ExoticTrading is a series of analyzes, which is created in collaboration with the broker InterTrader and is published on Comparic every Monday, Wednesday and Friday. The theme as the name suggests are so called- exotic currency pairs.

GBPNOK

From two weeks the market oscillates around resistance zone coinciding with the level of 38.2% Fibonacci correction of the earlier declines. Overcoming this level could open the way for further increases until at around the level of 11.268 coinciding with the 61.8% Fibo and bearish trend line. More likely, however,is the rejection, which could cause declines in around the momentum 50% of correction from ongoing since October 7 increases.

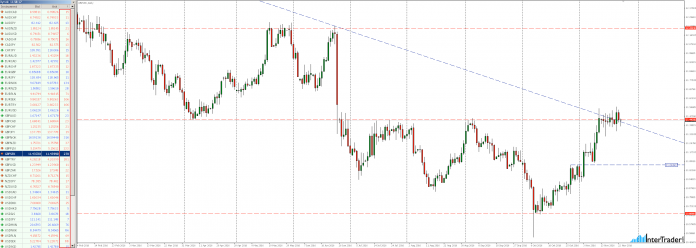

GBPSEK

The situation is much the same as above, except that here only this week, we overcame the downward trend line, which is currently re-testing from the top (as support). Continuation of growth could lead to re-test the level of 12.2025 while the scenario pro-downward could assume the appearance of the first reaction of demand already around 11.0660.

To invest in exotic pairs can take advantage of low spreads the broker InterTrader that at the time of the creation of the analysis for each instrument in turn were 31.0, 27.0 and 7.6 pips

USDMXN

Since the presidential elections in the United States market oscillates around the newly established historical highs. Looking at the daily chart we notice that, in accordance with the principle of changing the poles downward correction should reach a level of around 19.9000 while it ended already at the height measuring 38.2% Fibonacci correction.

Looking at the chart H4 we can see that the market breaks upwards of the ongoing consolidation of the week. If the breakout up want be soon negated, then we can expect a retest of level of 21.1950 area.