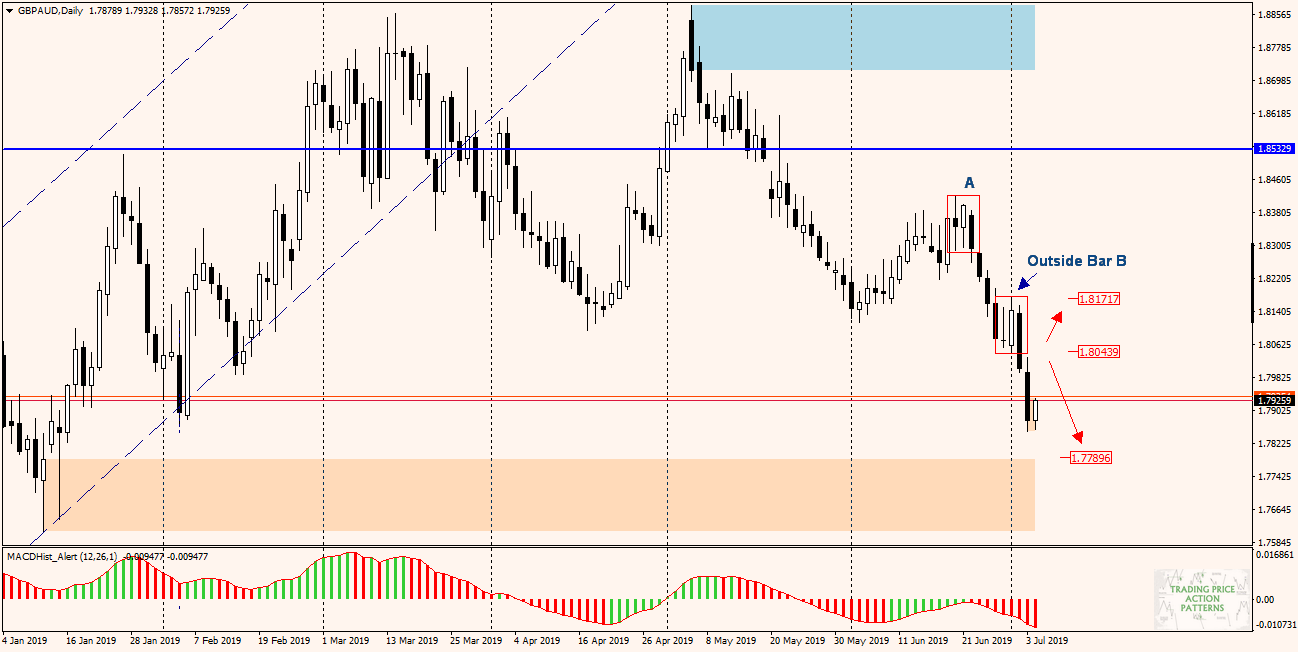

Since the beginning of May this year the pair has been moving in a downward trend, June started with a correction, which ended on 20 June with the Inside Bar formation (A) and after crossing its lower boundary (the mother candle minimum) the price returned to a downward trend. On Monday (01.07) the daily candle formed an Outside Bar (B) formation from which a strong southwards breakout took place on Tuesday.

Since the price has not reached the nearest significant demand zone, it seems that the market has turned back in the direction of the IB defeated yesterday and the decisive factor in the future direction will be the retest of its minimum at the level of 1.8045. Therefore, it is worth waiting for the price to be maintained tomorrow, a lot may be clarified by the most important data from that day, i.e. information from the US labour market – payrolls, which will be published at 14:30. If the next day’s candles are accompanied by the creation of a minimum for MACD and the indicator starts to rise, it may be a sign that the downward scenario is negated.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities