This week we have had two major events on the economic calendar The first is, of course, the FOMC meeting and the Fed’s decision on US interest rates. The second is today’s Bank of England decision setting interest rates at 3% in the UK.

The FED’s decision to raise interest rates by 75 bps to 4% caused a lot of volatility in financial markets. In the immediate aftermath of the decision, the dollar lost ground against major currencies and commodities, but as the conference by Fed chairman Jerome Powell began, the market turned around sharply, the dollar recovered and closed the day on a positive note

Such a volatile reaction was due to the difference between the rather dovish statement published in tandem with the rate decision and the hawkish stance presented during the press conference.

The monetary policy statement was clearly dovish, as the FOMC stated that it would “take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”. This seemed to indicate a slower pace of tightening in December (as suggested by the September dot plot).

Chairman Powell, in a conference call, said only that a change “could come as early as the next meeting or the one after that”. He also stressed that there is “still a lot of work to be done” on rates, and that it is “very premature” to think about holding off on hikes. Adding to the hawkish tone of the press conference, Powell said the final interest rate could be higher than the committee expected in September, when the dot plot showed it would rise to 4.50-4.75% next year.

Bank of England follows in Fed’s footsteps

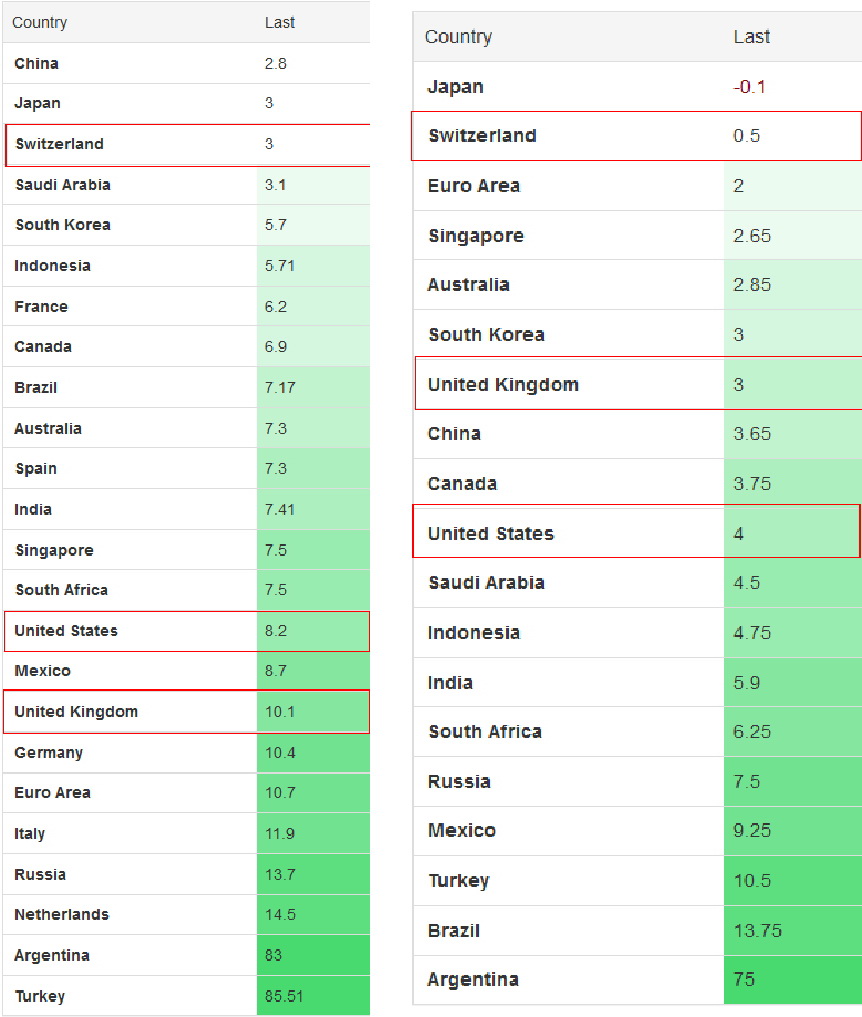

Today’s Bank of England decision saw another 75bp hike. If we compare the UK’s inflation rate with rates we still have a gap much larger than the US. Clearly the Fed’s monetary policy is having a better effect on inflation than the BoE’s actions. When we look at the tables below showing inflation and interest rates by country the UK lags behind countries such as the US and Switzerland.

In the US the difference is 4.2% , in the UK it is already -7% . Not bad against this background is Switzerland, where the difference between inflation and interest rates is just -2.5%. It is difficult to expect the pound to suddenly strengthen against the USD with such unfavourable indicators.

GBPCHF – fundamentally down and how it looks technically ?

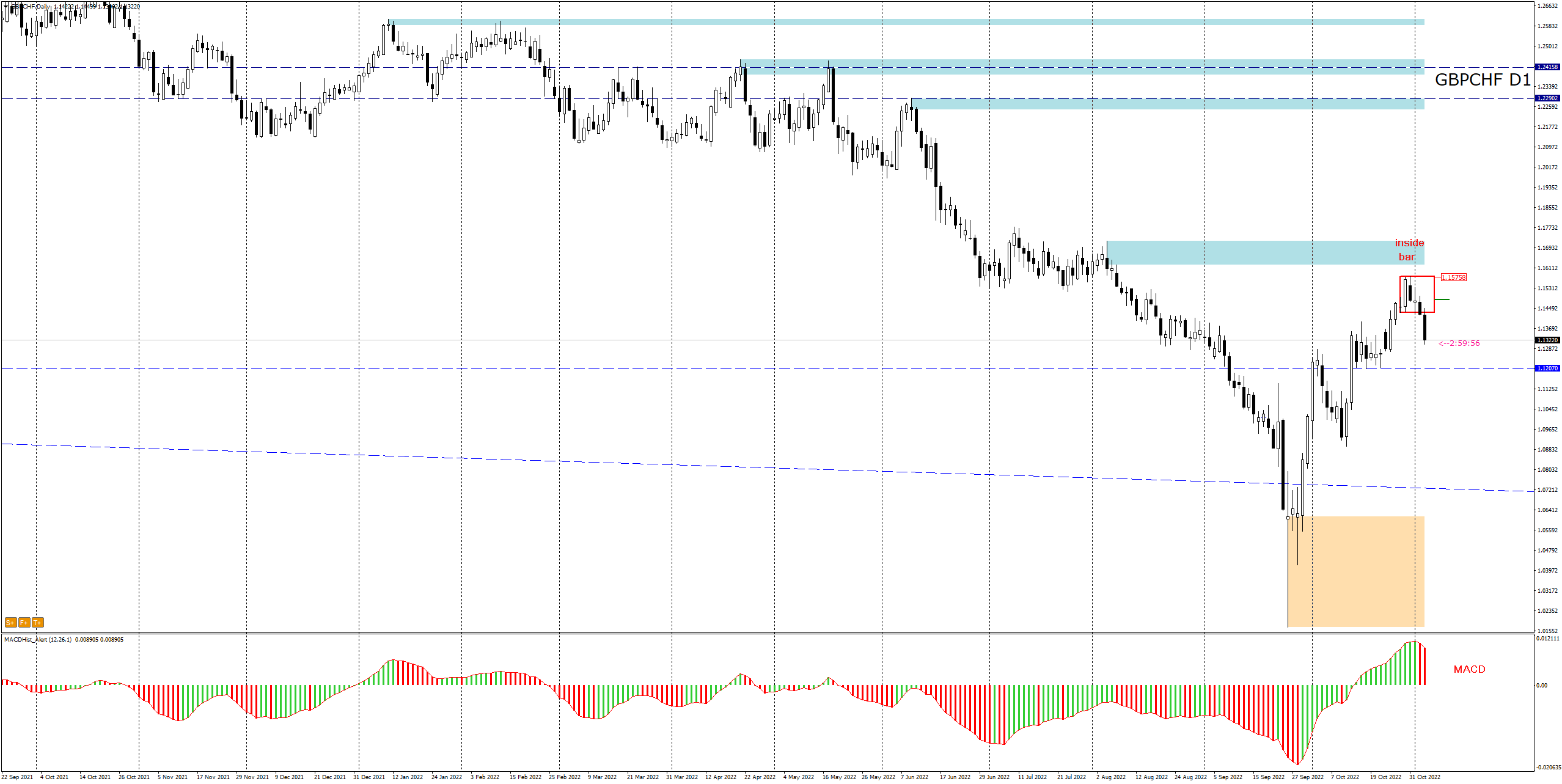

Seeing an even bigger difference between the Swiss and UK data, I took a closer look at the European currency pair of the pound and the franc – GBPCHF. Here the fundamentals support the strengthening of the franc against the pound.

Technically, there are also signals that the GBPCHF pair has started to decline. An inside bar formation appeared from which the price broke out from the bottom. The MACD oscillator entered a downward phase, which may herald the continuation of declines. The nearest support at the level of 1.12 may be a target for supply. Tomorrow we will hear data from the US labour market – payrolls. This event may also increase volatility and should be taken into account in your trading plans.

LIVE EDUCATION SESSIONS

This November I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo