From July to the end of September, the EURUSD pair moved in a downward trend, with the euro losing nearly 8% against the dollar. October and the first three weeks of November proved to be more favourable for the European currency and some of the losses of the previous three months were recovered.

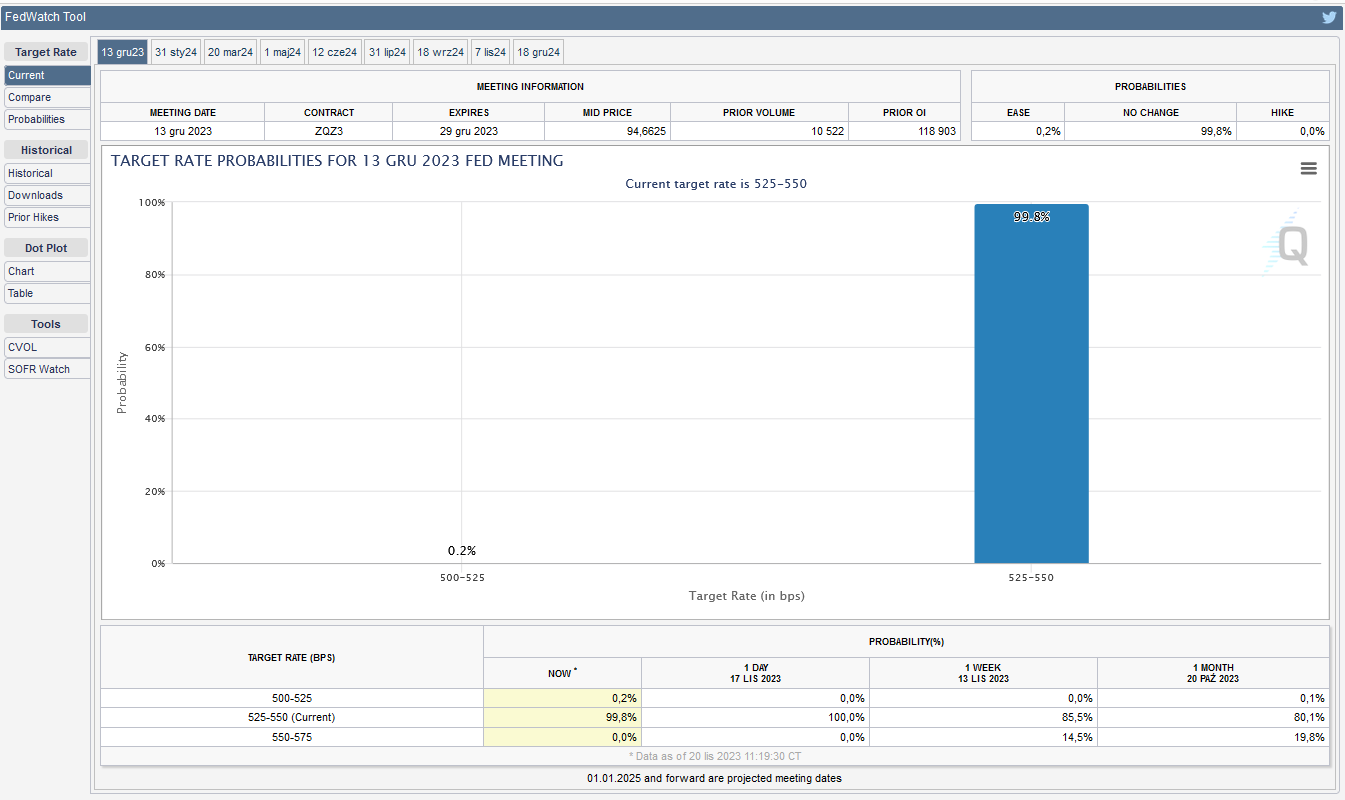

Certainly, data from overseas contributed to the euro’s strengthening against the dollar: lower-than-expected inflation and the market’s conviction that interest rate rises in the US are over.

Most investors expect the Fed to be done with interest rate hikes, and tomorrow’s (Tuesday’s) FOMC meeting minutes will be closely watched for further clues about the Fed’s plans for next year. Recently released data points to a slowdown in the US economy. Initial claims for unemployment benefits were well above expectations, reaching a near three-month high, while continuing unemployment claims rose to their highest level in two years, suggesting that the unemployed are having more difficulty finding available jobs. Looking further ahead, CPI, PPI and import prices showed that inflation continues to slow.

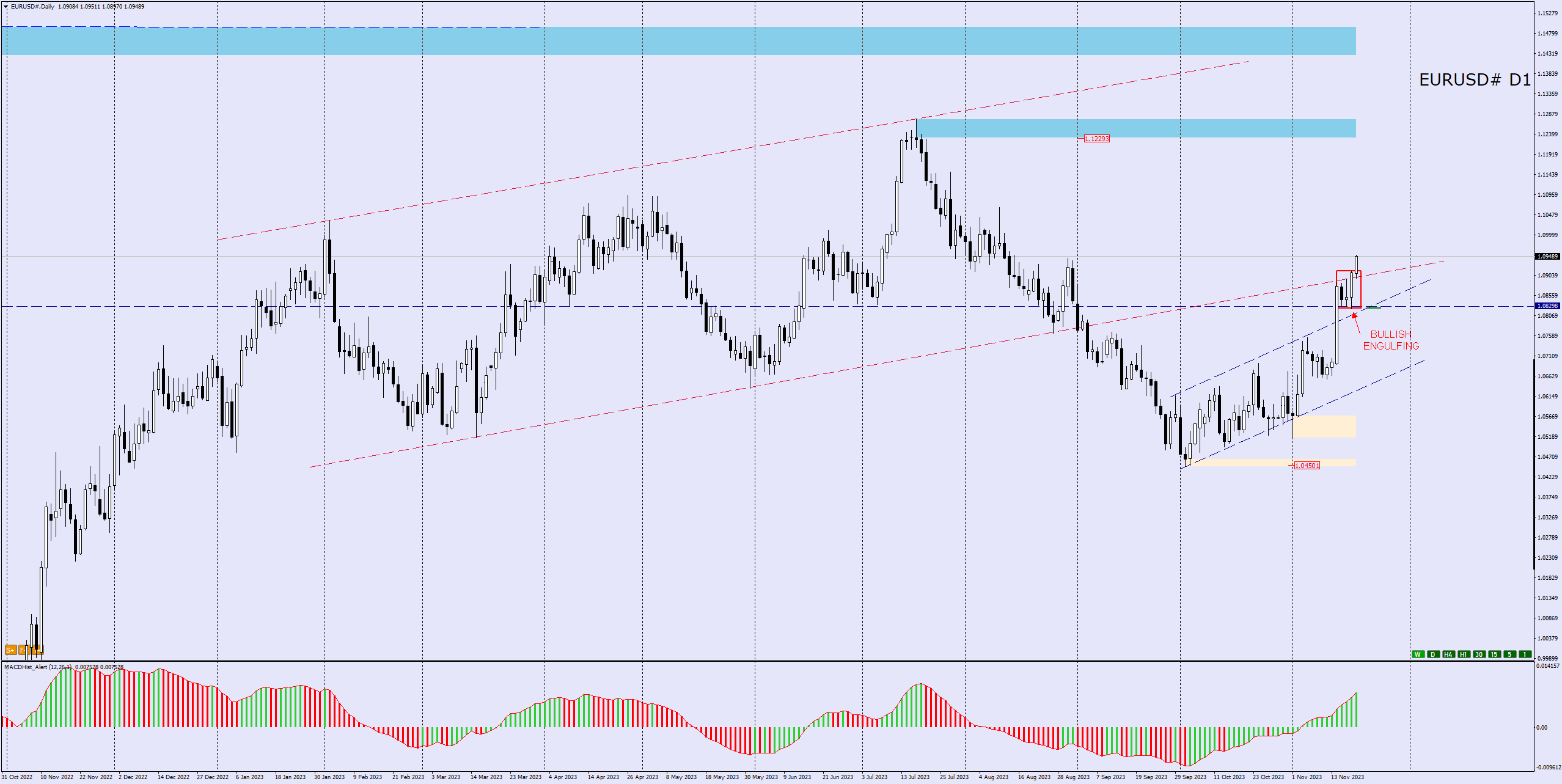

EURUSD technical analysis

Euro has been strengthening against the USD since early October. Friday’s day candle formed a bullish engulfing, today the price is breaking out the top with the MACD rising. The minimum of the candle forming the bullish engulfing formation is located at the strong support and resistance level of 1.0830. The price, having overcome the support of the long-term uptrend channel (red dashed), returned to its interior, which can be considered as a signal for further growth.

On the H4 chart, we see the price moving northwards. The nearest target for buyers may be the supply zone at 1.1050. The MACD should be observed, in case a downward bar appears, it may be a signal for a downward correction of the recent increases. Once it is over, there would be an opportunity to open a Buy position and join the increases at a good price.

Thanksgiving holiday will reduce volatility in the markets

The Thanksgiving holiday falls on Thursday and US markets will be closed on that day. Trading will resume on Friday, but normally everything and everyone will be in holiday mode until the weekend. This could therefore mean a shortened trading week for markets in general.

Keep this in mind when planning your trading for the week, expect low volatility on the last two days of the week in particular.

LIVE EDUCATION SESSIONS

This WEEK (20-24 November 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo