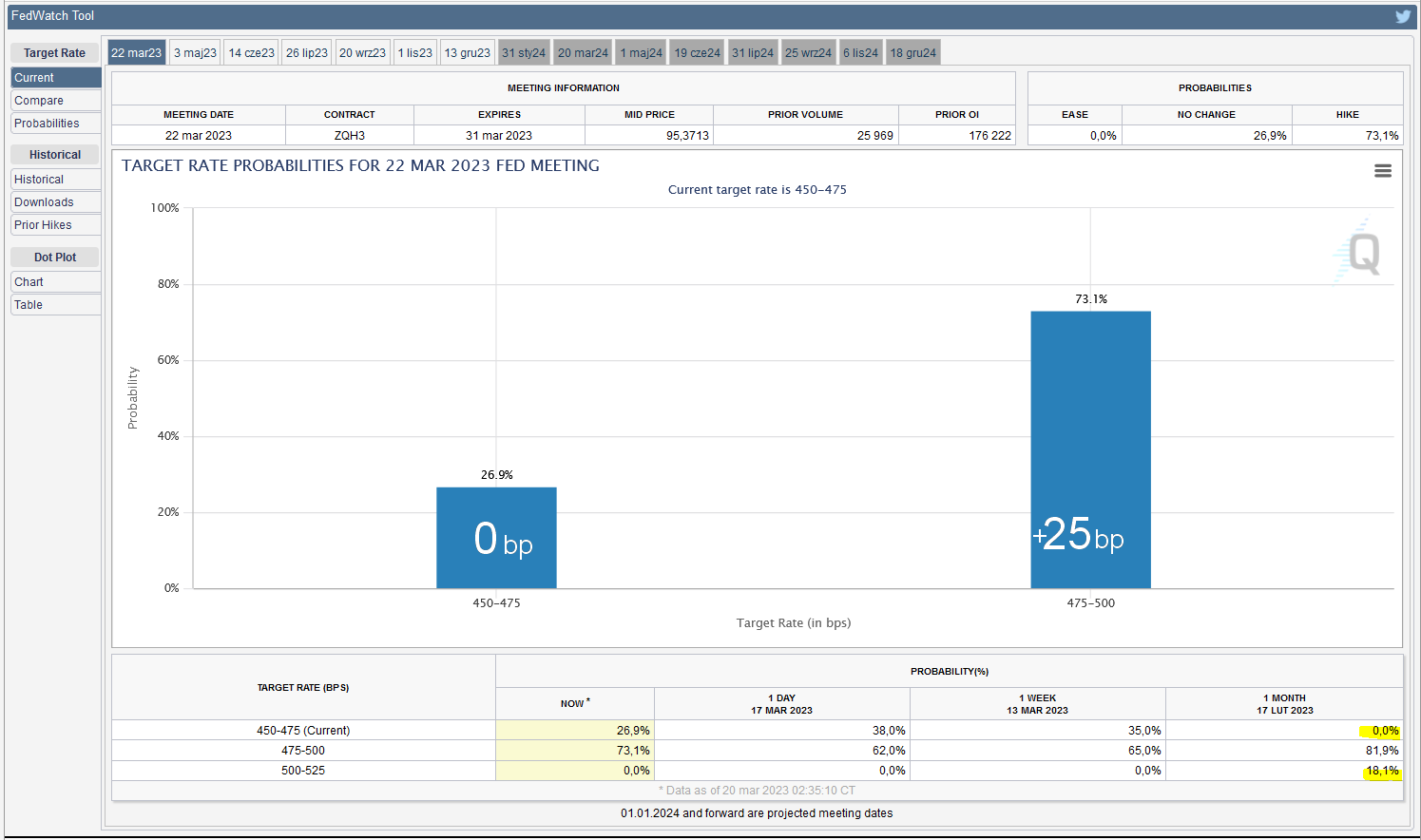

This week we are facing an important event for the financial world.On Wednesday at 18:00 GMT, the Fed will make a decision setting interest rates in the US. Over the past few weeks, the market’s expectations for Wednesday’s Fed decision have changed a lot. Only a month ago, the market did not consider the possibility of leaving interest rates unchanged at all, today the probability of such an event is estimated at 27%. Currently, the market is pricing in the highest possibility of a 0.25% hike .

What has influenced such conservative forecasts? Undoubtedly, it is the collapse of the SVB bank. Silicon Valley Bank (SVB) filed for protection from creditors on Friday. A week earlier it had been taken over by the Federal Deposit Insurance Corporation (FDIC). It is the largest US bank to fail since the memorable 2008 crisis and was recently ranked 16th on the list of largest US banks. It lent to and serviced technology companies and start-ups.

To make matters worse, a few days later the problems of Credit Suisse bank emerged. In both cases, central banks put out the fire by offering liquidity assistance. The Fed guaranteed the solvency of SVB’s deposits and the SNB aided CS with CHF 50 billion…. and persuaded rival UBS to take over Credit Suisse. This could not have affected markets positively, confidence in the banking system was strained. Hence the expectation that the Fed on Wednesday will prove less hawkish and be content with a 25bp hike. The fear in the markets at the moment is that any willingness by the Fed to raise rates will put further strain on banks, including regional banks, whose failure could have a knock-on effect on the global banking system.

What to trade in these uncertain times?

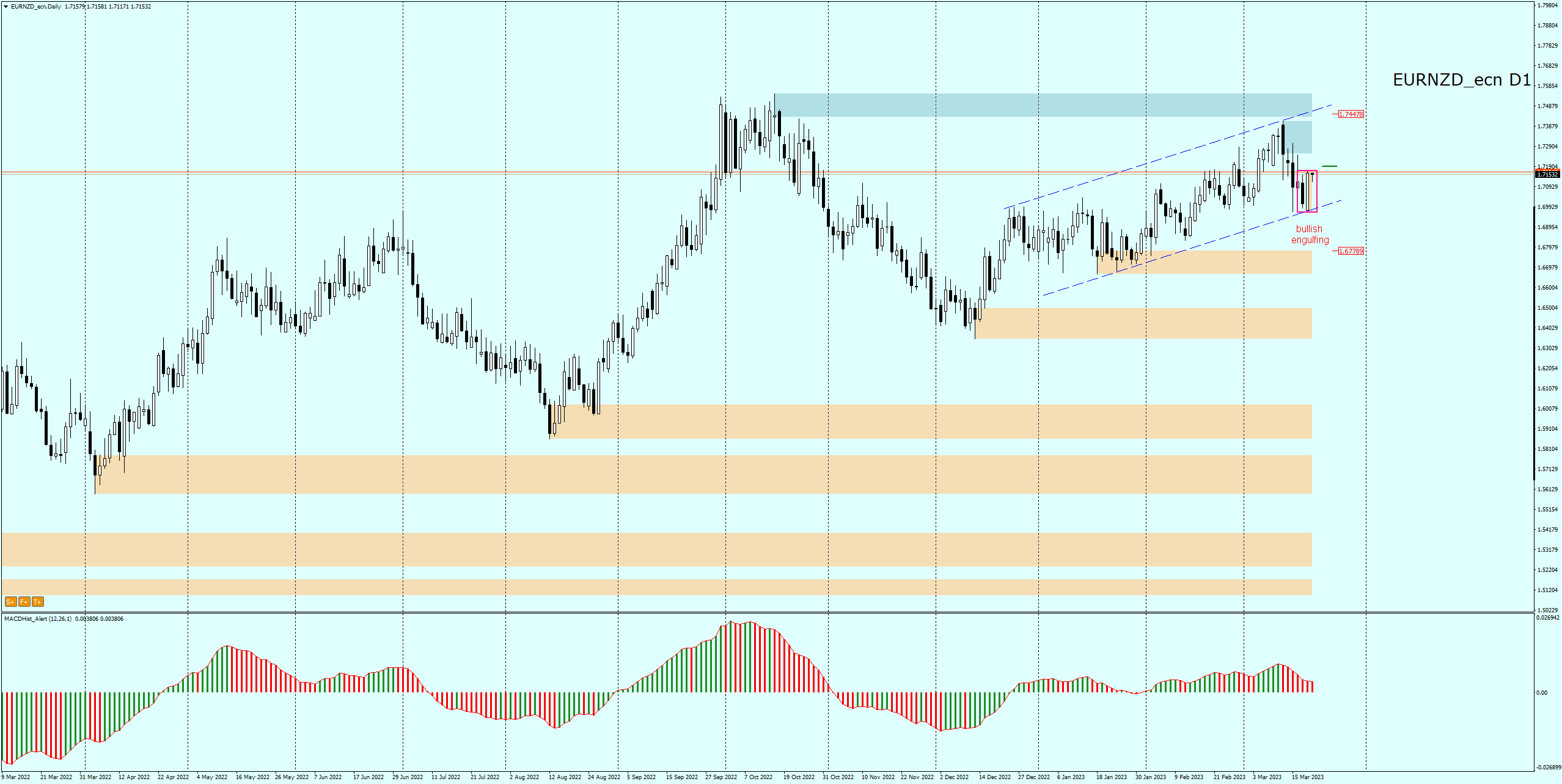

Whenever central bank decisions are imminent or important macroeconomic data is expected, the question is how and what to play? I usually choose crosses in such periods, i.e. currency pairs without USD participation. Today, I became interested in the EURNZD pair. I noticed that the EURNZD pair formed a bullish engulfing on the daily chart at the channel support. Such a formation usually signals a change of direction and the possibility of starting a new upward swing.

The price at the time of writing this analysis is still in the formation area and the MACD is still down. If there is an upward breakout and the MACD enters an upward phase (green) this could be a good signal to open a Buy position according to the PA+MACD strategy.

LIVE EDUCATION SESSIONS

This WEEK (20 MAR-25 MAR) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo