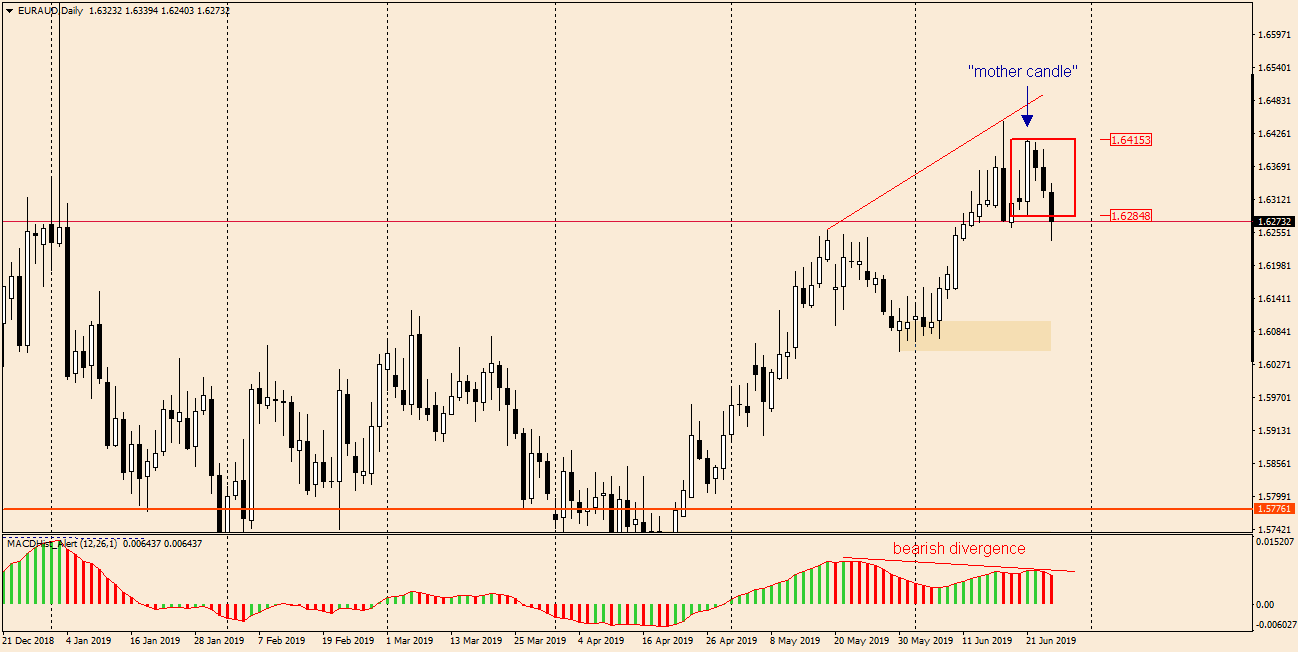

EURAUD has been on an upward trend since mid-April and on 18 th of June the maximum for this year was set at 1.6450. Two days later the market tried to set a new maximum, the attempt was unsuccessful and the daily candle turned out to be the “mother” of several others creating a double pattern: bullish engulfing for the preceding candle and Inside Bar for the next two days. As usual in such a situation, the form and direction of the breakout from the IB will be important for the future fate of this pair. Currently, the price is below the bottom edge of the IB, which may suggest further decreases. The declining scenario is supported by bearish divergence in the MACD chart.

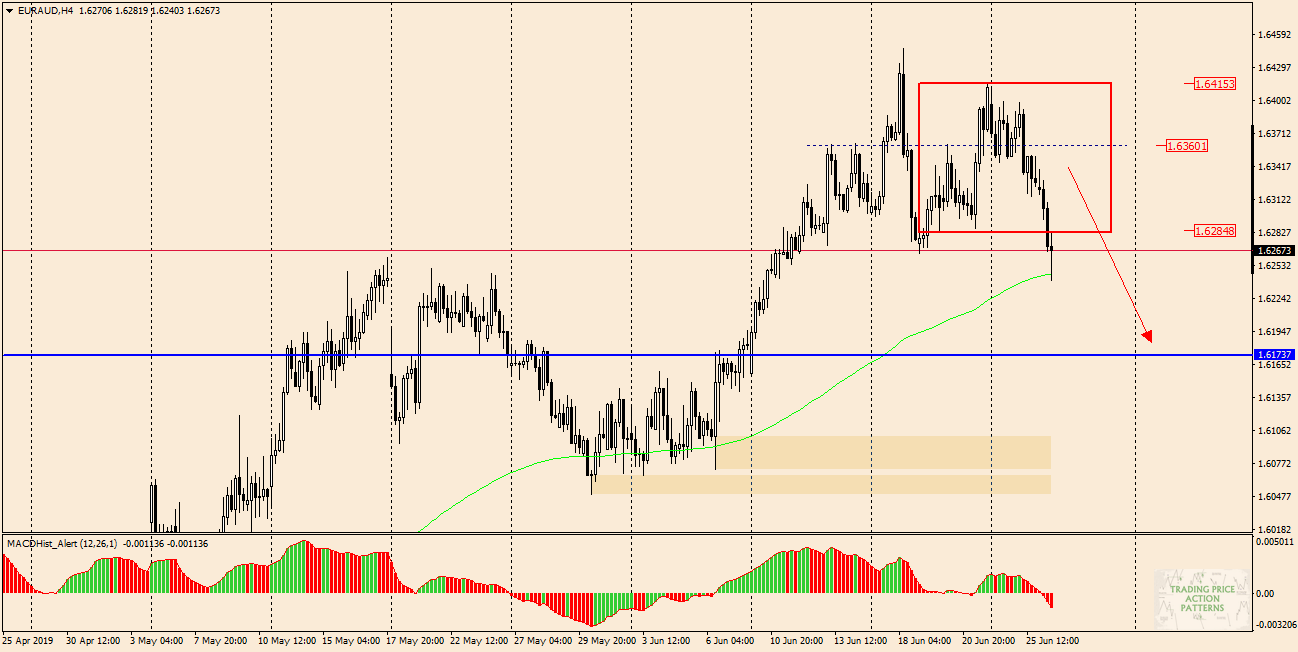

The lower H4 interval is also worth looking at. Here we can try to determine the decision levels for the Sell order.

The supply target can be the nearest S/R level = 1.6275 and overcoming the level 1.6360 can negate the drops so it can be a good place to Stop Loss of our order.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities