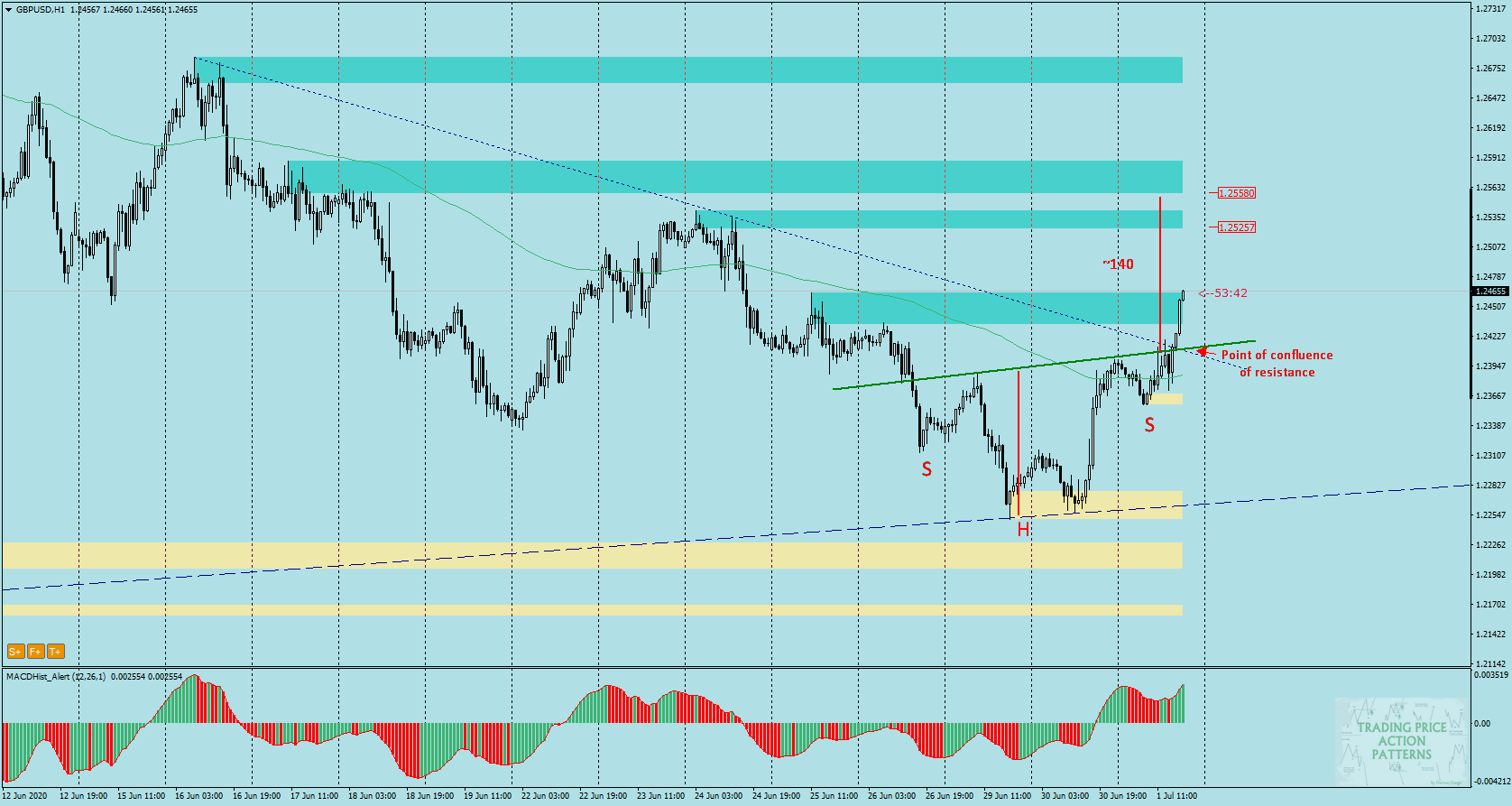

On the pair of the British pound with the American dollar (GBPUSD), popularly known as the “cable”, the point of confluence of the two resistances was broken.

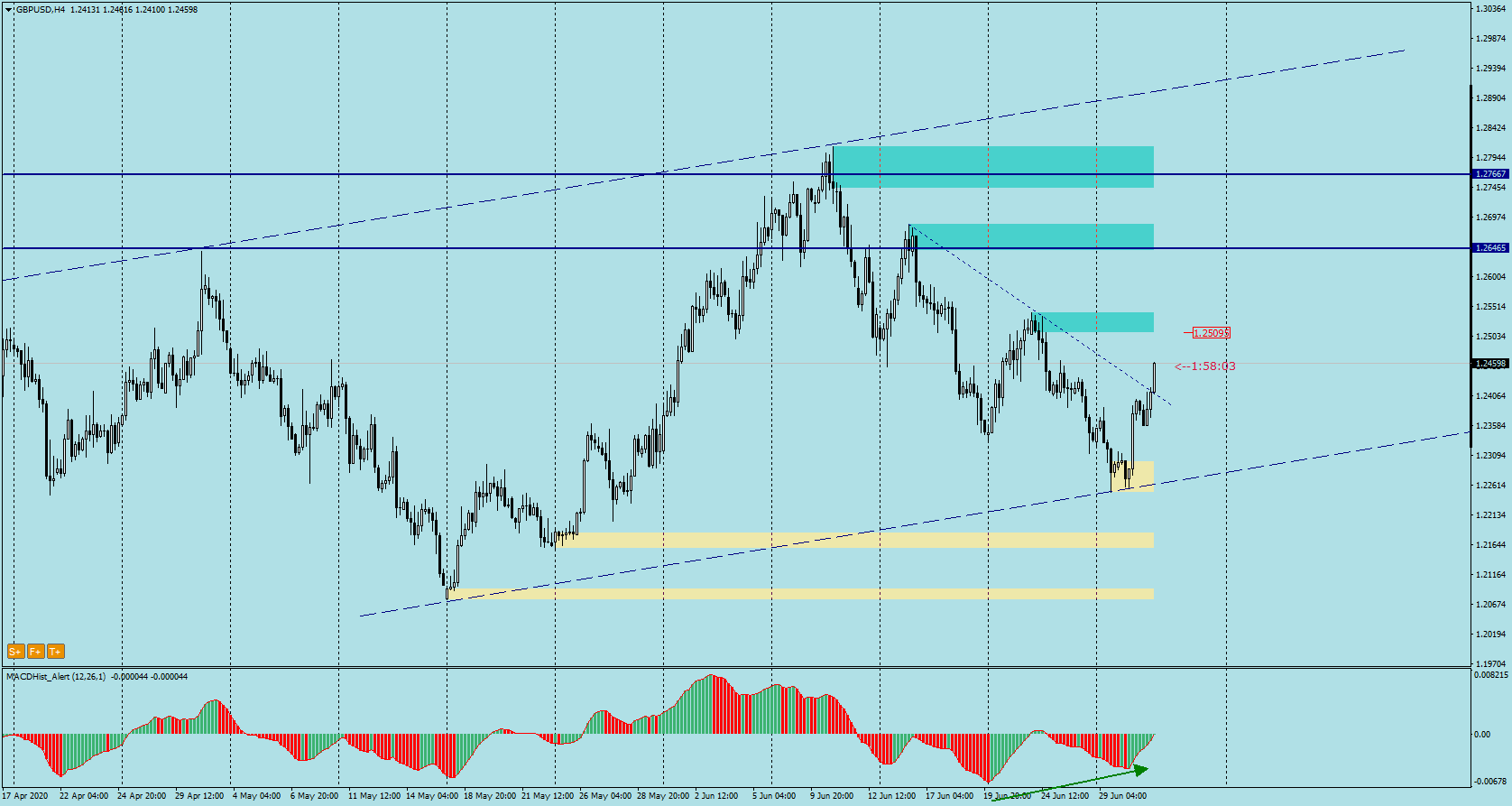

The first resistance is a downward trend line drawn at peaks of 16.06 and 24.06, marked on the H4 chart with a blue dashed line.

The second resistance is the neck line of the iH&S- inverted head and shoulders formation. The iH&S formation is more visible on the H1 hour chart (below). The green line is the neck line, which was successfully overcome today.

It was the intersection of these two lines that marked the point of confluence (marked on the H1 chart). Breaking the level determined by such a point usually results in an accelerated price action.

You can see me trading live every day from Monday to Friday between 1 p.m. and 2 p.m. (London time).

The H&S and iH&S belong to the trend reversal formations. The theory is that after crossing the neck line we can expect increases equal to the formation’s height – in this case it is about 140p.

If the theory were to coincide with practice, the increases should reach 1.2550. Bearish corrections can be a good opportunity to join bulls.

Additionally, the bullish scenario is supported by bullish divergence on the MACD oscillator.

It should be kept in mind that monthly payrolls will exceptionally be published tomorrow and not on Friday, due to the fact that Friday is a national holiday in the USA.

You can see me trading live every day from Monday to Friday between 1 p.m. and 2 p.m. (London time). During the live sessions I make analysis and show how I trade according to my strategies, I will also answer to your questions in the chat room. All you need to watch my live sessions is enter here: https://www.xm.com/live-player/intermediate

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities