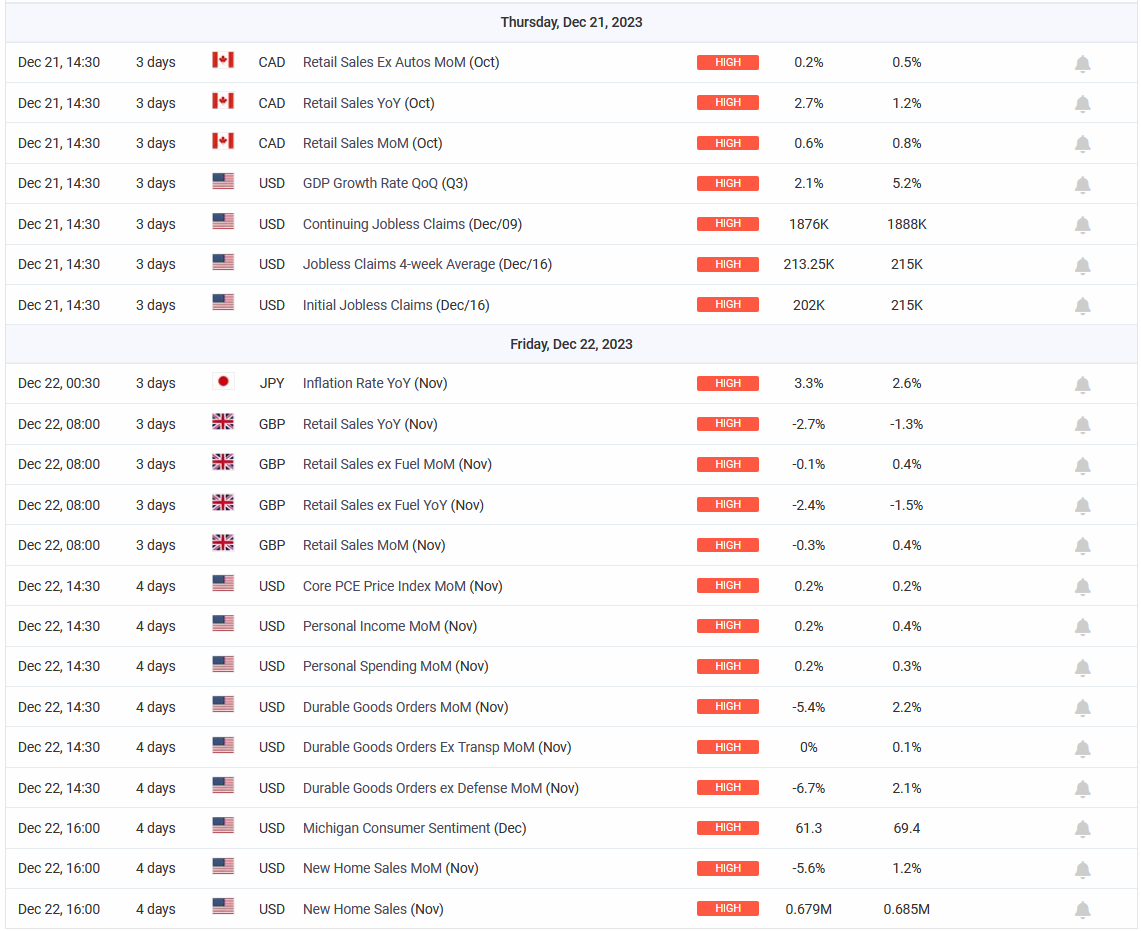

On Thursday, the highlights will be data from Canada – retail sales and the final US q/q GDP reading, as well as weekly unemployment claims.

Wrapping up the week on Friday, the UK will receive retail sales data, while the US will publish core PCE price index m/m, core durable goods orders m/m, durable goods orders m/m, personal income m/m, personal spending m/m, revised UoM consumer sentiment and revised UoM inflation expectations.

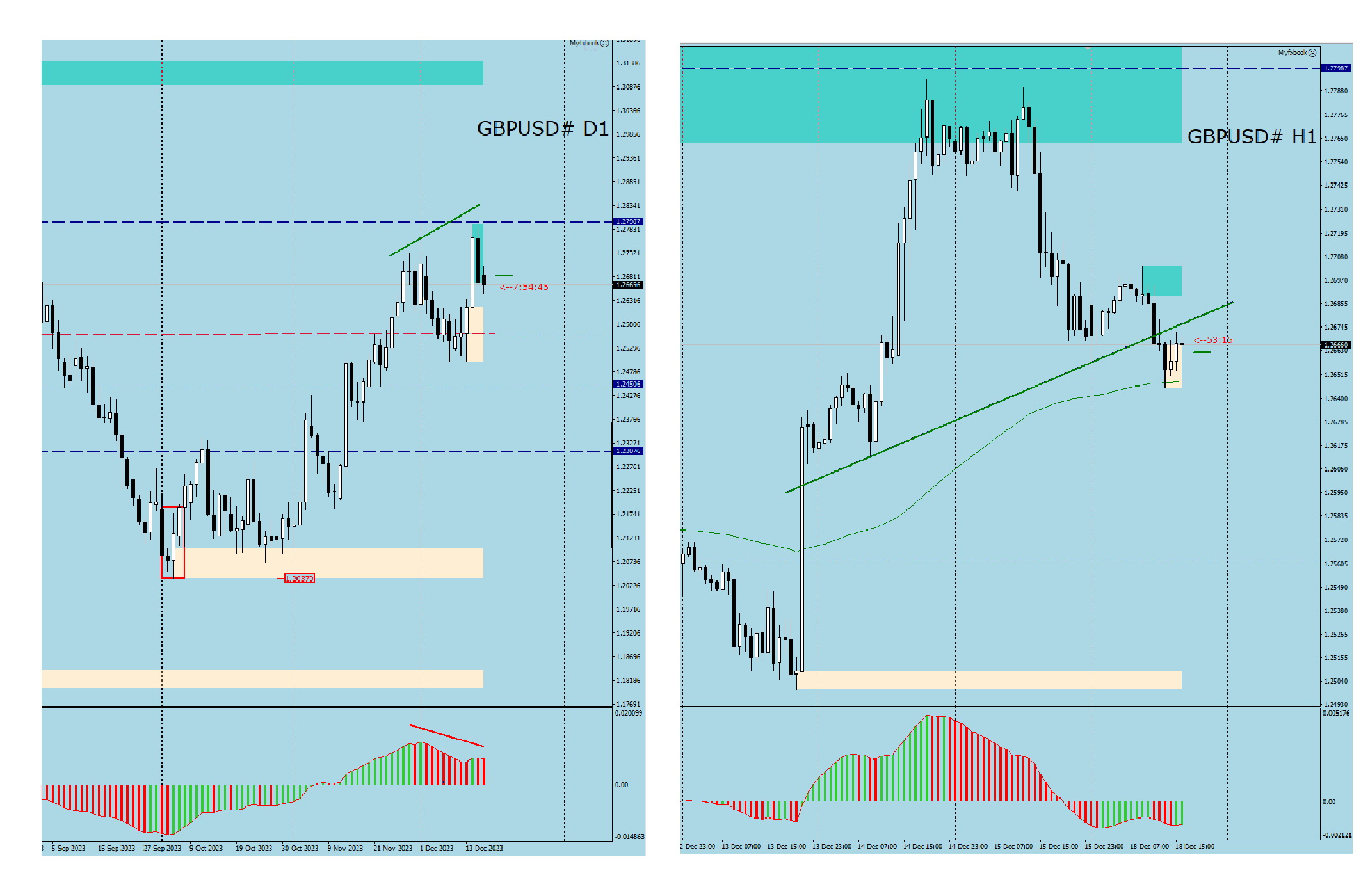

GBPUSD – RGR and divergence

A downward divergence appeared on the GBPUSD daily chart. On the H1 chart, the price has overcome the neckline of the RGR. These could be signals for a deeper correction of the recent gains made last week.

LIVE EDUCATION SESSIONS

This WEEK (18 – 22 December 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo