The end of last week was marked by several events of a heavy calibre that significantly changed the market picture. Fairly good US labour market data (payrolls) were overshadowed by the collapse of the SVB bank. Silicon Valley Bank (SVB) became the second worst banking failure in the US, after the collapse of Washington Mutual in 2008.

However, the backgrounds of the two cases could not be more different. SVB’s main focus is on corporates, as it is arguably a key liquidity player for tech startups and venture capitalists in the community, while Washington Mutual was a company that served the needs of retail customers.

The Fed’s quick response and assurance of solvency for all deposits halted the declines in stock indices. Risk appetite fell significantly and there was a noticeable increase in interest in safe-haven assets – gold, the Swiss franc or the yen proved to be the beneficiaries of the situation.

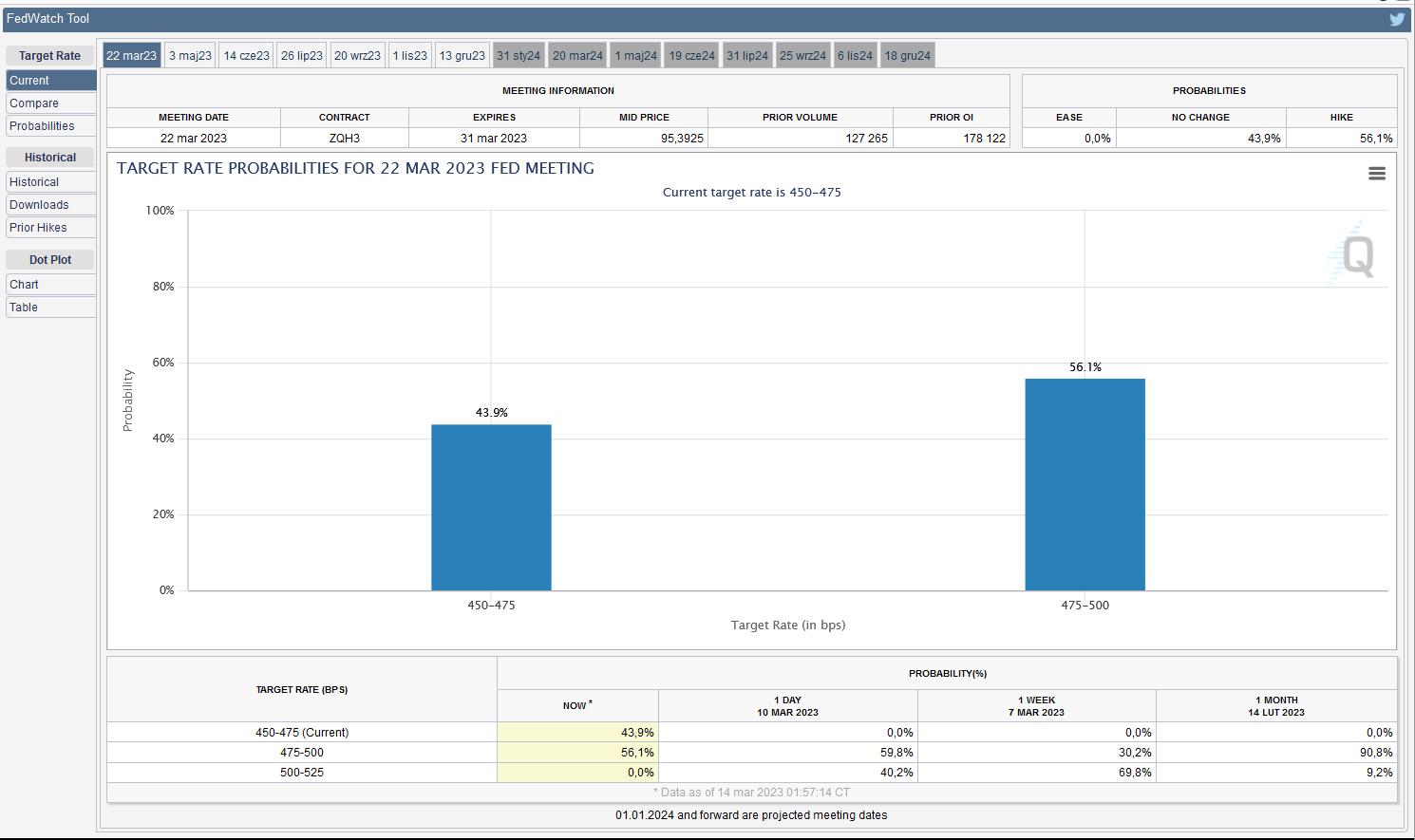

Expectations have also changed as to how much of an interest rate hike the Fed would introduce at its meeting on 22 March. Currently, 55% are betting on 25bp, while 45% believe rates will remain at their current level. This is a significant change from a week ago’s data when 75% were betting on a 50bp hike and the remaining 25% saw the possibility of a 25bp hike.

Today at 13:30 we will know the US inflation figures. In view of such important data for the Fed, I have focused on crosses, i.e. pairs without the USD, on which I anticipate less volatility than on the majors and therefore less risk of making a mistake. Among others, I turned my attention to the GBPCHF pair.

GBPCHF – pinbar at support on the D1 chart

Analysing the D1 chart, we will notice that yesterday closed above the opening level, forming a candle with a long lower leg – an bullish pinbar. Usually this is a signal for a change of direction, it can signal the start of an upward swing. A good confirmation of the upward scenario will be the MACD entering an upward phase, but we will still have to wait for that. This will occur when the price reaches the 1.1140 level.

A bullish engulfing outside bar already appeared yesterday on the H4 chart. This is quite a strong bullish signal, especially as the candle forming the formation is located on the confluence of the supports formed by the channel support (dashed red line) and the demand zone (brown). Today the price broke out on the upside. The MACD is in an upward phase. High probability of further increases. More on this pair and several others during the live sessions.

There will be more on the PA+MACD strategy during the public live sessions:

I invite you to my live sessions – LIVE EDUCATION SESSIONS

This WEEK (13 MAR – 19 MAR) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

Leave us a comment!